false0001024795DEF 14A0001024795ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2023-12-312024-12-280001024795ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberhlio:JosefMatosevicMemberecd:PeoMember2023-01-012023-12-300001024795ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2021-01-032022-01-010001024795ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2023-01-012023-12-300001024795ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2023-12-312024-12-2800010247952021-01-032022-01-010001024795hlio:JosefMatosevicMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2019-12-292021-01-020001024795ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2021-01-032022-01-010001024795ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberhlio:JosefMatosevicMemberecd:PeoMember2022-01-022022-12-310001024795hlio:JosefMatosevicMember2023-12-312024-12-280001024795hlio:JosefMatosevicMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2019-12-292021-01-020001024795hlio:WolfgangDangelMember2019-12-292021-01-020001024795ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberhlio:TriciaFultonMemberecd:PeoMember2019-12-292021-01-0200010247952023-01-012023-12-300001024795hlio:SeanBaganMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-12-312024-12-280001024795hlio:JosefMatosevicMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-12-312024-12-280001024795hlio:TriciaFultonMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2019-12-292021-01-020001024795hlio:JosefMatosevicMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-12-312024-12-280001024795hlio:JosefMatosevicMember2022-01-022022-12-310001024795ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2019-12-292021-01-0200010247952019-12-292021-01-020001024795hlio:SeanBaganMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2023-12-312024-12-280001024795ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberhlio:TriciaFultonMemberecd:PeoMember2019-12-292021-01-020001024795ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2022-01-022022-12-310001024795ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2023-01-012023-12-300001024795ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2022-01-022022-12-310001024795ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2023-01-012023-12-300001024795hlio:WolfgangDangelMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2019-12-292021-01-020001024795hlio:JosefMatosevicMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-01-032022-01-010001024795ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberhlio:JosefMatosevicMemberecd:PeoMember2022-01-022022-12-310001024795hlio:TriciaFultonMember2019-12-292021-01-020001024795ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberhlio:TriciaFultonMemberecd:PeoMember2019-12-292021-01-020001024795ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2021-01-032022-01-0100010247952023-12-312024-12-280001024795ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberhlio:JosefMatosevicMemberecd:PeoMember2019-12-292021-01-020001024795ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2022-01-022022-12-31000102479512023-12-312024-12-280001024795hlio:JosefMatosevicMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-300001024795ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2021-01-032022-01-010001024795hlio:JosefMatosevicMember2023-01-012023-12-300001024795ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2019-12-292021-01-020001024795hlio:SeanBaganMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-12-312024-12-280001024795hlio:JosefMatosevicMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-01-022022-12-31000102479542023-12-312024-12-280001024795ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2019-12-292021-01-020001024795ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2023-12-312024-12-280001024795ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberhlio:JosefMatosevicMemberecd:PeoMember2021-01-032022-01-010001024795ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2019-12-292021-01-020001024795ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2022-01-022022-12-310001024795hlio:SeanBaganMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-12-312024-12-280001024795ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberhlio:JosefMatosevicMemberecd:PeoMember2023-01-012023-12-300001024795hlio:SeanBaganMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2023-12-312024-12-280001024795ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberhlio:JosefMatosevicMemberecd:PeoMember2023-12-312024-12-280001024795ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberhlio:JosefMatosevicMemberecd:PeoMember2023-12-312024-12-280001024795ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberhlio:JosefMatosevicMemberecd:PeoMember2023-12-312024-12-280001024795hlio:TriciaFultonMember2020-04-012020-06-300001024795ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2021-01-032022-01-010001024795ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberhlio:WolfgangDangelMemberecd:PeoMember2019-12-292021-01-020001024795ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2021-01-032022-01-010001024795ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-01-012023-12-300001024795hlio:SeanBaganMember2024-07-012024-07-310001024795ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-01-012023-12-300001024795ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2019-12-292021-01-020001024795ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberhlio:TriciaFultonMemberecd:PeoMember2019-12-292021-01-02000102479532023-12-312024-12-280001024795ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberhlio:JosefMatosevicMemberecd:PeoMember2019-12-292021-01-020001024795hlio:WolfgangDangelMember2020-04-012020-04-300001024795hlio:JosefMatosevicMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-01-032022-01-010001024795ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2019-12-292021-01-020001024795ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberhlio:WolfgangDangelMemberecd:PeoMember2019-12-292021-01-020001024795ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberhlio:JosefMatosevicMemberecd:PeoMember2019-12-292021-01-020001024795ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberhlio:JosefMatosevicMemberecd:PeoMember2021-01-032022-01-010001024795ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2022-01-022022-12-310001024795ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2022-01-022022-12-310001024795ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberhlio:JosefMatosevicMemberecd:PeoMember2022-01-022022-12-31000102479522023-12-312024-12-280001024795ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberhlio:JosefMatosevicMemberecd:PeoMember2022-01-022022-12-3100010247952022-01-022022-12-310001024795hlio:TriciaFultonMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2019-12-292021-01-020001024795ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberhlio:WolfgangDangelMemberecd:PeoMember2019-12-292021-01-020001024795ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-12-312024-12-280001024795hlio:SeanBaganMember2023-12-312024-12-280001024795hlio:SeanBaganMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-12-312024-12-280001024795ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberhlio:JosefMatosevicMemberecd:PeoMember2021-01-032022-01-010001024795ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberhlio:JosefMatosevicMemberecd:PeoMember2023-01-012023-12-300001024795ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2023-12-312024-12-280001024795ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberhlio:JosefMatosevicMemberecd:PeoMember2021-01-032022-01-010001024795ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2023-01-012023-12-300001024795ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberhlio:JosefMatosevicMemberecd:PeoMember2019-12-292021-01-020001024795hlio:JosefMatosevicMember2021-01-032022-01-010001024795ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-12-312024-12-280001024795hlio:JosefMatosevicMember2020-06-012020-06-300001024795hlio:JosefMatosevicMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-300001024795ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberhlio:WolfgangDangelMemberecd:PeoMember2019-12-292021-01-020001024795hlio:WolfgangDangelMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2019-12-292021-01-020001024795hlio:JosefMatosevicMember2019-12-292021-01-020001024795ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberhlio:JosefMatosevicMemberecd:PeoMember2023-01-012023-12-300001024795ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberhlio:JosefMatosevicMemberecd:PeoMember2023-12-312024-12-280001024795hlio:JosefMatosevicMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-01-022022-12-31xbrli:pureiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant☒

Filed by a Party other than the Registrant☐

Check the appropriate box:

|

|

|

☐ |

|

Preliminary Proxy Statement |

|

|

☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

|

Definitive Proxy Statement |

|

|

☐ |

|

Definitive Additional Materials |

|

|

☐ |

|

Soliciting Material under $240.14a-12 |

HELIOS TECHNOLOGIES, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant

Payment of Filing Fee (Check all boxes that apply):

|

|

|

☒ |

|

No fee required. |

|

|

☐ |

|

Fee paid previously with preliminary materials. |

|

|

☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Dear Fellow Shareholders,

I am honored to have been appointed your new President and Chief Executive Officer ("CEO"). I had the benefit of joining the Company on August 9, 2023, as the Chief Financial Officer and since then have been getting to know our customers, our people, and our various subsidiaries’ operations. Last summer, I worked with the teams to develop a comprehensive strategic planning process and portfolio analysis to both evaluate past performance and also establish the future direction of our Company.

2024 was a challenging year for the markets we serve. The Helios team remained focused on its controllables, while executing on its financial priorities. The Company generated record cash flow from operations in 2024 of $122.1 million, reduced debt by $75.3 million and ended the year with a stronger balance sheet and improved financial flexibility.

Since being appointed as your new President and CEO, I began a listening tour and traveled around our global operations to speak with our talented teams across all levels to learn as much as possible about their views of what we are doing well and what can be improved. I also met with customers and spoke with you, our shareholders, to better understand your interests and conveyed this feedback to our team. Some of our key focus areas including driving organic growth, improving profitability, and more effective deployment of capital, are key objectives moving forward; a direct reflection of the comments that shareholders shared with our Company over the last few years. We are committed to these key focus areas in 2025 and beyond. I know that we have exceptional employees who are dedicated to delivering positive results, and I am excited for the future we will build together.

We appreciate your interest, investment in, and continued support of our Company.

With much gratitude,

A Message from our Board Chair

As recently elected Chair of Helios' Board of Directors, I am both honored and optimistic as I look ahead to a promising future for the Company. While 2024 proved to be quite a challenging one, the Company navigated through a tough market, a leadership change, and multiple weather-related disasters. The Board believes the Company exited the year as a stronger more united Company.

We are delighted with the appointment of Sean Bagan to the role of President and Chief Executive Officer. The Board conducted a comprehensive search, using a reputable search firm and unanimously determined that Sean was the right choice to lead Helios. To date, Sean has confidently guided the operations, carefully managed costs and working capital, and implemented new programs and processes to further develop the high performing talent we have within the organization.

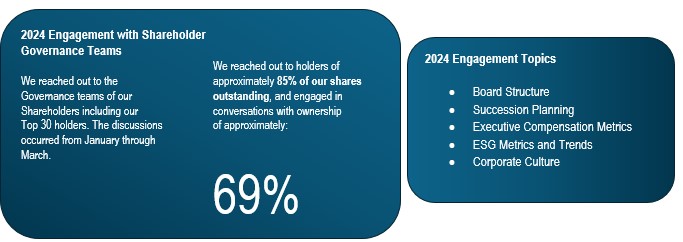

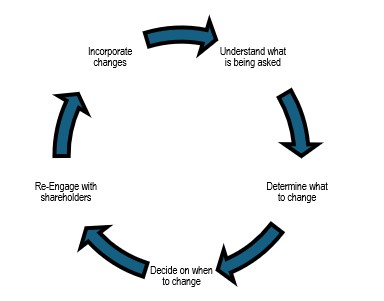

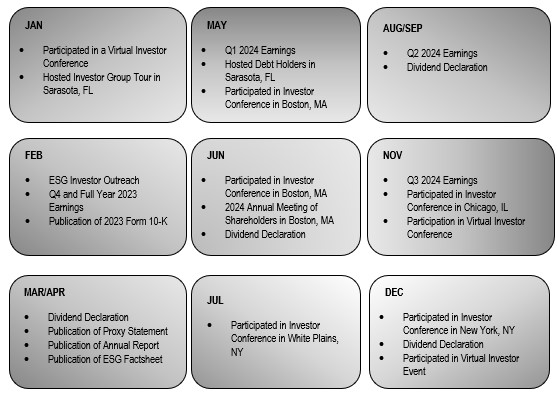

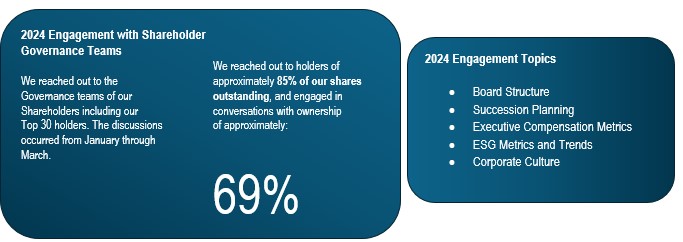

Since our last annual meeting, management and members of the Board have had extensive conversations with investors regarding governance. We reached out and engaged with our top shareholders. You will find in this proxy statement an in-depth review of our engagement process with shareholders, what they were asking for as well as what we have done, in response to their feedback.

The Board, in conjunction with management, will continue to evaluate updates to our governance practices based on the feedback from our key stakeholders including shareholders, employees and customers. We look forward to active discussions among the Board and management in 2025. On behalf of the Board of Directors and our leadership team, thank you for your continued interest in and support of Helios Technologies.

Warm regards,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sean P. Bagan President, Chief Executive Officer and Chief Financial Officer |

|

Laura Dempsey Brown Chair of the Board |

|

You are cordially invited to participate in the Helios Annual Meeting of Shareholders on June 4, 2025, at 9:00 a.m. (Central Time) at the Deer Path Inn, 255 E. Illinois Rd., Lake Forest, Illinois 60045. If you are a shareholder of record at the close of business on April 9, 2025, it is important that your shares are represented at the Annual Meeting even if you do not plan to attend. To ensure you will be represented, as soon as possible please vote by telephone, mail, or online.

HELIOS TECHNOLOGIES, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Wednesday, June 4, 2025

Notice is hereby given that the Annual Meeting of Shareholders of Helios Technologies, Inc., a Florida corporation, will be held in person on Wednesday, June 4, 2025, at 9:00 a.m. (Central Daylight Time) at the Deer Path Inn, 255 E. Illinois Rd., Lake Forest, Illinois 60045 for the following purposes:

1.To elect two directors, currently serving on our Board, to serve until the Annual Meeting in 2028, and one new director to serve until the Annual Meeting in 2027, whom shall serve until successors are elected and qualified or until an earlier resignation, removal from office or death.

2.To ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the year ending January 3, 2026.

3.To conduct an advisory vote to approve Named Executive Officer compensation.

4.To transact such other business as properly may come before the Meeting or any adjournment thereof.

Shareholders of record at the close of business on April 9, 2025 (referred to herein as the “record date”), are entitled to receive notice of and to vote at the Meeting and any adjournment thereof.

We sent a Notice of Internet Availability of Proxy Materials on or about April 23, 2025 and provided access to our proxy materials over the Internet beginning April 23, 2025, for the holders of record and beneficial owners of our common stock as of the close of business on the record date. If you received a Notice of Internet Availability by mail, you will not receive a printed copy of the proxy materials in the mail. Instead, the Notice of Internet Availability instructs you on how to access and review this proxy statement and our annual report and authorize a proxy online to vote your shares. If you received a Notice of Internet Availability by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability.

If your shares are held in street name by a brokerage, your broker will supply the Notice of Internet Availability instructions on how to access and review this proxy statement and our annual report and authorize a proxy online to vote your shares. If you receive paper copies of the materials from your broker by mail, please mark, sign, date and return your proxy card to the brokerage. It is important that you return your proxy to the brokerage as quickly as possible so that the brokerage may vote your shares. You may not vote your shares in person at the Meeting unless you obtain a power of attorney or legal proxy from your broker authorizing you to vote the shares, and you present this power of attorney or proxy at the Meeting.

|

|

|

|

|

By Order of the Board of Directors, |

|

|

|

|

|

Marc A. Greenberg |

|

|

General Counsel & Secretary |

Sarasota, Florida

April 23, 2025

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE SHAREHOLDERS MEETING TO BE HELD ON JUNE 4, 2025

This Proxy Statement and our Annual Report to Shareholders are available at: https://web.viewproxy.com/HeliosTechnologies/2025 and https://ir.heliostechnologies.com.

|

|

|

2025 Proxy Statement | i |

|

|

ii | 2025 Proxy Statement |

|

HELIOS TECHNOLOGIES, INC.

7456 16th Street East

Sarasota, Florida 34243

PROXY STATEMENT

This proxy overview is a summary of information that you will find throughout this proxy statement. As this is only an overview, we encourage you to read the entire proxy statement, which was first distributed to our shareholders on or about April 23, 2025.

|

|

|

|

|

2025 ANNUAL MEETING OF SHAREHOLDERS |

|

|

|

|

|

Time and Date: |

|

Wednesday, June 4, 2025, at 9:00 a.m. Central Daylight Time |

|

|

|

|

|

Place: |

|

Deer Path Inn, 255 E. Illinois Rd., Lake Forest, Illinois 60045 |

|

|

|

|

|

Record Date: |

|

April 9, 2025 |

|

|

|

|

|

Voting: |

|

Shareholders as of April 9, 2025 (the “record date”) may vote by mail, over the internet or by telephone on or before 11:59 p.m. Eastern Daylight Time on June 3, 2025 for shares held directly and by 11:59 p.m. Eastern Daylight Time on May 30, 2025 for shares held in a Helios Technologies, Inc. 401(k) (the "Plan") through one of the following options: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By completing, signing and

dating the voting instructions

in the envelope provided |

|

By the internet at www.fcrvote.com/HLIO |

|

By telephone at 1-866-402-3905 |

|

In person by completing,

signing and dating a ballot

at the annual meeting |

Any proxy delivered pursuant to this solicitation may be revoked, at the option of the person executing the proxy, at any time before it is exercised by delivering a signed revocation to the Company, by submitting a later-dated proxy or by attending the meeting in person and casting a ballot. If proxies are signed and returned without voting instructions, the shares represented by the proxies will be voted as recommended by the Board of Directors (the “Board”). If you are a shareholder of record, you may vote by granting a proxy. Specifically, you may vote:

•By Internet—If you have Internet access, you may submit your proxy by going to www.fcrvote.com/HLIO and by following the instructions on how to complete an electronic proxy card. You will need the 16-digit number included on your Notice or your proxy card in order to vote by Internet.

•By Telephone—If you have access to a touch-tone telephone, you may submit your proxy by dialing 1-866-402-3905 and by following the recorded instructions. You will need the 16-digit number included on your Notice or your proxy card in order to vote by telephone.

•By Mail—You may vote by mail by returning the card in the envelope that will be provided to you. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), indicate your name and title or capacity.

•In Person—You may vote by attending the Meeting in person and casting a ballot.

The cost of soliciting proxies will be borne by the Company. In addition to the use of the mail, proxies may be solicited personally, by internet or by telephone by regular employees of the Company. The Company does not expect to pay any compensation for the solicitation of proxies, but may reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their expense in sending proxy materials to their principals and obtaining their proxies. The approximate date on which this Proxy Statement and enclosed form of proxy first has been mailed or made available over the Internet to shareholders is as of April 23, 2025.

|

|

|

2025 Proxy Statement | 1 |

The close of business on April 9, 2025, has been designated as the record date for the determination of shareholders entitled to receive notice of and to vote at the Meeting. As of April 9, 2025, 33,331,814 shares of the Company’s Common Stock, par value $.001 per share, were issued and outstanding. Each shareholder will be entitled to one vote for each share of Common Stock registered in his or her name on the books of the Company on the close of business on April 9, 2025, on all matters that come before the Meeting. Abstentions will be counted as shares that are present and entitled to vote for purposes of determining whether a quorum is present. Shares held by nominees for beneficial owners will also be counted for purposes of determining whether a quorum is present if the nominee has the discretion to vote on at least one of the matters presented, even though the nominee may not exercise discretionary voting power with respect to other matters and even though voting instructions have not been received from the beneficial owner (a “broker non-vote”). Brokers have the discretionary voting power with respect to the ratification of the appointment of Grant Thornton LLP as our independent public accounting firm.

Vote Required

Directors are elected by a plurality of votes cast (meaning that the one director nominee who receives the highest number of shares voted “for” the election are elected). “Withhold” votes and broker non-votes are not considered votes cast for the foregoing purpose and will have no effect on the election of the nominee.

The ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm is approved if the votes cast favoring the action exceed the votes cast opposing the action. Abstentions are not considered votes cast for the foregoing purpose and will have no effect on the vote for this proposal. This proposal is considered a routine matter on which a broker will have discretionary authority to vote on the proposal should a beneficial holder not provide voting instructions. For that reason, if you are a beneficial holder and you wish to vote “for,” “against” or “abstain” from this proposal, you will have to provide your broker with such an instruction. Otherwise, your broker will vote in its discretion.

The advisory vote on named executive officer compensation is approved if the votes cast favoring the action exceed the votes cast opposing the action. Abstentions and broker non-votes are not considered votes cast for the foregoing purpose and will have no effect on the vote for this proposal.

Our Shared Values Shape our Culture

As an organization, we use our Shared Values as a guide to ensure we act in everyone’s best interest to achieve our mission.

|

|

2 | 2025 Proxy Statement |

|

These Shared Values are for the entire organization and every employee, no matter their role or function. They are the foundation from which we work and drive our organization forward each day.

These Shared Values are:

Honesty

Committing fully to truth, transparency, and actions that build trust and collaboration.

Excellence

Driving relentlessly for mastery that elevates quality, performance and standards.

Learning

Pursuing growth by harnessing successes and failures as fuel for advancing collective knowledge.

Innovation

Fostering a culture of creativity that ignites imagination and forges a better path forward.

Ownership

Embracing responsibility and taking accountability for all our actions results.

Solutions

Solving problems and conquering challenges to deliver impactful outcomes.

|

|

|

2025 Proxy Statement | 3 |

2024: Year in Review

27 CONSECUTIVE YEARS of Dividends to Shareholders

TOTAL COMPANY FINANCIAL RESULTS1

|

|

|

CONTINUED TO LEAD WITH INNOVATION Hydraulics: Launched 11 new cartridge valves including a high capacity electro-proportional flow control valve and a commercialized ENERGEN™ valve Electronics: Launched PowerView™ U150 15-inch and PowerView® U120 12-inch Displays, SenderCAN® Plus solution, and PowerView™ U35 Display |

|

|

|

DROVE OPERATIONAL EFFICIENCIES Operating Margin: 60 bps of annual expansion, while holding gross margin steady on lower volume Americas: Center of Excellence in Indiana improved on-time delivery and reduced lead times EMEA: Faster and NEM operational realignments APAC: 65% of Balboa branded products are now built in China for local customers as compared to zero two years ago |

|

|

|

CHALLENGED MARKETS / PRESSURED GROWTH Agriculture: Continued to operate in a severe multi-year down cycle Mobile: Primarily construction driving tough year over year results Industrial: Industrial machinery and power generation weakest areas Recreation: Marine, off-road, and motorcycle still in decline from pandemic highs, challenged by consumer confidence and interest rates |

|

|

|

FIRSTS AND NEW LEADERSHIP Record Cash Flow: Generated $122 million of cash from operations, up 46% over 2023 Refinanced and De-levered Balance Sheet: Extended and upsized credit facility, while reducing borrowing spreads; improved net debt to adjusted EBITDA leverage ratio down to 2.6X CEO Transition: CFO Sean Bagan named Interim President & CEO in July 2024, then promoted to the role permanently in January 2025 |

1 See Appendix A for reconciliations of non-GAAP financial measures to our results as reported under generally accepted accounting principles ("GAAP") in the United States.

|

|

4 | 2025 Proxy Statement |

|

|

|

|

|

|

|

|

|

|

|

PROPOSAL — ELECTION OF DIRECTORS |

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

The Board of Directors recommends a vote “FOR” the nominees. |

|

|

|

|

|

The Board of Directors recommends that you vote “FOR” Ms. Sacchi and Mr. Britt to serve until the Company’s annual meeting in 2028, or until their successors shall be duly elected and qualified and recommends that you vote “FOR” Mr. Bagan to serve until the Company’s annual meeting in 2027, or until his successor shall be duly elected and qualified. |

|

|

|

|

The proposed Board of the Company will consist of six members. The Board is divided into three classes of directors serving staggered three-year terms. Directors hold their positions until the annual meeting of shareholders in the year in which their terms expire, until their respective successors are elected and qualified, or until their earlier resignation, removal from office or death.

The term of office of two of the Company’s existing directors – Doug Britt and Diana Sacchi, will expire at the Meeting. Philippe Lemaitre, who previously announced his retirement from the Board, will not be nominated for reelection. The Board would like to express its sincere gratitude to Mr. Lemaitre for his years of service on the Helios Board which began in June 2007 and in which he has served as the Board Chair since 2013.

On July 1, 2024, the Company appointed Mr. Lemaitre Independent Executive Chairman, as it placed Josef Matosevic, then President & Chief Executive Officer and Director, on paid leave as it investigated allegations related to potential violations of the Company's Code of Business Conduct and Ethics. On that same date, the Company announced that Sean Bagan would be assuming the role of Interim President & Chief Executive Officer in addition to his responsibility as Chief Financial Officer.

On July 29, 2024, the Company terminated Mr. Matosevic for cause after an independent investigation from an outside law firm determined that Mr. Matosevic violated Company policy and demonstrated behavior that was inconsistent with the Company's shared values and Code of Business Conduct and Ethics. The Company would then initiate a comprehensive search to identify a permanent successor as President & Chef Executive Officer.

On January 6, 2025, the Company announced publicly that a promotion was extended to and accepted by Mr. Bagan to assume the role of President and Chief Executive Officer of the Company, effective immediately, as well as join the Board and seek election at the 2025 Annual Meeting.

The Nominating Committee to the Board of Directors has selected each of Mr. Britt and Ms. Sacchi as nominees to stand for reelection to the Board at the Meeting, to serve until the Company’s annual meeting of shareholders in 2028. The Nominating Committee also has nominated Sean Bagan for election to the Board at the Meeting. In its attempt to balance the classes of its Board, the Nominating Committee has nominated Mr. Bagan to serve until the Company’s Annual Meeting of shareholders in 2027.

In making its nominations of Mr. Bagan, Mr. Britt and Ms. Sacchi, the Nominating Committee reviewed the backgrounds of the individuals and believes each of them have valuable individual perspectives, backgrounds, skills and experiences that, taken together, provide the Company with the diversity and depth of knowledge, judgment and vision necessary to provide effective oversight. Biographical information for the nominees is set forth below under “Directors and Executive Officers.”

Shareholders may vote for up to three nominees for the class of directors who will serve until the Company’s annual meeting in 2027 and 2028, as described in this proposal above. If a quorum is present at the meeting, directors will be elected by a plurality of the votes cast. Shareholders may not vote cumulatively in the election of directors. In the event that the nominee would be unable to serve, which is not anticipated, the Proxy Committee, which consists of Cariappa Chenanda and Alexander Schuetz, will vote for such other person or persons for the office of Director as the Board may recommend.

|

|

|

2025 Proxy Statement | 5 |

GOVERNANCE OF THE COMPANY

Directors and Executive Officers

The following tables set forth the names and ages of the Company’s current and proposed directors and current Executive Officers and the positions they hold with the Company. Executive Officers serve at the pleasure of the Board.

|

|

|

|

|

|

|

|

|

Name/Age/Independence/Tenure |

|

|

Committee Membership (C: Chair) |

|

|

Biographies |

Audit |

Comp. |

Nom. |

ESG |

|

|

Laura Dempsey Brown, 61 Independent Director and Chair of the Board Chair Since: March 2025 Director Since: April 2020 |

|

Previously the Senior Vice President, Communications and Investor Relations for W.W. Grainger, Inc. (NYSE: GWW), a leading broad line supplier of maintenance, repair and operating products, reporting directly to Grainger’s CEO and Chairman, until her retirement in 2018 after 19 years, including serving as Vice President of Marketing, as well as leading the strategy development and operational execution of Grainger’s multi-year market expansion initiative focused on the top 25 U.S. metro markets. Ms. Dempsey Brown also served as the Vice President of Finance for Grainger’s field sales, operations, marketing and e-business functions. Prior to joining Grainger, Ms. Dempsey Brown was a Vice President at Alliant Foodservice and at Dietary Products at Baxter. She began her career at Baxter in 1985 focusing primarily on financial roles in the distribution and manufacturing businesses. Ms. Dempsey Brown has over 18 years in finance or accounting leadership roles and has extensive knowledge in strategy, M&A, corporate governance, crisis management and general overall business acumen. Ms. Dempsey Brown holds a Bachelor’s degree in accounting from Indiana University and obtained designation as a Certified Public Accountant in 1985. |

● |

|

|

● |

|

|

Sean Bagan, 49 President, Chief Executive Officer, Chief Financial Officer and Proposed Director Non-Independent Director Director Since: June 2025 |

|

President and Chief Executive Officer of the Company since January 6, 2025 and Chief Financial Officer since August 9, 2023. Mr. Bagan joined Helios after spending 23 years at Polaris Inc., a global leader in powersports and off-road innovation. With extensive financial management leadership experience, Mr. Bagan has more than 20 years of international business, strategic financial operations, and leadership experience. His responsibilities scaled with Polaris over the decades in operational finance, international sales, product segments, acquisitions and corporate finance and treasury. In addition to financial management positions, his roles included general management and operational oversight for U.S. and global businesses. He earned his B.A. double major in Accounting and Management from St. John’s University in Minnesota and began his career with Arthur Andersen, LLP. Mr. Bagan also holds a General Management Certificate from Cambridge University’s Judge Business School in England, along with a Certified Public Accountant (Inactive) Certificate from the state of Minnesota. |

|

|

|

|

|

|

|

|

|

|

|

|

6 |

2024 Proxy Statement |

|

|

|

|

|

Governance of the Company |

|

|

|

|

|

|

|

|

|

Name/Age/Independence/Tenure |

|

|

Committee Membership (C: Chair) |

|

|

Biographies |

Audit |

Comp. |

Nom. |

ESG |

|

|

Douglas M. Britt, 60 Independent Director Director Since: December 2016 |

|

President and Chief Executive Officer of Boyd Corporation, a multinational leader in engineered materials and thermal management solutions, with a workforce of over 6,000 employees, since May 2020. Previously, he served as President of the Integrated Solutions division of Flex Agility (NASDAQ: FLEX), a leading sketch-to-scale solutions company that provides innovative design, engineering, manufacturing, real-time supply chain insight, and logistics services to companies of all sizes in various industries and end-markets. Responsible for a $19B business within Flex Agility, which operates in over 30 countries with a workforce of over 200,000 employees. From May 2009 to November 2012, Mr. Britt served as Corporate Vice President and Managing Director of Americas for Future Electronics, and from November 2007 to May 2009, was Senior Vice President of Worldwide Sales, Marketing, and Operations for Silicon Graphics. From January 2000 to October 2007, Mr. Britt held positions of increasing responsibility at Solectron Corporation, culminating his career there as Executive Vice President, and responsible for Solectron’s customer business segments including sales, marketing and account and program management functions. As an executive at multinational companies, Mr. Britt has extensive global mergers and acquisition experience, global manufacturing and supply chain expertise and a deep understanding of customer relationships and leading a global business. Mr. Britt holds a Bachelor’s degree in business administration from California State University, Chico, and attended executive education programs throughout Europe, including the University of London. |

C |

|

● |

|

|

|

Cariappa (Cary) M. Chenanda, 57 Independent Director Director Since: April 2020 |

|

Cary Chenanda currently serves as the Executive Vice President and President of Novelis and leads all aspects of the company’s business in North America. Novelis is a subsidiary of Hindalco (Bombay Stock Exchange: HINDALCO.BO), headquartered in Atlanta, Georgia, and is a global leader in the production of innovative, sustainable flat rolled aluminum products and solutions and is the world's largest recycler of aluminum. Novelis, North America operates 15 aluminum products facilities and had revenues of US$6.7 billion in fiscal year 2024 serving the beverage packaging, automotive and specialties markets. Prior to joining Novelis in April 2024, Cary was a Vice President and an Officer of Cummins Inc. (NYSE: CMI), where he had worked for 26 years. He most recently held the position of Vice president & General Manager of Cummins Emissions Solutions, a $4 billion global business with 4,500 employees, 12 manufacturing plants, seven technical centers, and two joint ventures worldwide. In 2012, Cary established and led Cummins Electronics and in 2017, he oversaw the unification of Cummins Electronics and Cummins Fuel System Businesses into one combined business. Between 1998 and 2012, Mr. Chenanda had roles with increasing responsibility in engineering, marketing, purchasing and general management of a joint venture with Scania. Mr. Chenanda has also worked for Ecolab and Robert Bosch GmbH. He is a Certified Purchasing Manager, a certified Six Sigma Green Belt and holds 7 United States patents. Mr. Chenanda holds an MBA from Indiana University’s Kelly School of Business, an MS in Mechanical Engineering from Texas A&M University and a bachelor’s in mechanical engineering from the University of Mysore, India. Mr. Chenanda also currently serves on the Industry Advisory Council for Texas A&M’s Mechanical Engineering. |

|

● |

|

C |

|

|

|

2025 Proxy Statement | 7 |

|

Governance of the Company |

|

|

|

|

|

|

|

|

|

|

|

Name/Age/Independence/Tenure |

|

|

Committee Membership (C: Chair) |

|

|

Biographies |

Audit |

Comp. |

Nom. |

ESG |

|

|

Diana Sacchi, 65 Independent Director Director Since: June 2022 |

|

Chief Human Resources Officer ("CHRO") at Grameen America, a non-profit micro-finance organization dedicated to lending to women to enable financial mobility. Prior to returning to Grameen America in November 2020, served as EVP & CHRO at Welbilt, (NYSE: WBT), a global manufacturer of commercial foodservice equipment. From June 2014 to January 2016, served as Vice President HR for North America at LG Electronics USA and CHRO at Grameen America, where she built the foundation of the HR function. Ms. Sacchi brings more than 25+ years of global Human Resources expertise in addition to HR advisory and consulting expertise and leadership coaching. Her career includes roles of progressive HR leadership at Avon Products, Bristol Myers Squibb and the United Nations Development Program. As CHRO for several companies, Ms. Sacchi has advised CEOs, transformed global HR organizations, participated in acquisition and integration activities, and redesigned compensation programs. A leader with exceptional global experience, she has improved the effectiveness of a wide range of organizations, from multi- billion-dollar corporations to nonprofits serving a variety of sectors including manufacturing, cosmetics, electronics, pharmaceuticals, micro-finance and education. Ms. Sacchi holds a B.A. in Psychology from Texas Woman’s University and M.Ed. & M.A. in Psychological Counseling & Organizational Psychology from Columbia University. She is fluent in English, Spanish, and Italian. |

|

● |

C |

● |

|

|

|

|

Alexander Schuetz, 58 Independent Director Director Since: June 2014 |

|

CEO of Knauf Engineering GmbH, an engineering company in the gypsum based construction materials industry, responsible for a portfolio of multinational projects with a total volume of $500 million. Prior to joining Knauf in February 2009, Dr. Schuetz held various management positions in Finance, Business Development, Mergers & Acquisitions, Project Management and General Management in the fluid power industry at Mannesmann and Bosch Rexroth, including as CEO of Rexroth Mexico and Central America from August 2000 to August 2007. From 1998 to 2000, based in Beijing, China, he was responsible for the Finance, Tax and Legal division at Mannesmann (China) Ltd., the holding company for a number of affiliated companies of the Mannesmann Group, including Rexroth, Demag, Sachs and VDO. In 2003, Dr. Schuetz completed the Robert Bosch North America International General Management Program at Carnegie Mellon University. Dr. Schuetz brings a wealth of experience in major growth regions of the world, including Asia and Latin America and global insights into markets and customers to the Company, including the hydraulics industry. Dr. Schuetz holds a Ph.D. in international commercial law from the University of Muenster, Germany. |

|

|

● |

C |

|

● |

|

|

8 | 2025 Proxy Statement |

|

|

Governance of the Company |

|

|

|

|

|

|

|

|

|

Name/Age/Tenure |

|

Biographies |

|

|

|

|

|

|

|

Sean Bagan, 49 President, Chief Executive Officer, Chief Financial Officer and Proposed Director Executive Officer Since: August 2023 |

|

Mr. Bagan's biography is provided above in Director's Biographies. |

|

|

|

|

|

|

|

Billy Aldridge, 53 Senior Vice President, Managing Director, Electronics Executive Officer Since: April 2025 |

|

Senior Vice President, Managing Director of Electronics since April 2025. Previously served as the Senior Vice President, Managing Director of Enovation Controls since May 3, 2021. He joined FW Murphy, a division of Enovation Controls, in 2008 as the OEM Sales Manager where he grew the marine market prior to stepping into a director position in 2015 and then in 2018 moving to the Vice President of Business Development. Mr. Aldridge joined MerCruiser/Mercury, part of the Brunswick Corporation in 2000, where he earned his Lean Six Sigma and worked in many different functional areas including Supply Chain, Program Management & OEM Sales. He has a bachelor’s degree in Sociology from Oklahoma State University. |

|

|

|

|

|

|

|

Matteo Arduini, 52 President Hydraulics, EMEA Executive Officer Since: June 2019 |

|

President of Hydraulics, EMEA, previously President, QRC since June 18, 2019. Previously served as General Manager as well as Chief Financial Officer at Faster. From September 2012 to April 2018, Mr. Arduini was with Brevini /Dana Incorporated (NYSE: DAN). He served as the CFO of the Brevini Group and the project leader in Dana’s acquisition of Brevini Group as well as Head of Finance in Dana Brevini Italy. With previous professional experience with Ernst & Young, Ferrari Cars and Technogym, Mr. Arduini graduated from the University of Parma in 1998 with a degree in Economics. |

|

|

|

|

|

|

|

Marc Greenberg, 48 General Counsel and Secretary Executive Officer Since: January 2022 |

|

General Counsel & Secretary since January 4, 2022, having served as Associate General Counsel since January 2021 when he joined the Company. Previously General Counsel to Diversified Maintenance Systems, LLC, a national facilities maintenance services company, from January 2019 to January 2021. Served as Associate General Counsel at Welbilt Corporation (NYSE: WBT), a global manufacturer of commercial foodservice equipment, from 2016-2019. Prior to his corporate experience, Mr. Greenberg was a litigation attorney in the New York/New Jersey area for over seven years. He began his career in New York, New York as a Commercial Real Estate Agent for Newmark Group, Inc. in 1998 before working as a Corporate Specialist for Computershare Trust Company in November 2001. In addition to over 16 years of legal experience, Mr. Greenberg holds a Bachelor’s degree in Economics from Muhlenberg College in Allentown, Pennsylvania, as well as a Juris Doctorate degree from Nova Southeastern in Davie, Florida, and an MBA from Louisiana State University. |

|

|

|

|

|

|

|

|

|

Rick Martich, 54 President Hydraulics, Americas Executive Officer Since: March 2023 |

|

President of Hydraulics, Americas since March 30, 2023. Previously served as Interim President as well as Co-General Manager of the CVT business through a previous transition. Mr. Martich joined Enovation Controls in 2006 and progressed from managing customer service and quality, through leading global manufacturing, to operations and international sales. Mr. Martich was promoted to Senior Vice President, Global Manufacturing Operations in November 2020. He has over 25-years of leadership experience in engineering, manufacturing, finance and sales. Mr. Martich began his career in 1994 as a process/project engineer with PPG Industries. He went on to The Boeing Company where he led Lean Manufacturing activities on the 777 Floor Beam value stream and implemented Toyota Production System concepts & tools. He then spent time with Level 3 Communications where he progressed through a variety of roles across finance, engineering, and field services. A Six-Sigma Black Belt, as well as Gemba & Distribution Kaizen Coach, he holds a Bachelor of Mechanical Engineering degree from Georgia Tech and an MBA from The University of Tulsa with a focus in finance. |

|

|

|

2025 Proxy Statement | 9 |

|

Governance of the Company |

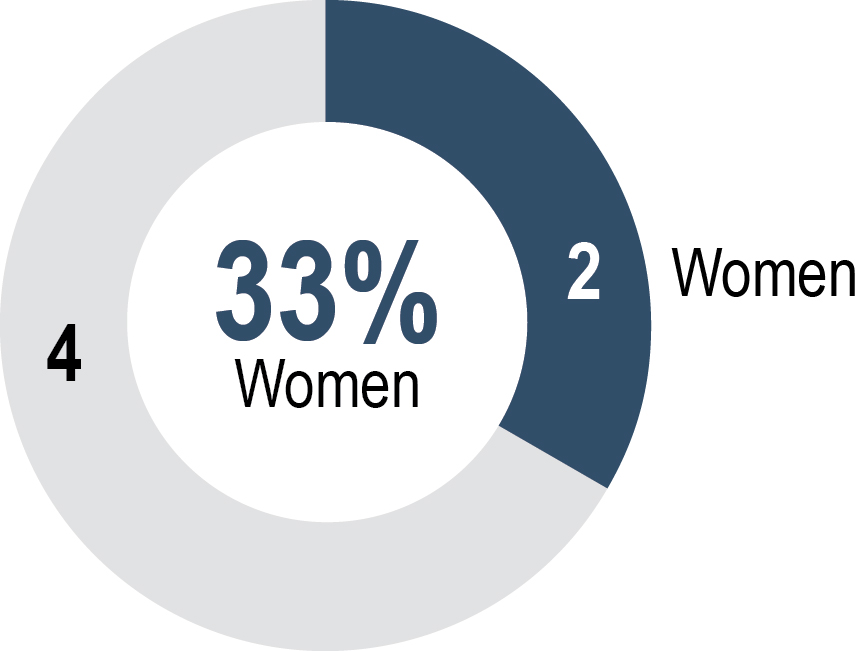

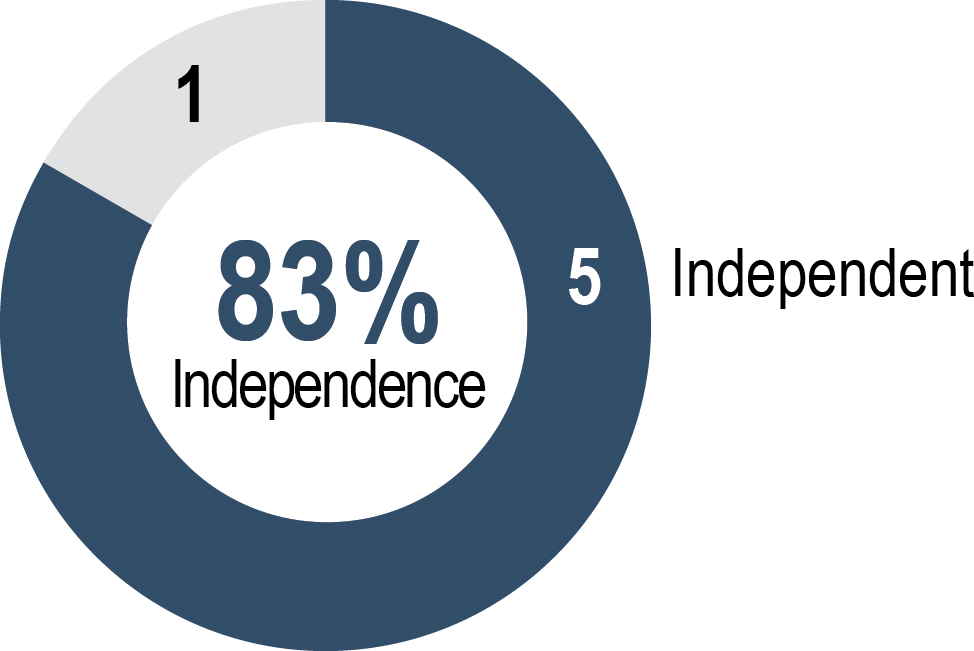

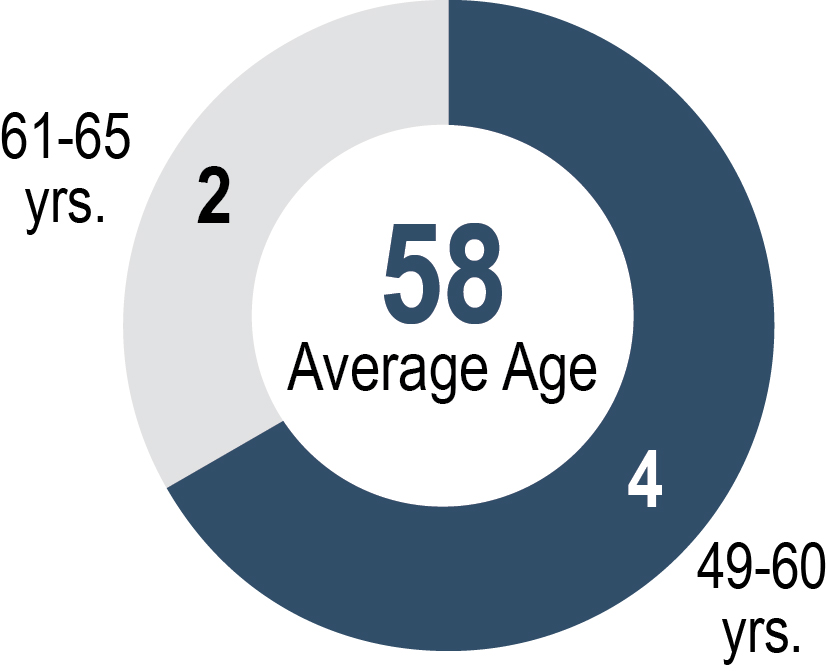

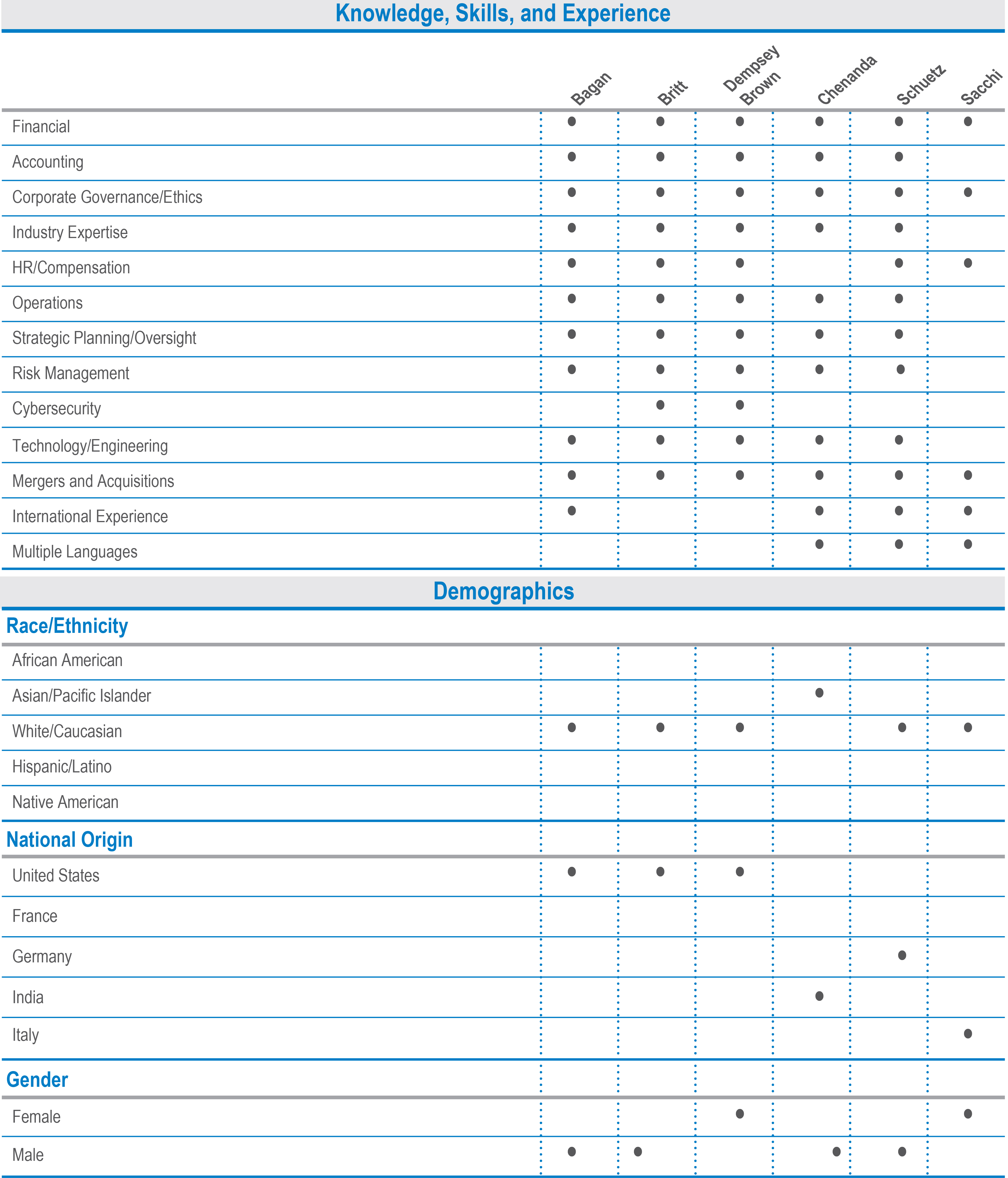

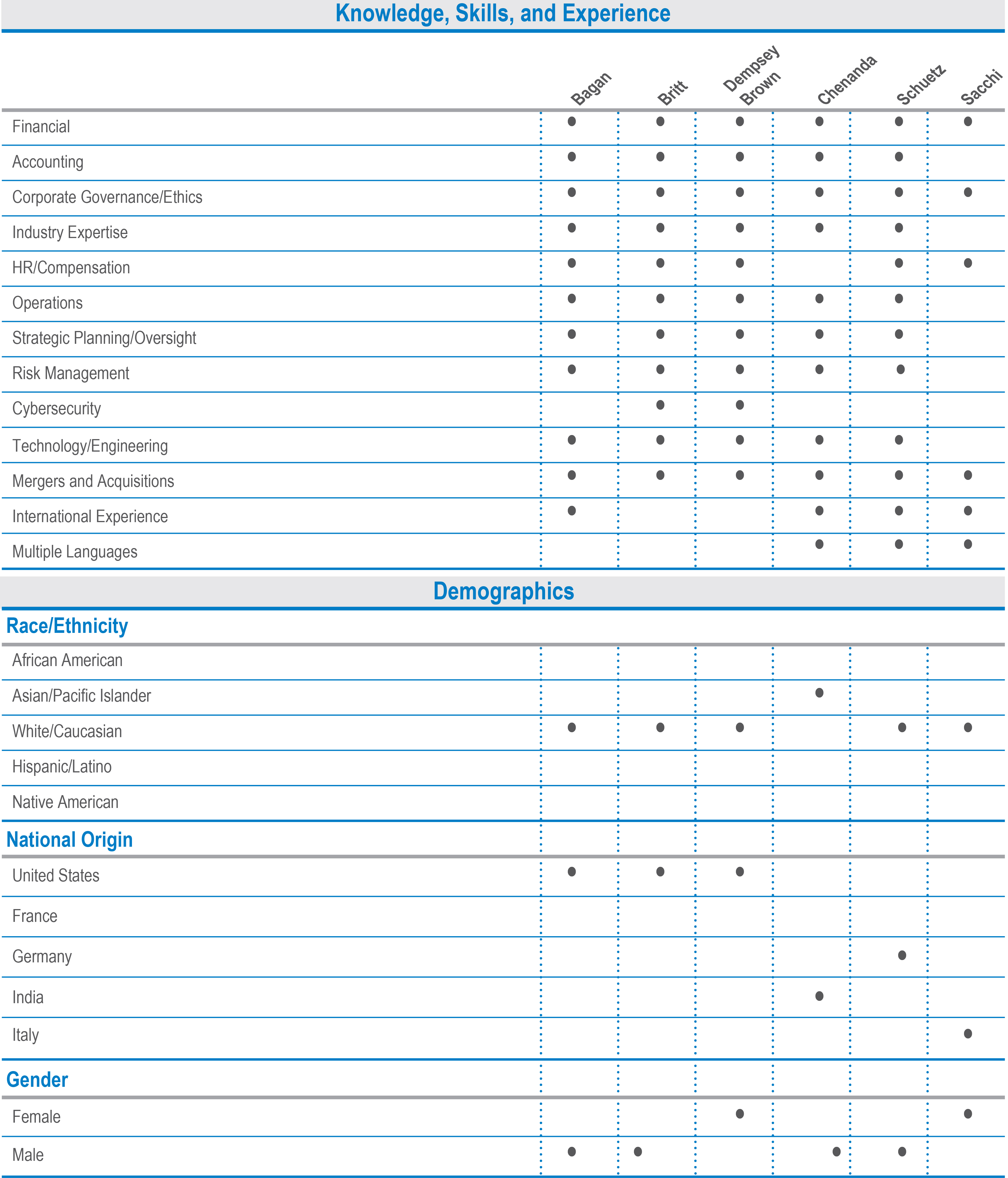

Board Skills and Diversity Matrix

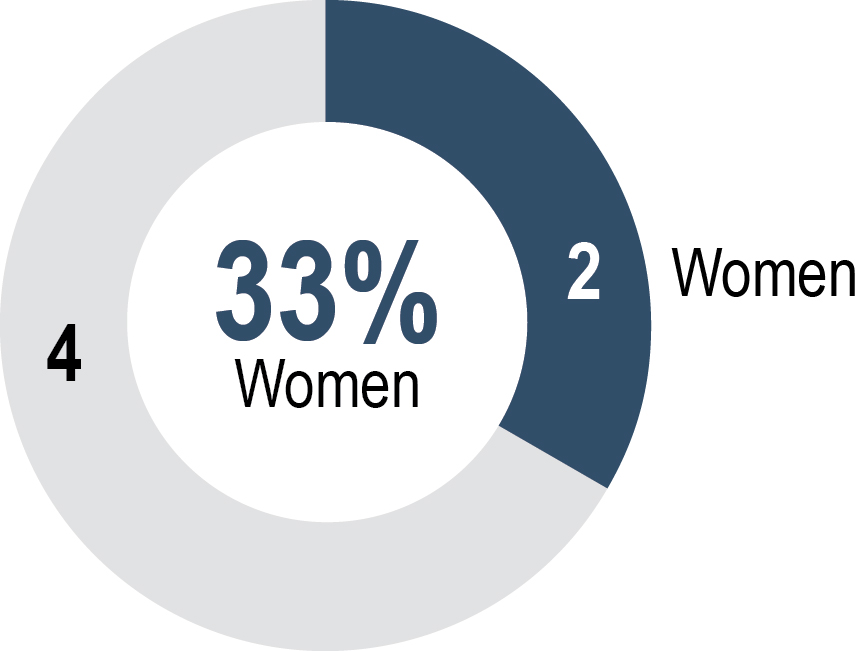

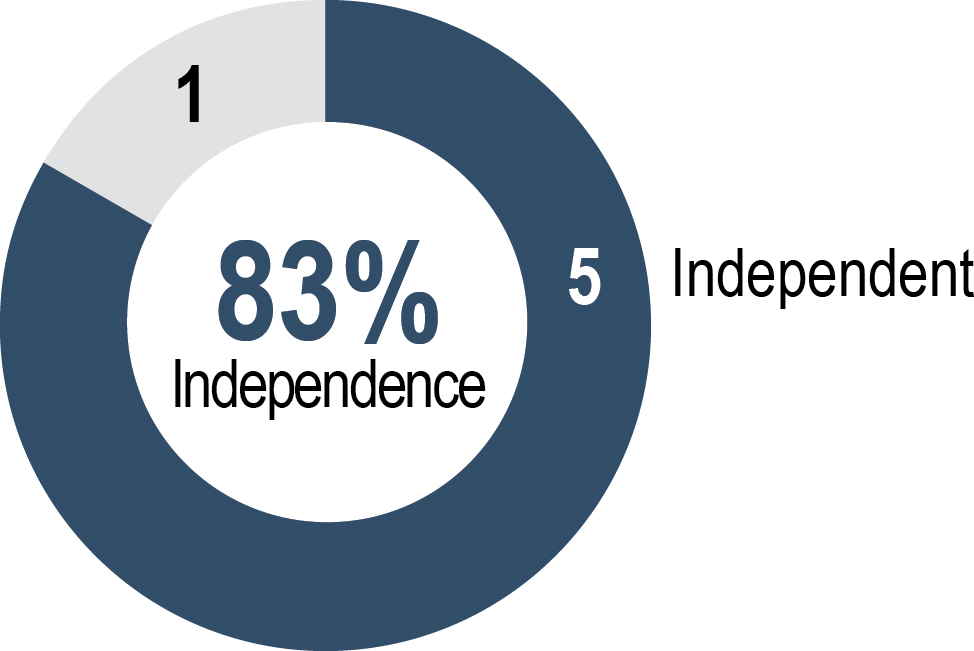

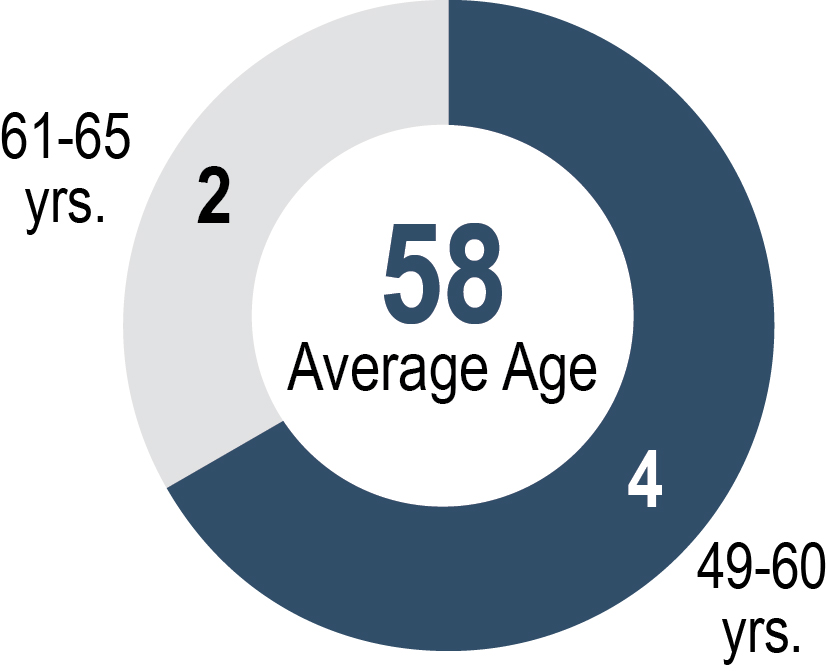

The below matrix summarizes the skills and diversity demographics of our proposed Board of Directors as of April 23, 2025.

|

|

|

|

|

|

|

|

|

|

Gender |

|

|

Independence |

|

|

Average Age |

|

|

Refreshment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OVER HALF of our Board refreshed within the past 5 years |

|

|

10 | 2025 Proxy Statement |

|

|

Governance of the Company |

|

|

|

2025 Proxy Statement | 11 |

|

Governance of the Company |

The Board acts as a collaborative body that encourages broad participation of each of the directors at Board meetings and in the Committees, described below, on which they serve. The Board believes a majority of directors should be independent. The independent directors meet informally, and they also meet in regular executive sessions of the Board. The Company currently separates the functions of Chair of the Board and Chief Executive Officer. The Chair of the Board, who is a non-management, independent director, chairs the meetings of the Board, serves as a nonvoting ex officio member of each of the Board Committees and is a current member of the Audit and ESG Committee. The Chair approves the agenda for each Board meeting, after soliciting suggestions from management and the other Directors. Given the size of the Company, its international operations and its culture of individual initiative and responsibility, the Board believes its leadership structure is appropriate. The Board believes that a governing body comprised of individuals with diverse backgrounds in terms of geographic, cultural and subject matter experience, strong leadership and collaborative skills, is best equipped to oversee the Company and its management. On July 29, 2024, the Company created the temporary role of Executive Chairman to be effective on an interim basis while the Company conducted a search for a new President and Chief Executive Officer. The previous Chair of the Board, Mr. Lemaitre, served in this capacity. Additionally, the Board appointed Mr. Bagan as "Interim President and Chief Executive Officer" and Mr. Bagan assumed these duties in addition to his role as Chief Financial Officer. On January 6, 2025, the Company publicly announced a promotion was extended to and accepted by Mr. Bagan to assume the role of President and Chief Executive Officer and to serve as a member of the Board. Mr. Lemaitre's interim role ceased on January 6, 2025. Mr. Bagan will continue to serve as the Chief Financial Officer while the Company conducts a search to backfill this position.

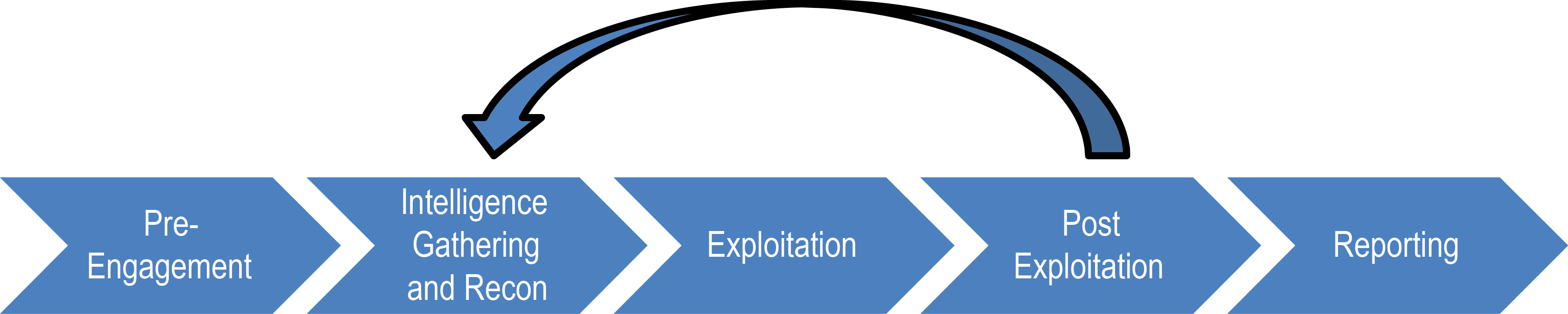

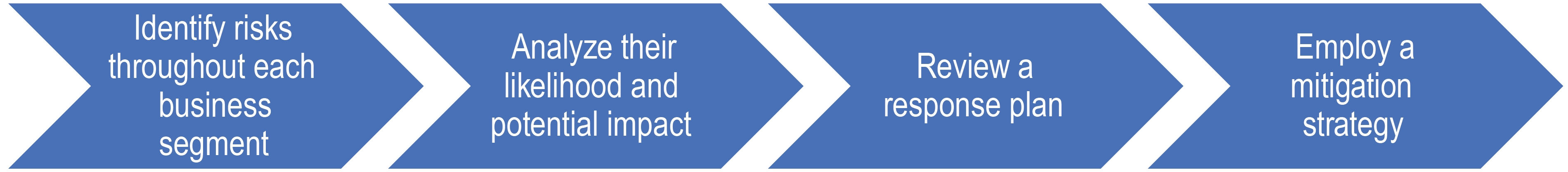

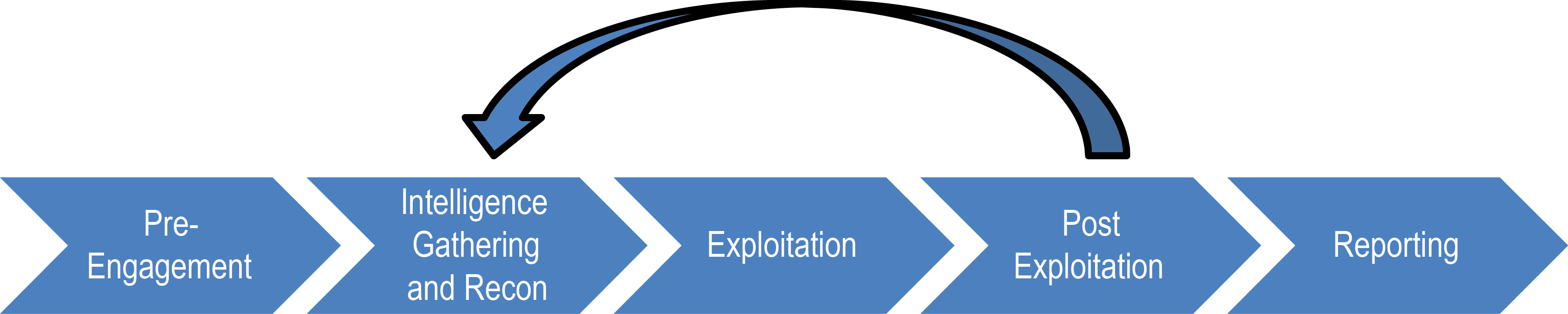

The Company’s culture emphasizes individual integrity, initiative and responsibility. The Company’s compensation structure does not encourage individuals to undertake undue risk for personal financial gain. The Board has delegated to the Audit Committee the responsibility for financial risk and fraud oversight, considering for approval all transactions involving conflicts of interest and monitoring compliance with the Company’s Code of Business Conduct and Ethics (“Code”). The Environmental, Social and Governance Committee ("ESG Committee") addresses non-financial risks, including political and economic risks, risks relating to the Company’s growth strategy, and current business risks on a quarterly basis, including material risks facing the businesses, risks it may face in the future, measures that management has employed to address those risks and other information relating to how risk analysis is incorporated into the Company’s corporate strategy and day-to-day business operations. The ESG Committee provides recommendations to the Board with respect to those and other risks, including leadership development and succession. Beginning in 2022, an updated risk governance framework was implemented to update the Board, on a quarterly basis, on various risks facing the Company, their likelihood and potential impact, and a response plan. That framework was updated in 2023 to provide more insight and input from the business units to the Board. That framework was expanded in 2024 to bring more risks from the Corporate level to the ESG Committee on a quarterly basis and presented to the Board of Directors at each Board meeting.

As part of its risk oversight and compliance responsibilities, the Board adheres to the Company's Code that serves as an overarching document to supplement similar policies adopted by its subsidiaries. The Code has been translated into multiple languages, and training programs are held annually to all Helios employees globally to help ensure the Code is understood and observed throughout the Company.

Shareholder Recommendations for Nomination as a Director

In order for the Committee to consider a candidate recommended by a shareholder, the shareholder must provide to the Corporate Secretary, at least 120, but not more than 150, days prior to the date of the shareholders’ meeting at which the election of directors is to occur, a written notice of such security holder’s desire that such person be nominated for election at the upcoming shareholders meeting; provided, however, that in the event that less than 120 days’ notice or prior public disclosure of the date of the meeting is given or made to shareholders, notice by the shareholder to be timely must be received not later than the close of business on the tenth business day following the day on which such notice of the date of the meeting was mailed or such public disclosure was made, whichever first occurs.

|

|

12 | 2025 Proxy Statement |

|

|

Governance of the Company |

|

A shareholder’s notice of recommendation must set forth: (a)as to each person whom the shareholder proposes be considered for nomination for election as a director (i)the name, age, business address and residence address, (ii)his or her principal occupation or employment during the past five years, (iii)the number of shares of Company common stock he or she beneficially owns, (iv)any other information relating to the person that is required to be disclosed in solicitations for proxies for election of Directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended, and (v)the consent of the person to serve as a Director, if so elected; and (b)as to the shareholder giving the notice (i)the name and record address of shareholder, (ii)the number of shares of Company common stock beneficially owned by the shareholder, (iii)a description of all arrangements or understandings between the shareholder and each proposed nominee and any other person pursuant to which the nominations are to be made, and (iv)a representation that the shareholder intends to appear in person or by proxy at the meeting to nominate the person(s) named. |

Board and Committee Oversight Responsibilities

The Board has adopted a Statement of Policy Regarding Director Nominations, setting forth qualifications of directors, procedures for identification and evaluation of candidates for nomination, and procedures for recommendation of candidates by shareholders.

|

As set forth in the Statement of Policy, a candidate for Director should meet the following criteria: •must, above all, be of proven integrity with a record of substantial achievement. •must have demonstrated ability and sound judgment that usually will be based on broad experience. •must be able and willing to devote the required amount of time to the Company’s affairs, including attendance at Board and Committee meetings and the annual shareholders’ meeting. •must possess a judicious and somewhat critical temperament that will enable objective appraisal of management’s plans and programs; and •must be committed to building sound, long-term Company growth. |

|

|

|

2025 Proxy Statement | 13 |

|

Governance of the Company |

Director Participation and Relationships

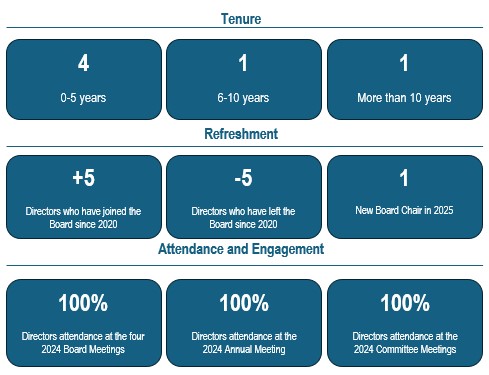

The Board held 4 Board Meetings and 12 Special Meetings during 2024 and all independent directors who served in 2024 were present at each meeting. Each director also attended all meetings of each Committee of which he or she was a member in 2024.

The Board has adopted a policy stating that it is in the best interests of the Company that all directors and nominees for director attend each annual meeting of the shareholders of the Company. The policy provides that the Board, in selecting a date for the annual shareholders meeting, will use its best efforts to schedule the meeting at a time and place that will allow all directors and nominees for election as directors at such meeting to attend. The policy further provides that an unexcused absence under the policy should be considered by the Nominating Committee in determining whether to nominate a director for re-election at the end of his or her term of office. All directors attended last year’s annual meeting of shareholders. No family relationships exist between any of the Company’s directors and executive officers. There are no arrangements or understandings between directors and any other person concerning service as a director.

Board Diversity and Tenure

Consistent with the Company’s Corporate Governance Guidelines, the Nominating Committee and the Board seek diversity among the members of the Board. The Nominating Committee and the Board believe that considering a diverse range of experience, perspective and knowledge creates a Board that can best serve the needs of the Company and its shareholders, and are important factors that are considered when identifying individuals for Board membership. In addition, diversity with respect to tenure is important to provide for both fresh perspectives and deep experience and knowledge of the Company. Therefore, we aim to maintain an appropriate balance of tenure across our Directors.

In furtherance of the Board’s active role in succession planning, the Board has appointed or nominated 5 new Directors since 2020.

Director Nominations, Board Refresh and Succession Planning

The Nominating Committee is charged with reviewing and recommending to the Board qualified individuals to become directors and continually assessing the size and composition of the Board to identify any needed changes. The Nominating Committee also engages in succession planning for the Board and key leadership roles on the Board and its committees. The Nominating Committee considers relevant experience, perspective and knowledge that it deems appropriate to maintain a healthy balance of our Board. Board recruitment is a year-round process. While the Nominating Committee focuses on the search process on a regular basis, the Nominating Committee provides updates to the Board on a quarterly basis and encourages discussion to ensure the Company’s needs are being met in terms of the skills and knowledge of the Board members.

Board Assessment Process

Identify

Board members are continually observing their environment and community to identify and bring forward suitable candidates to the Board. An evaluation of the strategic needs of the Company, including its goals, vision and strategy are considered when identifying candidates. Discussions with the Chief Executive Officer are also had to ensure organizational and Board needs are being met, as well as to keep the Board informed of any updates that would help to identify new needs at the Board level.

|

|

14 | 2025 Proxy Statement |

|

|

Governance of the Company |

Analyze

The Nominating Committee reviews candidate profiles along with the current Board matrix to analyze the skills, attributes and various perspectives of each member to determine whether a potential candidate possesses the experience and expertise needed to expand the Board's collective knowledge.

Review

After a prospective Board member is found, the Nominating Committee assesses the qualifications of that candidate and presents to the Board as a whole on a quarterly basis. The Nominating Committee reviews and discusses how the candidate will support the Board as well as the organization and conducts an initial interview with the candidate.

Recommend

Once the candidate has been interviewed and evaluated, the individual's Board profile is forwarded to the Board for recommendation for election. Typically, a candidate observes a Board Meeting in person which can help them understand the Company's objectives as well as provides them an opportunity to understand where they can contribute to the mix of knowledge and skills of the full Board. Voting for new members typically happens on a quarterly basis at an in-person meeting.

Shareholder Approval

Following the new candidate's election by the Board as a new Board member, the new Board member will then be elected by the shareholders at the new Annual Shareholder Meeting.

Orientation

Upon becoming a member of the Board, all new members go through an orientation in which information on their roles and responsibilities are discussed as well as membership in a third-party resources for director education and development along with networking opportunities.

In March 2025, Laura Dempsey Brown was appointed Chair of the Board.

On the recommendation of the Nominating Committee, Laura Dempsey Brown was appointed Chair of the Board following the March Board Meeting. Mrs. Dempsey Brown is an independent Director and has a wealth of leadership experience and deep understanding of the Board from her experiences as Chair of the Audit Committee from 2020 to 2023 as well as Chair of the ESG Committee from 2023 to 2025.

Management Succession Planning

Highlighted by recent events involving the termination of the Company's former President & Chief Executive Officer, Josef Matosevic, the Board continues to make management succession planning a top priority. The Board is committed to finding and retaining the right leaders for the Company as well as those who seek long-term success for Company shareholders. In wake of the departure of Mr. Matosevic, the Board created an internal search committee, comprised of independent Board members, to:

•Engage a search firm for the next CEO

•Develop a timeline for the CEO search

•Identify the skills, knowledge and expertise needed for the CEO

•Review all internal and external candidates

•Coordinate interviews between the CEO candidates and Board members

Each candidate went through a rigorous process including a cultural diagnostic with the search firm, extensive background and reference check and discussions with each Board Member. After an lengthy process, the Board determined that Sean Bagan was the right leader for the Company and best positioned to effectively address and attack the needs of the business and interests of its shareholders.

|

|

|

2025 Proxy Statement | 15 |

|

Governance of the Company |

The Board also discusses management succession with, and without, the CEO at each Board Meeting, as needed.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s Directors, Officers and holders of more than 10% of the Company’s Common Stock to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and any other equity securities of the Company. To the Company’s knowledge, based solely upon a review of the forms, reports and certificates filed with the Company by such persons, all of the Company’s directors, officers, and holders of more than 10% of the Company’s Common Stock complied with the Section 16(a) filing requirements in 2024 with the exception of Josef Matosevic, Matteo Arduini and Rick Martich, each of whom filed a late Form 4 that reported one late transaction.

Communications with the Board of Directors

Shareholders and other parties interested in communicating with our Board may do so by writing to the Board, Helios Technologies, Inc., Attn: General Counsel & Secretary, 7456 16th Street East, Sarasota, Florida 34243. Under the process for such communications established by the Board, the Chair of the Board reviews all such correspondence and regularly forwards it, or a summary of the correspondence, to all of the other members of the Board. Directors may at any time review a log of all correspondence received by the Company that is addressed to the Board or any member of the Board and request copies of any such correspondence. Additionally, correspondence that, in the opinion of the Chair, relates to concerns or complaints regarding accounting, internal accounting controls and auditing matters is forwarded to the Chair of the Audit Committee.

Holding Ourselves Accountable through Strong ESG Governance

ESG Committee

Accountability starts with board-level oversight of ESG to address non-financial topics of interest to our investors, shareholders, and other stakeholders. In March 2021, the Board created the ESG Committee to oversee risks related to the Company’s environmental, social, and corporate governance practices, as well as enterprise risk and other matters. In 2022, we added the Chair of our Board to the ESG Committee and in March 2025, our ESG Committee Chair succeeded our former Chair of the Board.

The purpose of the ESG Committee is to (a) develop and recommend to the Board corporate governance guidelines and policies for the Company, (b) monitor the Company’s compliance with good corporate governance standards and oversee the evaluation of the Board and management against these standards, and (c) oversee the Company’s significant ESG and sustainability activities and practices, which include, among other things, reviewing our ESG and sustainability strategy, initiatives and policies and updates from the Company’s management committee responsible for significant ESG and sustainability activities; charitable contributions by the Company; and community reinvestment activities and performance thereof.

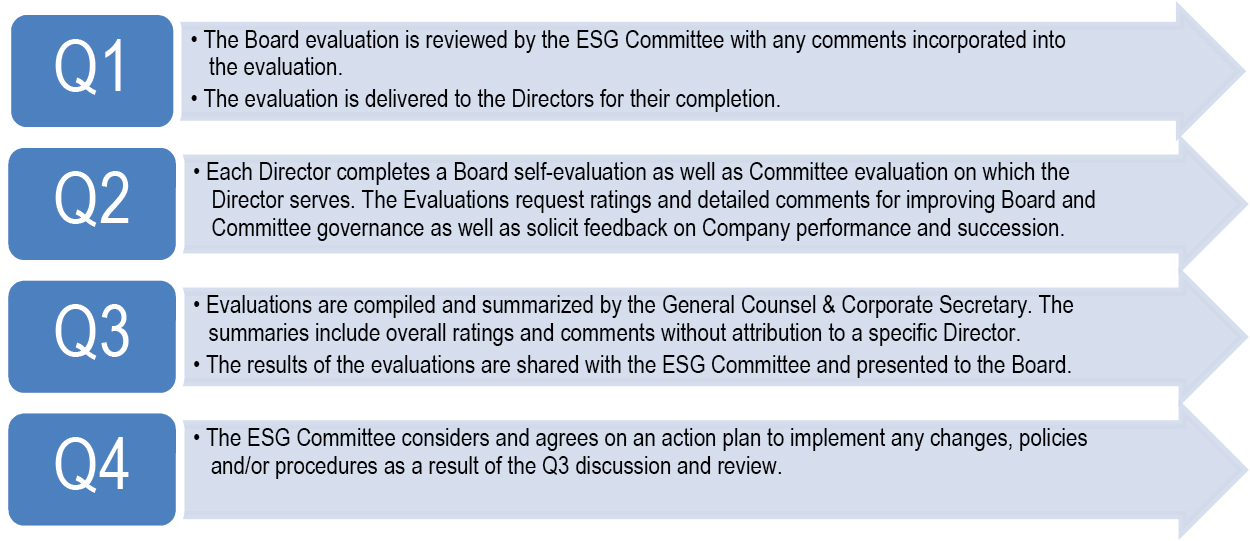

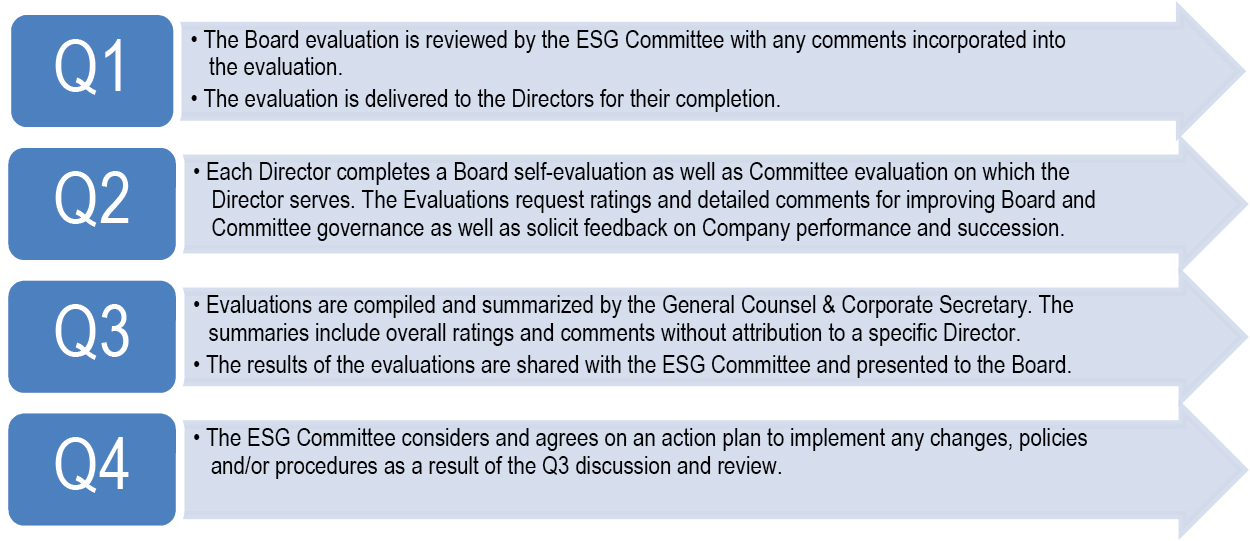

2024 Board Evaluation Program

|

|

|

SELF-EVALUATION |

|

The Board understands that honest and practical evaluations are crucial for good governance and Board effectiveness. Annual evaluations focus on two primary functions of a Board: oversight and decision-making, with an emphasis on Board and Committee processes, and Board Committee compositions. The ESG Committee oversees the annual evaluations with the assistance from the General Counsel & Secretary, and conducts a multi-step process to disseminate, collect and review the results. The ESG Committee then discusses the results of the evaluations and other feedback in a closed session with the Board. |

|

|

16 | 2025 Proxy Statement |

|

|

Governance of the Company |

|

|

|

BOARD AND COMMITTEE EVALUATION PROCESS

|

IMPLEMENTATION & RESULTS |

|

Confidential evaluations and subsequent discussions from the evaluations continue to be instrumental in making enhancements to meeting materials, committee compositions, the Board evaluation process, and interactions with our business leaders as well as providing directors with further opportunities for continuing education. |

2025 Changes to Board Evaluation Program

Beginning in 2025, the Company has engaged with a reputable third-party Board assessment tool to provide more data driven, actionable and individualized focus to its Board Evaluation program. Board members will continue to take annual evaluations; however they will now receive individualized reporting on their performance and effectiveness, benchmarks and comparisons against peer groups in the Company's industry, as well as year-on-year comparisons to establish ongoing data to develop the Board systematically in a time efficient and structured manner.

|

|

|

2025 Proxy Statement | 17 |

|

Governance of the Company |

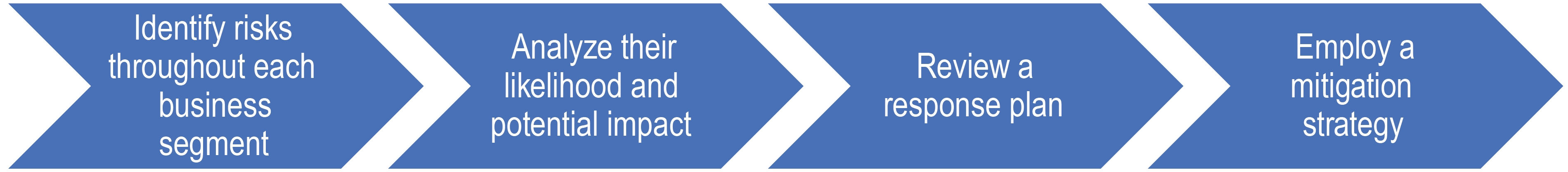

Board Role in Risk Oversight

A successful Risk Management program is critical for the Company to both understand the risks it faces as well as understand the significance of those risks. The Board takes an active role in proactively promoting an effective risk management program. In carrying out its responsibilities, the Board has charged the ESG Committee with oversight and responsibility of the Company’s Risk Management Program, and to work closely with management to ensure key controls and processes are in place.

Rather than an annual risk assessment at an enterprise level, the Company created an internal risk management structure administered by its General Counsel & Secretary whereby sub-committees formed at Helios Corporate, Sun Hydraulics, Faster, Enovation Controls and Balboa, where representatives within each segment, including Finance, Human Resources, Sales, Operations, Safety and Information Technology, meet on a quarterly basis to:

In turn, these risks are reported on a quarterly basis to the ESG Committee, including mitigation factors that management has employed to address those risks, and other information relating to how risk analysis is incorporated into the Company’s corporate strategy and day-to-day business operations. The ESG Committee, in turn, reports out these risks to the full Board, highlighting the top risk for enhanced discussion.

Our Operations function continues to have the main oversight responsibility to ensure enhanced disclosure on issues facing the Company and continue a targeted approach of addressing risks and material concerns in the way we design, manufacture, and deliver our products. We believe this approach will help eliminate risks to shareholders and their financial interests while promoting leadership accountability.

Independence and Committees of the Board of Directors

At its meeting in March 2025, the Board undertook a review of Director Independence. Except as described under “Certain Relationships and Related Transactions,” it was determined there were no reportable transactions or relationships between any of the directors or any member of the directors’ immediate families and the Company and its subsidiaries and affiliates. The purpose of this review was to determine the independence of each of the directors under the rules of the New York Stock Exchange (“NYSE”) and, for Audit Committee and Compensation Committee members, also under the heightened independence standards of the SEC. The Board determined that Messrs. Britt, Chenanda, Schuetz, and Mses. Dempsey Brown and Sacchi qualify as independent directors under both the rules of the NYSE and the Securities and Exchange Commission ("SEC"). By virtue of his position as President, Chief Executive Officer and Chief Financial Officer of the Company, the Board has concluded that Mr. Bagan does not qualify as independent.

Our Board of Directors has four standing Committees: Audit Committee, Compensation Committee, Environmental, Social and Governance Committee and Nominating Committee. The current composition and responsibilities of the four standing Committees are set forth below. Each committee has adopted a written charter approved by the Board, which is available on the Company’s website at https://ir.heliostechnologies.com/corporate-governance. Each Committee meets regularly throughout the year and reports its actions and recommendations to the Board.

The Company’s website contains the Company’s Bylaws, Corporate Governance Guidelines, Board Committee Charters and Code. To view these documents, go to https://www.heliostechnologies.com, click “Investors” and then “Governance Documents.” To view the Company’s SEC filings, including Forms 3, 4 and 5 filed by the Company’s Directors and executive officers, go to https://www.heliostechnologies.com, click on “Investors,” then “SEC Filings” and then “All SEC Filings.”

|

|

18 | 2025 Proxy Statement |

|

|

Governance of the Company |

|

|

|

|

Current Members: Doug Britt (Chair) Laura Dempsey Brown Diana Sacchi (During 2024, Philippe Lemaitre served on the Audit Committee). The Audit Committee held 8 meetings in 2024. Each of the current members of the Audit Committee is financially literate and satisfies the heightened independence standards of Rule 10A-3 under the Exchange Act. |

|

The Board determined, under applicable SEC and NYSE rules, that all of the members of the Audit Committee are independent, and that Mr. Doug Britt meets the qualifications as an Audit Committee Financial Expert, and he has been so designated. The Audit Committee is responsible for, among other things: |

|

- |

Reviewing and approving the selection of the Company’s independent public accountants who will prepare and issue an audit report on the annual financial statements of the Company and a report on the Company’s internal controls over financial reporting; |

|

- |

Establishing the scope and fees for the prospective annual audit with the independent public accountants; |

|

- |

Reviewing the results thereof with the independent public accountants; |

|

- |

Reviewing and approving non-audit services of the independent public accountants; |

|

- |

Reviewing compliance with existing major accounting and financial policies of the Company; |

|

- |

Reviewing the adequacy of the financial organization of the Company; |

|

- |

Reviewing management’s procedures and policies relative to the adequacy of the Company’s internal accounting controls; |

|

- |

Reviewing areas of financial risk and providing fraud oversight; and |

|

- |

Reviewing compliance with federal and state laws relating to accounting practices and to review and approving any transactions with affiliated parties. |

|

The Audit Committee also invites and investigates reports regarding accounting, internal accounting controls or auditing irregularities or other matters as well as provides oversight for the Company’s compliance with its Code of Conduct, including its confidential ethics reporting hotline. The Code of Conduct is available on the Company’s website at: https://ir.heliostechnologies.com/governance-docs. No waivers of the Company’s Code of Conduct were requested or granted during the year ended December 28, 2024. The Code of Conduct is available on the Investors page of our website and from the Company upon written request sent to the Corporate Secretary, 7456 16th Street East, Sarasota, Florida 34243. |

|

|

|

|

Current Members: Diana Sacchi (Chair) Cary Chenanda Alexander Schuetz The Compensation Committee held 4 meetings in 2024. Each of the current members of the Compensation Committee satisfies the heightened independence standards of Rule 10C-1 under the Exchange Act. |

|

The Compensation Committee is responsible for, among other things: |

|

- |

Overseeing the Company’s compensation program, including executive officer and key management compensation; |

|

- |

Administering the Company’s equity incentive and non-employee director fees plans; and |

|

- |

Carrying out the responsibilities required by the rules of the SEC and NYSE. |

|

The Compensation Committee may delegate any of its responsibilities to one or more subcommittees, each to be comprised of at least two of the Compensation Committee’s members. For information regarding the role of our executive officers and the Compensation Committee’s independent compensation consultant in determining or recommending the amount or form of executive compensation, see “Executive Compensation — Compensation Discussion and Analysis” below. None of the current members of the Compensation Committee have been an officer or employee of the Company. Additionally, none of our executive officers serve as a member of the Board of Directors or Compensation Committee of any other entity that has one or more executive officers serving as a member of the Board or Compensation Committee. |

|

|

|

2025 Proxy Statement | 19 |

|

Governance of the Company |

|

|

|

|

Current Members: Cary Chenanda (Chair) Laura Dempsey Brown Alexander Schuetz (During 2024, Philippe Lemaitre served on the ESG Committee). The ESG Committee held 4 meetings in 2024. |

|

The ESG Committee is responsible for, among other things: |

|

- |

Developing and recommending to the Board corporate governance guidelines and policies for the Company; |

|

- |

Overseeing the annual individual performance evaluation on all Board members; |

|

- |

Overseeing the enterprise-wide risk management policies of the Company; |

|

- |

Monitoring the Company’s compliance with good corporate governance standards; and |

|

- |

Overseeing the Company’s significant ESG and sustainability activities and practices. |

|

The ESG Committee is committed to ensuring the governance of the Company is in full compliance with the law, reflects generally accepted principles of corporate governance, encourages flexible and dynamic management and effectively manages the risks of the business and operations of the Company. |

|

|

|

|

Current Members: Alexander Schuetz (Chair) Doug Britt Diana Sacchi The Nominating Committee held 4 meetings in 2024. |

|

The Nominating Committee is responsible for, among other things: |

|

- |

Developing and recommending to the Board for adoption, qualifications for members of the Board and its Committees and criteria for their selection; |

|

- |

Reviewing and recommending changes which the Committee determines advisable; |

|

- |