UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

| For the fiscal year ended December 30, 2006 | Commission file number 0-21835 |

SUN HYDRAULICS CORPORATION

(Exact Name of Registration as Specified in its Charter)

| Florida | 59-2754337 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

| 1500 West University Parkway Sarasota, Florida |

34243 | |

| (Address of Principal Executive Offices) | (Zip Code) |

941/362-1200

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act

| Title of Each Class | Name of each exchange on which registered | |

| Common Stock $.001 Par Value | NASDAQ Stock Market, LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the shares of voting common stock held by non-affiliates of the Registrant, computed by reference to the closing sales price of such shares on the Nasdaq Stock Market, LLC, as of the last business day of the Registrant’s most recently completed second fiscal quarter was $150,821,136.

As of March 2, 2007, there were 10,926,753 shares of common stock outstanding.

PART I

ITEM 1. BUSINESS

Overview

The Company is a leading designer and manufacturer of high-performance screw-in hydraulic cartridge valves and manifolds, which control force, speed, and motion as integral components in fluid power systems. The innovative floating construction of the Company’s screw-in cartridge valves and the design of the cavities in which they are installed provide demonstrable performance and reliability advantages compared to other available screw-in cartridge valves. The Company designs and manufactures one of the most comprehensive lines of screw-in hydraulic cartridge valves and manifolds in the world. The Company has generated a profit every year since 1972 and has paid a dividend every quarter since its initial public offering of securities in 1997. The Company believes that its success is primarily a result of its innovative product design, consistent high quality, superior product performance and the breadth of the markets it serves.

The Company sells its products primarily through a global network of independent fluid power distributors to a diverse universe of end users, for use in various “mobile” applications, such as construction, agricultural and utility equipment (historically, approximately 66% of net sales), and a broad array of “industrial” applications, such as machine tools and material handling equipment (historically, approximately 34% of net sales). While many of the Company’s end users are subject to cyclical demand for their products, the Company mitigates this exposure through the wide variety of applications and industries it serves. In 2006, sales to the Company’s largest distributor represented less than 7% of net sales, and approximately 53% of the Company’s net consolidated sales were outside the United States.

The Company was organized as a Florida corporation in 1986 to take over the operations of the business of the Company’s predecessor, Suninco, Inc. (f/k/a Sun Hydraulics Corporation). Suninco, Inc. was founded in 1970 by Robert E. Koski for the specific purpose of developing and promoting screw-in cartridge valve technology. The Company’s executive offices are located at 1500 West University Parkway, Sarasota, Florida 34243, and its telephone number is (941) 362-1200. The Company’s website is www.sunhydraulics.com.

Industry Background

Fluid power is one of three basic technologies, along with electrical and mechanical, utilized to achieve power transmission and motion control. Due to its mechanical advantage, fluid power is widely employed to move and position materials, control machines, vehicles and equipment, and improve industrial efficiency and productivity. Fluid power can perform work on very light loads with a high degree of accuracy or develop enormous forces to move and position materials and equipment that weigh many tons.

Screw-in hydraulic cartridge valves first appeared in the late 1950s as an alternative to conventional forms of hydraulic valves. Conventional hydraulic valves are generally larger in size, typically manufactured from cumbersome iron castings, relatively limited in their ability to interface with machinery and equipment, and are usually simple devices designed to control a single task. Screw-in cartridge valves represent a miniaturization of hydraulic valves, providing the same functional characteristics as conventional valves, but in a smaller package size. In addition to being lighter-weight and more compact, screw-in cartridge valves frequently offer significant advantages in interface flexibility and cost over conventional hydraulic valves.

Screw-in cartridge valves have significant marketplace acceptance because hydraulic system design engineers are easily able to develop multiple-function control systems. A number of screw-in cartridge valves can be grouped together in a manifold, creating a hydraulic control system that is functionally analogous to an electronic integrated circuit. End users can utilize screw-in cartridge valves and custom manifolds to design an optimal solution for control of their fluid power systems that significantly reduces assembly time and expense.

2

Strategy

The Company will continue to design, manufacture, market and support, on a worldwide basis, differentiated high-performance and high-quality cartridge valves and integrated valve packages. The Company believes this focus supports its business objectives of sustaining revenue growth that will yield an above-average return on capital while achieving a high level of customer satisfaction. Key elements of the Company’s strategy include the following:

Deliver Value Through High-Quality, High-Performance Products. The Company’s products are designed with operating and performance characteristics that exceed those of many functionally similar products. Overall, the Company’s products provide high value because they generally operate at higher flow rates and pressures than competitive offerings of the same size. The Company tests 100% of its screw-in cartridge valves to ensure the highest level of performance on a consistent basis.

Achieve a High Level of Customer Satisfaction. The Company is a build-to-order operation that schedules orders to the customer’s request date. To ensure all employees are dedicated to meeting customer requests, the Company measures and posts monthly the percentage of shipments that satisfy the customers’ requests. In addition to meeting the above requirement, the Company tests 100% of the screw-in cartridge valves before shipment. The Company tests extensively all product returns due to questions regarding functionality and issues a written report of findings upon request. The Company believes that its long-term success is dependent upon its reputation in the marketplace, which in turn is a result of its ability to service its customers.

Offer a Wide Variety of Standard Products. The Company currently offers one of the most comprehensive lines of screw-in cartridge valves and manifolds in the world. The Company is committed to producing functionally superior, standard products that contain a high degree of common content to minimize work in process and maximize manufacturing efficiency. Products are designed for use by a broad base of industries to minimize the risk of dependence on any single market segment or customer. The Company expands its business through the development of new products that are complementary to its existing products.

Expand the Product Line. The Company is continuously engaged in new product development programs to offer new and better cartridge valve solutions to its customers. New cartridge products generally fit into existing cavities, often allowing them to be installed in existing standard manifolds. The Company recently has aggressively begun designing and introducing to the marketplace electro-hydraulic cartridge valves, including solenoid and proportional valves. The Company believes these products provide the opportunity to obtain sales for which it previously could not compete, and further believes that the electro-hydraulic cartridge valves will help increase sales of the Company’s other cartridge valve and manifold products.

Capitalize on Custom Manifold Opportunities. Because fluid power system design engineers are increasingly incorporating screw-in cartridge valves into custom control systems, the Company concentrates its efforts in custom manifolds in two ways. The Company designs and manufactures manifolds which incorporate the Company’s screw-in cartridge valves for sale to original equipment manufacturers (“OEMs”). To support this effort, the Company is able to design and manufacture manifolds at its operations in Sarasota, Florida and Kansas City, Kansas, USA, Coventry, England, Erkelenz, Germany, Seoul, Korea and at its operation in Shanghai, China. The Company also encourages competitive manifold manufacturers to utilize the Company’s screw-in cartridge valves in their manifold designs. The Company sells tooling for machining its cavities, allowing independent manifold manufacturers to easily incorporate the Company’s screw-in cartridge valves into their designs.

Expand Global Presence. The Company intends to continue to strengthen its global presence in the areas of distribution and international operations. The Company has strong distributor representation in most developed and developing markets, including North and South America, Western Europe, Asia, Australia, and South Africa. In 2006, the Company generated approximately 53% of its net sales outside the United States. The Company is continuing to expand its distribution arrangements in Eastern Europe and expand its market presence in China, Central and South America. The Company believes that further expansion of its international facilities will enhance its competitive position in certain foreign markets. In addition, custom manifolds provide an opportunity for operating units and distributors to offer significant value-added content through the local production of manifolds that incorporate the Company’s screw-in cartridge valves. This strategy helps minimize potential tariffs and duties that could inflate the price of the Company’s products in foreign markets.

3

Maintain a Horizontal Organization with Entrepreneurial Spirit. The Company believes that maintaining its horizontal management structure is critical to retaining key personnel and an important factor in attracting top talent from within the hydraulic valve and manifold industry. The Company strives to maintain its horizontal management structure that encourages communication, creativity, entrepreneurial spirit, and individual responsibility among employees. Employee initiatives have led to continuous process improvements, resulting in considerable operating efficiencies and quality control, as well as the maintenance of a safe and comfortable working environment. The Company believes that a lack of job titles and direct formal reporting responsibilities eliminates perceived barriers to advancement and reduces the potential for adversarial relationships to arise within the organization. A workplace without walls in the Company’s offices as well as on the shop floor encourages informal employee consultation and provides the opportunity for all personnel to interface across functional areas.

Leverage Manufacturing Capability and Know-how as Competitive Advantages. The Company believes that one of its competitive advantages is its ability to consistently manufacture products to demanding specifications. The Company’s strong process capability is critical in achieving the high performance characteristics of its screw-in cartridge valves. The Company has the ability to manufacture most of the components of its products with the exception of springs, elastomer seals, and electrical coils, although most high-volume machining is performed by independent, outside vendors (see Manufacturing). The Company has in-house heat treatment capability to provide consistent and reliable control of this critical operation.

Sell Through Distributors. Due to the variety of potential customers and the Company’s desire to avoid unnecessary bureaucracy, the sales function has been performed primarily by independent distributors. The Company has 65 distributors, 43 of which are located outside the United States, and a majority of which have strong technical backgrounds or capabilities, which enable them to develop practical, efficient and cost-effective fluid power systems for their customers. Many of these distributors sell products manufactured by other companies that allow them to provide a complete hydraulic system to the customer. The Company provides a high level of technical support to its distributors through open access to the Company’s engineering staff, technical documentation, and technical training programs.

Develop Closer Relations with Key Customers. The Company maintains close relationships with many OEMs and end users of its products to help it understand and predict future needs for fluid power control devices and to test and refine new product offerings. The Company also recognizes it will sometimes have to develop a direct relationship in the areas of sales and support with some large OEMs that are existing or potential customers. The Company will be selective in developing these relationships and believes the closer ties will help increase sales without compromising profits or developing excessive bureaucracy.

Brand Label and License Manufacturing where desirable. When it is deemed to be of strategic benefit, the Company sometimes enters into marketing, brand labeling and/or non-exclusive manufacturing licensing agreements with other manufacturers of fluid power components. Historically, approximately 5% of the Company’s sales have been to other fluid power manufacturers that incorporate the Company’s products into complete system solutions.

Products

Screw-in Cartridge Valves

The Company designs and manufactures high-performance, screw-in hydraulic cartridge valves in five size ranges, suitable for flows from one to 400 gallons per minute and continuous operating pressures up to 5,000 pounds per square inch. The floating construction pioneered by the Company provides demonstrable performance and reliability advantages compared to most competitors’ product offerings due to its self-alignment characteristic that accommodates potential manufacturing deviations common in the thread-making operations of screw-in cartridge valves and manifolds. This floating construction significantly differentiates the Company from most of its competitors, which design and manufacture rigid screw-in cartridge valves that fit an industry common cavity. The floating construction of the Company’s screw-in cartridge valves eliminates the tendency of working parts inside the cartridge valves to bind

4

when screwed into the manifold, which leads to unnecessary stress and, often, premature failure. Some competitors manufacture products that fit the Company’s cavity. Strategically, the Company believes the markets for its products will expand more rapidly if other sources are available for products that fit the Company’s cavity.

Electro-hydraulic Cartridges

In recent years the Company has developed and released to the marketplace a broad range of electro-hydraulic cartridge valves. These valves, while commonly available in the industry for more than 30 years, are a relatively recent addition to the Company’s product line. Electro-hydraulic products are differentiated from competitive products in the same ways the Company’s pure hydraulic valves are, namely performance, pressure rating, size relative to capacity, reliability and broad range of options.

Manifolds

A manifold is a solid block of metal, usually aluminum or ductile iron, which is machined to create threaded cavities and channels into which screw-in cartridge valves can be installed and through which the hydraulic fluid flows. The manifolds manufactured by the Company are described below:

Standard Manifolds. The variety of standard, catalogued manifolds offered by the Company is unmatched by any screw-in cartridge valve or manifold competitor. These products allow customers to easily integrate the Company’s screw-in cartridge valves into their systems in many different ways. Once designed, standard manifolds require minimal, if any, maintenance engineering over the life of the product and can be readily manufactured at all of the Company’s operations.

Custom Manifolds. Custom manifolds are designed for a customer-specific application and typically combine many different screw-in cartridge valves in a single package or multiple packages. The Company’s internally-developed, proprietary expert system software allows the Company to manufacture manifolds efficiently in low volumes. The innovative design of the Company’s screw-in cartridge valves allows manifolds to be physically smaller for certain applications than functionally similar manifolds containing competitors’ screw-in cartridges that fit industry common cavities. The Company believes many of the custom manifolds that incorporate cartridge valves which fit industry common cavities require testing after assembly. The Company does not routinely test manifolds that contain its screw-in cartridge valves because of the inherent reliability of the cartridge valves, and this provides the Company with a significant competitive advantage. Custom manifolds provide many benefits to end users and equipment manufacturers, including reduced assembly time, order simplification, reduced leakage points, neater packaging, potentially fewer hose and fitting connections, and more control functions in a single location.

Integrated Packages

An integrated package is an assembly of cartridge valves into a custom designed manifold. In recent years, with the proliferation of more electro-hydraulic cartridges, the Company has altered its approach to supplying fully assembled integrated packages. Previously, the Company designed and manufactured custom manifolds but routinely shipped the manifolds and cartridges separately, leaving the assembly task to either the distributor or the customer. This approach was taken because the Company, in the past, often could not supply the electro-hydraulic valve content of the circuit and was left to design in and manufacture competitive cavities for that purpose. As the Company has expanded its offerings of electro-hydraulic products, it is now able to provide most of the functionality required in the marketplace. Therefore, the Company now ships fully assembled integrated packages, often direct to the customer. Due to the inherent service advantage for all parties, this approach has helped make the Company more attractive as an integrated package and system supplier.

Engineering

The Company’s engineers play an important role in all aspects of the Company’s business, including design, manufacturing, sales and marketing and technical support. When designing products, engineers work within a disciplined set of design parameters that often results in repeated incorporation of existing screw-in cartridge valve parts in new functional products.

During product development, engineers work closely with manufacturing personnel to define the processes required to manufacture the product reliably and consistently. The close link between engineering and manufacturing helps smooth the transition from design to market. Design changes to

5

facilitate manufacturing processes are sometimes considered but typically not if product performance levels would be compromised. The Company practices a continuous improvement process, which it believes is largely attributable to its horizontal management structure that empowers employees and encourages their creative contribution. At various times the Company may incorporate design changes in a product to improve its performance or life expectancy. All of the Company’s engineers provide application support to customers and distributors.

Manufacturing

The Company is a process intensive manufacturing operation that extensively utilizes computer numerically controlled (“CNC”) machinery to manufacture its products. Where commercial machinery is not available for specific manufacturing or assembly operations, the Company often designs and builds its own machinery to perform these tasks. The Company makes extensive use of automated handling and assembly technology (including robotics) where possible to perform repetitive tasks, thus promoting manufacturing efficiencies and workplace safety. The Company has its own electric heat treatment furnaces to provide consistent and reliable control of this important operation.

At its two Sarasota, Florida, manufacturing plants, the Company has extensive testing facilities that allow its design engineers to test fully all cartridge valve products at their maximum rated pressure and flow rates. A metallurgist and complete metallurgical laboratory support the Company’s design engineers and in-house heat treatment. The resident engineers at the Company’s other facilities also utilize test equipment.

The Company employs a build-to-order philosophy and relies on its distributors to purchase and maintain sufficient inventory to meet their customers’ demands. With this build-to-order philosophy, most raw materials, including aluminum and steel, are delivered on a just-in-time basis. These and other raw materials are commercially available from multiple sources.

The Company controls most critical finishing processes in-house but does rely on a small network of outside manufacturers to machine cartridge parts to varying degrees of completeness. Many high-volume machining operations are performed exclusively at outside suppliers. The Company is very selective in establishing its supplier base and attempts to develop and maintain long-term relationships with suppliers. The Company continually reviews all of its suppliers to improve the quality of incoming parts and to assess opportunities for better control of both price and quality. The Company’s quality systems at the U.S. and U.K. facilities are in compliance with ISO 9001:2000 for design and manufacture of steel cartridge valves, aluminum and ferrous manifolds for hydraulic systems. Those in Korea are certified to ISO 9001:2000 and 14001:2004 for the design, development, production, and after sales service of hydraulic valves.

Sales and Marketing

The Company’s products are sold globally, primarily through independent fluid power distributors. Distributors are supported with product education programs conducted by the Company at its facilities. Technical support is provided by each of the Company’s operations (Florida, Kansas, England, Germany, France, Korea, and China). Included in the Company’s sales and marketing staff are hydraulic engineers who have significant experience in the fluid power industry. Discount pricing structures encourage distributors to buy in moderate to high volumes to ensure there is a local inventory of products in the marketplace.

The Company currently has 65 distributors, 43 of which are located outside the United States and a majority of which have strong technical backgrounds or capabilities, which enable them to develop practical, efficient, and cost-effective fluid power systems for their customers. In 2006, sales to the Company’s largest distributor represented less than 7% of net sales and net sales outside of the United States represented approximately 53% of total net sales.

In addition to distributors, the Company sells directly to other companies within the hydraulic industry under a pricing program that does not undermine the primary distributors’ efforts. Companies that participate in this program utilize the Company’s products in a value-added application, integrating the Company’s screw-in cartridge valves into other fluid power products or systems of their manufacture. Management believes this strategy strengthens the Company by encouraging other manufacturers to buy products from the Company that they might otherwise develop themselves.

6

The Company has in the past, to a limited degree, sold product directly to OEMs. Although the Company does not have any employee whose primary responsibility is direct sales, it may consider this in the future. The Company recognizes that to gain access to certain large OEM accounts it may have to deal directly in the areas of sales and support.

While the Company principally sells its products through distributors, it provides end users with technical information via its website and catalogues that offers design engineers all of the information necessary to specify and obtain the Company’s products. The Company believes that providing complete technical information to the marketplace helps to stimulate demand for the Company’s products. The Company’s website continues to evolve and has helped to drastically reduce the time between engineering release of products and their appearance in the marketplace. The Company is continuing to invest in this technology as one of the best ways to keep its broad product offering available to customers around the world.

Customers

While many of the Company’s customers’ requirements are growing, management does not believe that the loss of any one customer would have a material adverse effect on the Company’s business. End-user customers are classified by whether their primary applications for the Company’s products are “mobile” or “industrial.”

Mobile applications involve equipment that generally is not fixed in place and is often operated in an uncontrolled environment, such as construction, agricultural, mining, and fire and rescue and other utility equipment. Mobile customers were the original users of screw-in cartridge valves due to the premium that these industries place on considerations of space, weight, and cost. Mobile customers historically account for approximately 66% of the Company’s net sales.

Industrial applications involve equipment that generally is fixed in place in a controlled environment. Examples include automation machinery, presses, plastics machinery such as injection molding equipment, and machine tools. The requirements of the industrial marketplace are more demanding than most mobile applications since industrial equipment typically operates at significantly higher cycles. The Company’s products are designed to withstand these operating imperatives, and industrial applications historically account for approximately 34% of the Company’s net sales. Many conventional valve designs are still used in industrial applications and represent substitution opportunities for the Company’s products.

The Company does not warrant its products for use in any of the following applications, (i) any product that comes under the Federal Highway Safety Act, such as steering or braking systems for passenger-carrying vehicles or on-highway trucks, (ii) aircraft or space vehicles, (iii) ordnance equipment, (iv) life support equipment, and (v) any product that, when sold, would be subject to the rules and regulations of the United States Nuclear Regulatory Commission. These “application limitations” have alleviated the need for the Company to maintain the internal bureaucracy necessary to conduct business in these market segments.

Competition

The hydraulic valve industry is highly fragmented and intensely competitive. The Company has a large number of competitors, some of which are full-line producers and others that are niche suppliers similar to the Company. Most competitors market globally. Full-line producers have the ability to provide total hydraulic systems to customers, including components functionally similar to those manufactured by the Company. There has been increasing consolidation activity within the industry in recent years, with large, full-line producers filling out their product lines by acquiring or entering into relationships with other hydraulics companies, and management expects there will be further consolidation in the future. The Company believes that it competes based upon quality, reliability, price, value, speed of delivery and technological characteristics.

Most of the Company’s screw-in cartridge valve competitors produce screw-in cartridge valves that fit an industry common cavity that sometimes allows their products to be interchangeable. The industry common cavity is not currently supported by any national or global standards organizations, although there is an ongoing effort to standardize a modified version of this cavity in the United States. The International Standards Organization (ISO) has developed a standard screw-in cartridge cavity that is

7

different from the industry common cavity, but the Company is not aware of any major competitor that currently produces a full line of standard products conforming to the ISO standard. The Company does not manufacture a product that fits either the industry common or the ISO standard cavity. Some competitors manufacture selected screw-in cartridge valves that fit the Company’s cavity. The Company believes the majority of these products are load control valves. Management believes that increased use of the Company’s cavity will be beneficial in the long term because, although competition will increase, markets and applications for the Company’s products also will increase.

Employees

As of December 30, 2006, the Company had 663 full-time employees in the United States, 74 in England, 36 in Germany, two in France and 34 in Korea. The Company continues to focus its efforts on designing and manufacturing standard products, allowing it to maintain over 90% of its employees in manufacturing, distribution, and engineering functions. No employees are represented by a union in any of the Company’s operating units, and management believes that relations with its employees are good. Employees are paid either hourly or with an annual salary at rates that are competitive with other companies in the industry and in its geographic areas. Management believes that the combination of competitive salary, above average health and retirement plans, and a safe and pleasant working environment discourages employee turnover and encourages efficient, high-quality production. Nevertheless, due to the nature of the Company’s manufacturing business, it is often difficult to attract skilled personnel.

Patents and Trademarks

The Company believes that the growth of its business is dependent upon the quality and functional performance of its products and its relationship with the marketplace, rather than the extent of its patents and trademarks. The Company’s principal trademark is registered internationally in the following countries: Argentina, Australia, Brazil, Canada, Chile, China, France, Germany, India, Italy, Japan, Korea, Mexico, Peru, Spain, Sweden, Switzerland, the United Kingdom and the United States. While the Company believes that its patents have significant value, the loss of any single patent would not have a material adverse effect on the Company.

Available Information

The Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, as well as its proxy statements and other materials which are filed with or furnished to the Securities and Exchange Commission (“SEC”) are made available, free of charge, on or through its website under the heading “Investor Relations—Reports—SEC Filings,” as soon as reasonably practicable after they are filed with, or furnished to, the SEC.

ITEM 1A.—RISK FACTORS

FACTORS INFLUENCING FUTURE RESULTS—FORWARD-LOOKING STATEMENTS

This Annual Report contains “forward-looking statements” (within the meaning of the Private Securities Litigation Reform Act of 1995) that are based on current expectations, estimates, forecasts, and projections about us, our beliefs, and assumptions made by us, including (i) our strategies regarding growth, including our intention to develop new products; (ii) our financing plans; (iii) trends affecting our financial condition or results of operations; (iv) our ability to continue to control costs and to meet our liquidity and other financing needs; (v) the declaration and payment of dividends; and (vi) our ability to respond to changes in customer demand domestically and internationally, including as a result of standardization. In addition, we may make other written or oral statements, which constitute forward-looking statements, from time to time. Words such as “may,” “expects,” “projects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words, and similar expressions are intended to identify such forward-looking statements. Similarly, statements that describe our future plans, objectives or goals also are forward-looking statements. These statements are not guarantees of future performance and are subject to a number of risks and uncertainties, including those discussed below and elsewhere in this report. Our actual results may differ materially from what is expressed or forecasted in such forward-looking statements, and undue reliance should not be placed on such statements. All forward-looking statements are made as of the date hereof, and we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

8

Factors that could cause actual results to differ materially from what is expressed or forecasted in such forward-looking statements include, but are not limited to: (i) conditions in the capital markets, including the interest rate environment and the availability of capital; (ii) changes in the competitive marketplace that could affect our revenue and/or cost bases, such as increased competition, lack of qualified engineering, marketing, management or other personnel, and increased labor and raw materials costs; (iii) new product introductions, product sales mix and the geographic mix of sales nationally and internationally; and the following risk factors:

Sales in our industry are subject to economic cycles. The capital goods industry in general, and the hydraulic valve and manifold industry in particular, are subject to economic cycles, which directly affect customer orders, lead times and sales volume. The downturn in the industry from 2001 - 2003 had a material adverse effect on our business and results of operations. The strength of the economic recovery which began in 2004 directly affected orders for our products through 2006. The continued strength or a weakening in the economy in the future will directly affect future orders.

Our products are subject to obsolescence due to technological change. The fluid power industry and its component parts are subject to technological change, evolving industry standards, changing customer requirements and improvements in and expansion of product offerings. If technologies or standards used in our products become obsolete, our business, financial condition and results of operations will be adversely affected. Although we believe that we have the technological capabilities to remain competitive, we cannot assure you that developments by others will not render our products or technologies obsolete or noncompetitive. See “Item 1—Business — Strategy.”

We are subject to intense competition. The hydraulic valve industry is highly fragmented and intensely competitive, and we face competition from a large number of competitors, some of which are full-line producers and others that are niche suppliers like us. Full-line producers have the ability to provide total hydraulic systems to customers, including components functionally similar to those manufactured by us. We believe that we compete based upon quality, reliability, price, value, speed of delivery and technological characteristics. Many of our screw-in cartridge valve competitors are owned by corporations that are significantly larger than us and have greater financial resources than we do. We cannot assure you that we will continue to be able to compete effectively with these companies.

The manifold business is also highly fragmented and intensely competitive. All of the major screw-in cartridge valve manufacturers either manufacture manifolds or have sources that they use on a regular basis. In addition, there are a number of independent manifold suppliers that produce manifolds incorporating various manufacturers’ screw-in cartridge valves, including those made by us. Finally, there are many small, independent machine shops that produce manifolds at very competitive prices. We believe that competition in the manifold business is based upon quality, price, proximity to the customer and speed of delivery. Many of our competitors have very low overhead structures and we cannot assure you that we will continue to be able to compete effectively with these companies.

In addition, we compete in the sale of hydraulic valves and manifolds with certain of our customers. Generally, these customers purchase cartridge valves from us to meet a specific need in a system that cannot be filled by any valve made by such customer. To the extent that we introduce new valves in the future that increase the competition between us and such customers, such competition could adversely affect our relationships with these customers.

The marketplace could adopt an industry standard cavity that would not accommodate our products. Our screw-in cartridge valves fit into a unique cavity for which, to date, few other manufacturers have designed products. Accordingly, our screw-in cartridge valves are not interchangeable with those of other manufacturers. Most competitive manufacturers produce screw-in cartridge valves that fit into an industry common cavity. There is an ongoing effort in the United States to produce a new standard for screw-in hydraulic cartridge valve cavities based on the industry common cavity. Additionally, the International Standards Organization (“ISO”) has an existing industry standard for screw-in hydraulic cartridge valve cavities, which is different from our cavity and the industry common cavity. In our view, the industry common cavity as well as the suggested standardized form of this cavity and the ISO standard cavity fail to address critical functional requirements, which could result in performance and safety problems of significant magnitude for end users. To our knowledge, no major

9

competitor has converted its standard product line to fit the ISO standard cavity. Any move by a substantial number of screw-in cartridge valve and manifold manufacturers toward the adoption of ISO standard or another standard, based on the existing industry common cavity, could have a material adverse effect on our business, financial condition and results of operation. See “Item 1.—Business — Competition.”

We are subject to risks relating to international sales. In 2006, approximately 53% of our net sales were outside of the United States. We are expanding the scope of our operations outside the United States, both through direct investment and distribution, and expect that international sales will continue to account for a substantial portion of our net sales in future periods. International sales are subject to various risks, including unexpected changes in regulatory requirements and tariffs, longer payment cycles, difficulties in receivable collections, potentially adverse tax consequences, trade or currency restrictions, and, particularly in emerging economies, potential political and economic instability and regional conflicts. Furthermore, our international operations generate sales in a number of foreign currencies, particularly British pounds, the Euro, and the Korean Won. Therefore, our financial condition and results of operation are affected by fluctuations in exchange rates between the United States dollar and these currencies. Any or all of these factors could have a material adverse effect on our business, financial condition and results of operations.

We are subject to various risks relating to our growth strategy. In pursuing our growth strategy, we intend to expand our presence in our existing markets and enter new markets. In addition, we may pursue acquisitions and joint ventures to complement our business. Many of the expenses arising from our expansion efforts may have a negative effect on operating results until such time, if at all, that these expenses are offset by increased revenues. We cannot assure you that we will be able to improve our market share or profitability, recover our expenditures, or successfully implement our growth strategy. See “Item 1—Business — Strategy.”

Our expansion strategy also may require substantial capital investment for the construction of new facilities and their effective operation. We may finance the acquisition of additional assets using cash from operations, bank or institutional borrowings, or through the issuance of debt or equity securities. We cannot assure you that we will be able to obtain financing from bank or institutional sources or through the equity or debt markets or that, if available, such financing will be on terms acceptable to us.

We are dependent upon key employees and skilled personnel. Our success depends, to a significant extent, upon a number of key individuals. The loss of the services of one or more of these individuals could have a material adverse effect on our business. Our future operating results depend to a significant degree upon the continued contribution of our key technical personnel and skilled labor force. Competition for management and engineering personnel is intense, and we compete for qualified personnel with numerous other employers, some of which have greater financial and other resources than we do. We conduct a substantial part of our operations at our facilities in Sarasota, Florida. Our continued success depends on our ability to attract and retain a skilled labor force at this location. While we have been successful in attracting and retaining skilled employees in the past, we cannot assure you that we will continue to be successful in attracting and retaining the personnel we require to develop, manufacture and market our products and expand our operations. See “Item 1—Business — Employees.”

We are subject to the risk of liability for defective products. The application of many of our products entails an inherent risk of product liability. We cannot assure you that we will not face any material product liability claims in the future or that the product liability insurance we maintain at such time will be adequate to cover such claims.

We are subject to fluctuations in the prices of raw materials. The primary raw materials used in the manufacture of our products are aluminum, ductile iron and steel. We cannot assure you that prices for such materials will not increase or, if they do, that we will be able to increase the prices for our products to maintain our profit margins. Material costs have increased during the past fiscal year. These costs increases were partially offset by sales price increases in January and July of this year. If future price increases do not adequately cover material cost increases, our operating results may be adversely affected.

10

We are dependent upon our parts suppliers. Our largest expense in the cost of sales is purchased cartridge valve parts. We cannot assure you that our manufacturing costs and output would not be materially and adversely affected by operational or financial difficulties experienced by one or more of our suppliers.

Hurricanes could cause a disruption in our operations which could adversely affect our business, results of operations, and financial condition. A significant portion of our operations are located in Florida, a region that is susceptible to hurricanes. Such weather events can cause disruption to our operations and could have a material adverse effect on our overall results of operations. While we have property insurance to partially reimburse us for wind losses resulting from a named storm, such insurance would not cover all possible losses.

We are subject to the cost of environmental compliance and the risk of failing to comply with environmental laws. Our operations involve the handling and use of substances that are subject to federal, state and local environmental laws and regulations that impose limitations on the discharge of pollutants into the soil, air and water and establish standards for their storage and disposal. We believe that our current operations are in substantial compliance with applicable environmental laws and regulations, the violation of which could have a material adverse effect on our business, financial condition and results of operations. New laws and regulations, or stricter interpretations of existing laws or regulations, could have a material adverse affect on our business, financial condition and results of operations.

Our board may decide to reduce or eliminate dividends. Although we have paid a cash dividend each quarter since our common stock began trading in 1997, we cannot assure you that funds will be available for this purpose in the future. The declaration and payment of dividends is subject to the sole discretion of our board of directors and will depend upon our profitability, financial condition, capital needs, future prospects and other factors deemed relevant by the board, and may be restricted by the terms of credit agreements that we may enter into.

Certain anti-takeover provisions may hinder or prevent a change in control. Our Articles of Incorporation provide for a classified board of directors. In addition, the Articles give the board of directors the authority, without further action by the shareholders, to issue and fix the rights and preferences of a new class, or classes, of preferred stock. These and other provisions of the Articles and our Bylaws may deter or delay changes in control, including transactions in which shareholders might otherwise receive a premium for their shares over then current market prices. In addition, these provisions may limit the ability of shareholders to approve transactions that they may deem to be in their best interests.

We are subject to control by certain shareholders and management. Members of the Koski family, including two Directors, Robert E. Koski, our founder and former Chairman, and Christine L. Koski, and their affiliates own or control approximately 31% of the outstanding shares of our common stock. Accordingly, the members of the Koski family have the ability to influence significantly the election of our directors and the outcome of certain corporate actions requiring shareholder approval, and to influence our business. Such influence could preclude any acquisition of the Company and could adversely affect the price of our common stock. Our directors and executive officers as a group beneficially own or control approximately 33% of the outstanding shares of our common stock. See “Item 12.—Security Ownership of Certain Beneficial Owners and Management.”

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

The Company owns major facilities in the United States, United Kingdom, Germany, and Korea, as set forth below.

The Company owns a 66,000 square foot facility in Sarasota, Florida, which houses manufacturing, design, marketing and other administrative functions. The Sarasota facility is well suited for the design, testing and manufacture of the Company’s products.

11

The Company also owns a 77,000 square foot manufacturing facility in Manatee County, Florida. The Manatee County facility, constructed in 1997, has a productive capacity similar to the Sarasota facility.

The close proximity of the Florida facilities allows for quick change and the ability to shift resources, including machinery and people, to effectively meet changing business requirements.

Both facilities in Florida are encumbered by a revolving line of credit, which is due August 1, 2011. Monthly payment of interest only is due on the revolving line of credit, with a variable interest rate based upon the Company’s leverage ratio. At December 30, 2006, there was no outstanding balance on the Line of Credit.

The Company also owns vacant land in Manatee County, Florida, for future expansion requirements. There is no mortgage on this property and the Company believes the land to be well suited to add over 30,000 square feet of manufacturing capacity.

The Company leases a 17,000 square foot manufacturing facility in Lenexa, Kansas, which is used to manufacture manifolds for the North American market.

The Company owns a 37,000 square foot facility in Coventry, England, free of any encumbrances. The facility, while primarily acting as a distributor, is also involved in cartridge assembly and manifold manufacturing.

The Company’s 45,000 square foot distribution and manufacturing facility in Erkelenz, Germany is encumbered by a mortgage loan, which is due September 30, 2008, and has a fixed interest rate of 6.05%. At December 30, 2006, the principal balance was $0.5 million. This facility is well suited to house equipment used for manufacturing and testing of the Company’s products. Currently, a small portion of the manufacturing area is utilized and the remainder is leased on an annual basis to an outside company.

The Company owns a 10,000 square foot distribution and manufacturing facility in Inchon, Korea, free of any encumbrances.

The Company believes that its properties have been adequately maintained, are generally in good condition, and are suitable and adequate for its business as presently conducted. The extent of utilization of the Company’s properties varies from time to time and among its facilities.

ITEM 3. LEGAL PROCEEDINGS

The Company from time to time is involved in routine litigation incidental to the conduct of its business. The Company does not believe that any pending litigation will have a material adverse effect on its consolidated financial position or results of operations.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE

OF SECURITY HOLDERS

There were no matters submitted to a vote of the security holders of the Company through the solicitation of proxies or otherwise during the fourth quarter of the fiscal year ended December 30, 2006.

12

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY,

RELATED STOCKHOLDER MATTERS AND

ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

The Common Stock of the Company has been trading publicly under the symbol SNHY on the Nasdaq Global Select Market since the Company’s initial public offering on January 9, 1997. The following table sets forth the high and low closing sale prices of the Company’s Common Stock as reported by the Nasdaq Global Select Market and the dividends declared for the periods indicated. 2005 First Quarter stock prices and dividends are adjusted for a three-for-two stock split, effected in the form of a 50% stock dividend, which became effective on July 15, 2005.

| High | Low | Dividends declared | |||||||

| 2006 |

|||||||||

| First quarter |

$ | 25.390 | $ | 19.670 | $ | 0.100 | |||

| Second quarter |

22.450 | 16.950 | 0.100 | ||||||

| Third quarter |

20.720 | 16.620 | 0.100 | ||||||

| Fourth quarter |

22.130 | 19.970 | 0.100 | ||||||

| 2005 |

|||||||||

| First quarter |

$ | 21.060 | $ | 9.667 | $ | 0.050 | |||

| Second quarter |

25.733 | 15.460 | 0.050 | ||||||

| Third quarter |

32.340 | 19.490 | 0.100 | ||||||

| Fourth quarter |

26.250 | 17.580 | 0.100 | ||||||

Holders

There were 101 shareholders of record of Common Stock on March 2, 2007. The number of record holders was determined from the records of the Company’s transfer agent and does not include beneficial owners of Common Stock whose shares are held in the names of securities brokers, dealers, and registered clearing agencies. The Company believes that there are between 2,500 and 3,000 beneficial owners of Common Stock.

Dividends

Dividends were paid on the 15th day of each month following the date of declaration. The Company’s Board of Directors currently intends to continue to pay a quarterly dividend of at least $0.10 per share during 2007. However, the declaration and payment of future dividends is subject to the sole discretion of the Board of Directors, and any determination as to the payment of future dividends will depend upon the Company’s profitability, financial condition, capital needs, future prospects and other factors deemed pertinent by the Board of Directors.

Stock Split

On June 10, 2005, the Company declared a three-for-two stock split, effected in the form of a 50% stock dividend, to shareholders of record on June 30, 2005, which was paid on July 15, 2005. The Company issued approximately 3,600,000 shares of common stock as a result of the stock split. The effect of the stock split on outstanding shares, earnings per share and dividends per share has been retroactively applied to all periods presented.

Issuer Purchases of Equity Securities

The Company did not repurchase any of its stock during the fourth quarter of 2006.

13

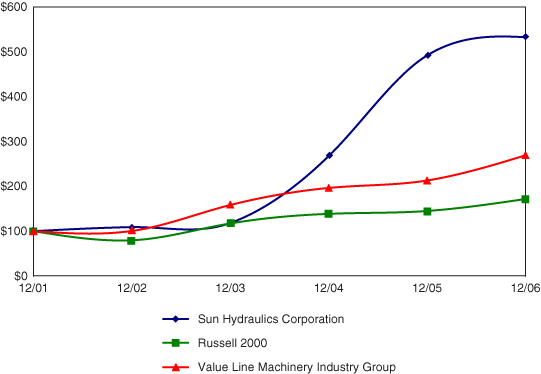

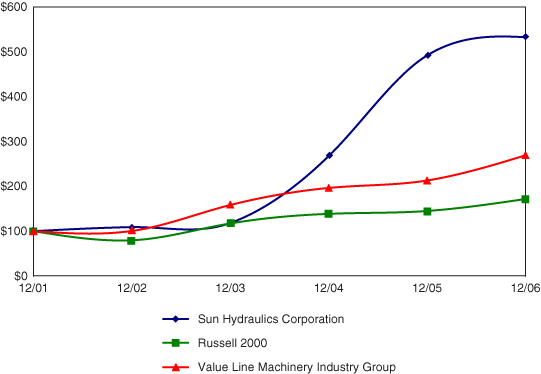

Five-Year Stock Performance Graph

The following graph compares cumulative total return among Sun Hydraulics Corporation, the Russell 2000 Index and the Value Line Machinery Industry Stock Index, from December 31, 2001, to December 30, 2006, assuming $100 invested in each on December 31, 2001. Total return assumes reinvestment of any dividends for all companies considered within the comparison. The stock price performance shown in the graph is not necessarily indicative of future price performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Sun Hydraulics Corporation, The Russell 2000 Index

And The Value Line Machinery Industry Group

| * | $100 invested on 12/31/01 in stock or index-including reinvestment of dividends. Indexes calculated on month-end basis |

| 12/01 | 12/02 | 12/03 | 12/04 | 12/05 | 12/06 | |||||||

| Sun Hydraulics Corporation |

100.00 | 108.66 | 117.87 | 267.16 | 491.90 | 532.32 | ||||||

| Russell 2000 |

100.00 | 79.52 | 117.09 | 138.55 | 144.86 | 171.47 | ||||||

| Value Line Machinery Industry Group |

100.00 | 100.09 | 158.05 | 196.21 | 212.96 | 268.82 |

14

ITEM 6. SELECTED CONSOLIDATED FINANCIAL DATA

The following summary should be read in conjunction with the consolidated financial statements and related notes contained herein. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Item 1. Business.”

The Company reports on a fiscal year that ends on the Saturday closest to December 31st. Each quarter generally consists of two 4-week periods and one 5-week period. As a result of the 2005 fiscal year ending December 31, 2005, the quarter ended April 2, 2005 consisted of one 4-week period and two 5-week periods, resulting in a 53-week year.

| Year Ended | |||||||||||||||

| Dec 30, 2006 | Dec 31, 2005 | Dec 25, 2004 | Dec 27, 2003 | Dec 28, 2002 | |||||||||||

| (in thousands except per share data) | |||||||||||||||

| Statement of Operations: |

|||||||||||||||

| Net sales |

$ | 142,282 | $ | 116,757 | $ | 94,503 | $ | 70,798 | $ | 64,545 | |||||

| Gross profit |

43,932 | 36,918 | 28,535 | 18,486 | 15,964 | ||||||||||

| Operating income |

25,051 | 19,180 | 12,294 | 3,683 | 3,420 | ||||||||||

| Income before income taxes |

24,903 | 19,137 | 11,732 | 3,277 | 2,592 | ||||||||||

| Net income |

$ | 16,223 | $ | 12,808 | $ | 7,830 | $ | 2,176 | $ | 1,778 | |||||

| Basic net income per common share |

$ | 1.49 | $ | 1.18 | $ | 0.76 | $ | 0.22 | $ | 0.18 | |||||

| Diluted net income per common share |

$ | 1.48 | $ | 1.17 | $ | 0.76 | $ | 0.22 | $ | 0.18 | |||||

| Dividends per common share |

$ | 0.40 | $ | 0.30 | $ | 0.14 | $ | 1.44 | $ | 0.11 | |||||

| Other Financial Data: |

|||||||||||||||

| Depreciation and amortization |

$ | 5,849 | $ | 5,604 | $ | 5,465 | $ | 5,152 | $ | 5,100 | |||||

| Capital expenditures |

9,525 | 8,813 | 4,987 | 3,076 | 5,870 | ||||||||||

| Balance Sheet Data: |

|||||||||||||||

| Cash and cash equivalents |

$ | 9,497 | $ | 5,830 | $ | 9,762 | $ | 5,219 | $ | 3,958 | |||||

| Working capital |

24,015 | 16,391 | 16,723 | 12,663 | 12,828 | ||||||||||

| Total assets |

87,185 | 73,561 | 71,808 | 63,032 | 62,285 | ||||||||||

| Total debt |

1,072 | 2,384 | 12,254 | 18,207 | 9,611 | ||||||||||

| Redeemable common stock |

— | — | — | — | 2,250 | ||||||||||

| Shareholders’ equity |

70,800 | 56,440 | 45,403 | 35,063 | 42,899 | ||||||||||

15

Quarterly Results of Operations

(unaudited, in thousands)

| For the Quarter Ended | ||||||||||||

| Dec 30, 2006 |

Sep 30 2006 |

Jul 1, 2006 |

Apr 1, 2006 | |||||||||

| Net sales |

$ | 34,967 | $ | 36,202 | $ | 36,928 | $ | 34,185 | ||||

| Gross profit |

11,051 | 10,662 | 11,239 | 10,981 | ||||||||

| Operating income |

6,237 | 5,955 | 6,549 | 6,310 | ||||||||

| Income before income taxes |

6,253 | 5,896 | 6,501 | 6,253 | ||||||||

| Net income |

$ | 3,813 | $ | 3,916 | $ | 4,314 | $ | 4,180 | ||||

| Basic net income per common share |

$ | 0.35 | $ | 0.36 | $ | 0.39 | $ | 0.38 | ||||

| Diluted net income per common share |

$ | 0.35 | $ | 0.36 | $ | 0.39 | $ | 0.38 | ||||

| For the Quarter Ended | ||||||||||||

| Dec 31, 2005 |

Oct 1, 2005 |

Jul 2, 2005 |

Apr 2, 2005 | |||||||||

| Net sales |

$ | 27,938 | $ | 28,726 | $ | 31,014 | $ | 29,079 | ||||

| Gross profit |

8,054 | 9,025 | 10,086 | 9,753 | ||||||||

| Operating income |

3,702 | 4,381 | 5,562 | 5,533 | ||||||||

| Income before income taxes |

3,833 | 4,202 | 5,583 | 5,518 | ||||||||

| Net income |

$ | 2,888 | $ | 2,918 | $ | 3,536 | $ | 3,466 | ||||

| Basic net income per common share |

$ | 0.26 | $ | 0.27 | $ | 0.33 | $ | 0.33 | ||||

| Diluted net income per common share |

$ | 0.26 | $ | 0.27 | $ | 0.32 | $ | 0.32 | ||||

| Dec 25, 2004 |

Sep 25, 2004 |

Jun 26, 2004 |

Mar 27, 2004 | |||||||||

| Net sales |

$ | 23,426 | $ | 23,164 | $ | 26,522 | $ | 21,390 | ||||

| Gross profit |

6,796 | 7,047 | 8,386 | 6,305 | ||||||||

| Operating income |

2,817 | 3,045 | 4,190 | 2,241 | ||||||||

| Income before income taxes |

2,561 | 2,972 | 4,117 | 2,082 | ||||||||

| Net income |

$ | 2,001 | $ | 1,880 | $ | 2,591 | $ | 1,358 | ||||

| Basic net income per common share |

$ | 0.19 | $ | 0.18 | $ | 0.25 | $ | 0.13 | ||||

| Diluted net income per common share |

$ | 0.19 | $ | 0.18 | $ | 0.25 | $ | 0.13 | ||||

16

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OVERVIEW

Sun Hydraulics Corporation is a leading designer and manufacturer of high-performance screw-in hydraulic cartridge valves and manifolds, which control force, speed and motion as integral components in fluid power systems. The Company sells its products globally through wholly owned subsidiaries and independent distributors. Sales outside the United States for the year ended December 30, 2006, were approximately 53% of total net sales.

Approximately 66% of product sales are used by the mobile market, which is characterized by applications where the equipment is not fixed in place, the operating environment is often unpredictable, and duty cycles are generally moderate to low. Some examples of mobile equipment include off-road construction equipment, fire and rescue equipment and mining machinery.

The remaining 34% of sales are used by industrial markets, which are characterized by equipment that is fixed in place, typically in a controlled environment, and which operates at higher pressures and duty cycles. Automation machinery, metal cutting machine tools and plastics machinery are some examples of industrial equipment. The Company sells to both markets with a single product line.

Company Focus

In recent years, the Company has realized robust growth in all areas of the world. Management believes there are five key reasons why:

| • | Delivery performance, |

| • | New products, especially electro-hydraulic products, |

| • | Integrated packages, |

| • | Our geographic presence, and |

| • | Our website. |

The company is continuously engaged in efforts to improve productivity to enhance productive capacity and be in the best position to be able to respond to marketplace demand. Company engineering and manufacturing personnel redesign existing products, where necessary, to improve manufacturability. New product design efforts include personnel from engineering, manufacturing and marketing to help reduce the time and effort required to release products to the market. These on-going activities enable the Company to maintain a level of delivery performance and shipping reliability that it believes differentiates it from its competitors.

The Company continues to add to its electro-hydraulic valve offerings with many new products, including different types of solenoid and proportional valves. Electrically actuated cartridges help create new system opportunities as they enable the Company to offer complete integrated valve packages which could not be offered previously. The addition of electro-hydraulic products allows integrated packages to be designed with 100% Sun content. Integrated packages, standard cartridges housed in a custom designed manifold, have been one of the Company’s fastest growing areas.

The Company has wholly-owned companies in North America, Europe and the Far East, augmented by what management believes to be the finest distribution network in the fluid power industry. The Company’s distributors are particularly skilled in applying products and developing integrated solutions for the local market. Through its wholly-owned companies and global distribution network, the Company is able to service all major industrialized market areas.

The Company’s major marketing tool is its website, www.sunhydraulics.com. The Company’s website is developed for serious design engineers. It provides all the detailed technical information and specifications to select, apply and obtain Sun products, 24 hours a day, seven days a week. The website continues to evolve by adding greater levels of detail in technical information and new configuration capability.

17

Industry Conditions

Demand for the Company’s products is dependent on demand for the capital goods into which the products are incorporated. The capital goods industries in general, and the fluid power industry specifically, are subject to economic cycles. According to the National Fluid Power Association (the fluid power industry’s trade association in the United States), the United States index of shipments of hydraulic products increased 9% and 13%, in 2006 and 2005, respectively.

The Company’s order trend has historically tracked closely to the United States Purchasing Managers Index (PMI). The index was 51.4 at the end of December 2006 compared to 55.6 at the end of December 2005. When the PMI is over 50, it indicates economic expansion.

Results for the 2006 fiscal year

(Dollars in millions except net income per share)

| December 30, 2006 |

December 31, 2005 |

Increase | |||||||

| Twelve Months Ended |

|||||||||

| Net Sales |

$ | 142.3 | $ | 116.8 | 22 | % | |||

| Net Income |

$ | 16.2 | $ | 12.8 | 27 | % | |||

| Net Income per share: |

|||||||||

| Basic |

$ | 1.49 | $ | 1.18 | 26 | % | |||

| Diluted |

$ | 1.48 | $ | 1.17 | 26 | % | |||

| Three Months Ended |

|||||||||

| Net Sales |

$ | 35.0 | $ | 27.9 | 25 | % | |||

| Net Income |

$ | 3.8 | $ | 2.9 | 31 | % | |||

| Net Income per share: |

|||||||||

| Basic |

$ | 0.35 | $ | 0.26 | 35 | % | |||

| Diluted |

$ | 0.35 | $ | 0.26 | 35 | % | |||

Fourth quarter orders and shipments finished very strong and the Company’s 2006 financial results were even better than had been expected. While North America continued to hold up, the Company saw robust demand in Europe and Asia/Pacific. The strong order trends have continued through January and February and management anticipates first quarter 2007 results will continue to outpace the industry. Management expects continued double digit growth in Q1 2007, even given the strength of last year’s first quarter.

The keys to the Company’s success have not changed. Shipping reliability, new complementary and differentiated products, a focus on integrated packages, its strong geographic presence and its website continue to help Sun gain market share. In the product area, the Company is excited about the launch of additional electro-hydraulic products at the Hannover Fair in Germany in April. Having the right products at the right time has been, and continues to be, the Company’s focus.

The Company is in its tenth year as a public company. During that time the Company has continued to grow both the top and bottom lines, and has returned to shareholders over $29 million in dividends. For long-term investors, the value of an investment in Sun in January 1997, has grown more than 300%, compared to a 200% return on the S&P 500 over the same 10-year period.

Dividends

The Company declared quarterly dividends of $0.10 per share for a total dividend of $0.40 for 2006. These dividends were paid on the 15th day of each month following the date of declaration.

18

Cash Flow

Net cash generated from operations for the year was $19.6 million, a $2.6 million increase compared to $17.0 million in 2005. Capital expenditures for the year were $9.5 million, cash on hand increased $3.7 million to $9.5 million, debt decreased $1.3 million to $1.1 million, and $4.3 million was paid to shareholders in dividends.

Results of Operations

The following table sets forth, for the periods indicated, certain items in the Company’s statements of operations as a percentage of net sales.

| For the Year Ended | |||||||||||||||

| Dec 30, 2006 | Dec 31, 2005 | Dec 25, 2004 | Dec 27, 2003 | Dec 28, 2002 | |||||||||||

| Net sales |

100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||

| Gross profit |

30.9 | % | 31.6 | % | 30.2 | % | 26.1 | % | 24.7 | % | |||||

| Operating income |

17.6 | % | 16.4 | % | 13.0 | % | 5.2 | % | 5.3 | % | |||||

| Income before income taxes |

17.5 | % | 16.4 | % | 12.4 | % | 4.6 | % | 4.0 | % | |||||

Segment Information (in thousands)

| United States |

Korea | United Kingdom |

Germany | Elimination | Consolidated | ||||||||||||||

| 2006 |

|||||||||||||||||||

| Sales to unaffiliated customers |

$ | 89,077 | $ | 16,368 | $ | 17,709 | $ | 19,128 | $ | — | $ | 142,282 | |||||||

| Intercompany sales |

25,809 | — | 2,990 | 106 | (28,905 | ) | — | ||||||||||||

| Operating income |

16,608 | 2,212 | 2,330 | 4,046 | (145 | ) | 25,051 | ||||||||||||

| Identifiable assets |

59,505 | 7,580 | 13,756 | 8,187 | (1,843 | ) | 87,185 | ||||||||||||

| Depreciation and amortization |

4,206 | 150 | 983 | 510 | 5,849 | ||||||||||||||

| Capital expenditures |

8,408 | 122 | 757 | 238 | 9,525 | ||||||||||||||

| 2005 |

|||||||||||||||||||

| Sales to unaffiliated customers |

$ | 73,998 | $ | 11,604 | $ | 16,054 | $ | 15,101 | $ | — | $ | 116,757 | |||||||

| Intercompany sales |

21,239 | — | 2,873 | 80 | (24,192 | ) | — | ||||||||||||

| Operating income |

13,443 | 1,520 | 1,260 | 3,145 | (188 | ) | 19,180 | ||||||||||||

| Identifiable assets |

50,019 | 4,958 | 12,403 | 8,777 | (2,596 | ) | 73,561 | ||||||||||||

| Depreciation and amortization |

3,944 | 149 | 1,025 | 473 | — | 5,591 | |||||||||||||

| Capital expenditures |

7,007 | 29 | 934 | 843 | — | 8,813 | |||||||||||||

| 2004 |

|||||||||||||||||||

| Sales to unaffiliated customers |

$ | 59,847 | $ | 8,723 | $ | 13,375 | $ | 12,558 | $ | — | $ | 94,503 | |||||||

| Intercompany sales |

15,702 | — | 1,812 | 66 | (17,580 | ) | — | ||||||||||||

| Operating income |

8,417 | 926 | 483 | 2,399 | 69 | 12,294 | |||||||||||||

| Identifiable assets |

44,765 | 4,449 | 13,742 | 10,062 | (1,210 | ) | 71,808 | ||||||||||||

| Depreciation and amortization |

3,792 | 137 | 1,061 | 475 | — | 5,465 | |||||||||||||

| Capital expenditures |

4,264 | 42 | 540 | 141 | — | 4,987 | |||||||||||||

Outlook for first quarter 2007

2007 first quarter sales are estimated to be in the range of $39 million, a 14% increase over last year. First quarter earnings per share are estimated to be between $0.42 and $0.45 per share, compared to $0.38 per share last year.

19

Comparison of Years Ended December 30, 2006 and December 31, 2005

Net Sales

Net sales were $142.3 million, an increase of $25.5 million, or 21.8%, compared to $116.8 million in 2005. Net sales increased 21.4% excluding the effect of exchange rates.

The increase was due in large part to the continued growth of international sales, particularly in Asia where sales increased 41.9%, or $6.9 million, to $23.4 million. Domestic sales in Korea increased 41.1%, sales to China increased 63.0%, and to Japan 36.6%.

European sales increased 26.0%, or $8.5 million, to $41.2 million. Sales to France increased 20.5%, to Germany 23.0%, and to the U.K. 19.5%. Significant increases were also noted in Norway, Italy, Ireland and Sweden.

North American sales increased 14.2%, or $9.2 million, to $74.0 million.

Gross Profit

Gross profit increased 19.0% to $43.9 million in 2006, compared to $36.9 million in 2005. Gross profit as a percentage of net sales decreased to 30.9% in 2006, compared to 31.6% in 2005. Declines in the gross profit percentage were due to higher variable costs and an increased fixed cost base. Increased materials, fringe benefits, and productivity declines during the third quarter accounted for the majority of the increased variable costs. The fixed cost increases were primarily made up of salaries, fringe benefits, utilities, and depreciation. Gross profit percentage decreases were partially offset by higher sales volume and sales price increases that occurred in January and July of this year.

Selling, Engineering, and Administrative Expenses

Selling, engineering and administrative expenses in 2006 were $18.9 million, a $1.1 million, or 6.4%, increase, compared to $17.7 million in 2005. The increase was primarily due to increases in compensation expense, including additional engineering and marketing personnel, and insurance. These increases were partially offset by decreased advertising and professional fees. The prior year period included higher audit and contract labor fees, including Sarbanes-Oxley 404 compliance, and a write-off of the remaining deferred loan costs related to the extinguishment of debt.

Interest Expense

Interest expense was $0.3 million and $0.4 million, in 2006 and 2005, respectively. While average outstanding debt decreased $5.6 million, from $7.3 million in 2005 to $1.7 million in 2006, the average interest rate on variable debt increased from the period ended December 31, 2005, due to an increase in the LIBOR rate.

Foreign Currency Transaction (Gain) Loss

Foreign currency transaction loss in 2006 was $0.2, compared to a gain of $0.4 million in 2005. While the Euro, the Korean Won and the British Pound made gains against the U.S. dollar during 2006, the U.K. operations experienced losses related to sales conducted in U.S. dollars and from the revaluation of balance sheet items which were held in U.S. dollars.

Miscellaneous (Income) Expense

Miscellaneous income was $0.4 in 2006 compared to a minimal impact on net income in 2005. The increase was primarily a result of earnings from joint ventures and interest income.

Income Taxes

The provision for income taxes for the year ended December 30, 2006, was 34.9% of pretax income compared to 33.1% for the year ended December 31, 2005. The change was primarily due to the relative

20

levels of income and different tax rates in effect among the countries in which the Company sells its products and an increase in the U.S. effective rate of almost 2%. The increase was primarily a result of additional U.S. income taxed at the higher incremental federal tax rate and an increase in state taxes. The prior year provision included a cumulative benefit for a deduction in the state tax rate and a benefit for the change in foreign valuation allowance.

Comparison of Years Ended December 31, 2005 and December 25, 2004

Net Sales

Net sales were $116.8 million, an increase of $22.3 million, or 23.5%, compared to $94.5 million in 2004. Net sales increased 21% excluding the effect of exchange rates.

Net sales from the United States operation increased 23.7% with shipments to Asia up 14.0%, Canada up 38.1% and domestic shipments up 23.0%. Net sales from the United Kingdom operation increased 20.0%, primarily due to increases in domestic sales and sales to European distributors. German operation net sales increased 20.3%, with significant increases in domestic sales and sales to Italy, Switzerland and Austria. Net sales from the Korean operation increased 33.0%, due to increased domestic sales in Korea and sales to China.

Gross Profit

Gross profit increased 29.4% to $36.9 million in 2005, compared to $28.5 million in 2004. Gross profit as a percentage of net sales increased to 31.6% in 2005, compared to 30.2% in 2004. A moderate and selective sales price increase in January of 2005, coupled with increased sales volume and improved productivity, more than offset the increased cost of materials and labor.

Selling, Engineering, and Administrative Expenses

Selling, engineering and administrative expenses in 2005 were $17.7 million, a $1.5 million, or 9.2%, increase, compared to $16.2 million in 2004. The increase was primarily due to increased audit and contract labor fees related to 2005, including Sarbanes-Oxley 404 compliance, personnel related expenses, foreign compensation expense, a write-off of the remaining deferred loan costs related to the extinguishment of debt and costs for a bi-annual European trade show.

Interest Expense

Interest expense was $0.4 million and $0.5 million in 2005 and 2004, respectively. While average outstanding debt decreased $7.9 million, from $15.2 million in 2004 to $7.3 million in 2005, the average interest rate on variable debt increased from the period ended December 25, 2004, due to an increase in the LIBOR rate.

Foreign Currency Transaction (Gain) Loss

Foreign currency transaction gain in 2005 was $0.4 million, compared to a minimal impact on net income in 2004. The gain was primarily a result of the revaluation of United Kingdom balance sheet items which were held in U.S. dollars.

Miscellaneous (Income) Expense

Miscellaneous (income) expense had a minimal impact on net income in 2005 and 2004.

Income Taxes

The provision for income taxes for the year ended December 31, 2005, was 33.1% of pretax income compared to 33.3% for the year ended December 25, 2004. The decrease was due to a change in the relative levels of income and different tax rates in effect among the countries in which the Company sells its products.

21

Liquidity and Capital Resources

Historically, the Company’s primary source of capital has been cash generated from operations, although short-term fluctuations in working capital requirements have been met through borrowings under revolving lines of credit as needed. The Company’s principal uses of cash have been to pay operating expenses, pay dividends to shareholders, make capital expenditures, and service debt.