Exhibit 99.1

2021 Investor Day Welcome and Agenda Tania Almond VP, Investor Relations & Corporate Communications

Safe Harbor Statement This presentation and oral statements made by management in connection herewith that are not historical facts are “forward‐looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934. Forward‐looking statements involve risks and uncertainties, and actual results may differ materially from those expressed or implied by such statements. They include statements regarding current expectations, estimates, forecasts, projections, our beliefs, and assumptions made by Helios Technologies, Inc. (“Helios” or the “Company”), its directors or its officers about the Company and the industry in which it operates, and assumptions made by management, and include among other items, (i) the Company’s strategies regarding growth, including its intention to develop new products and make acquisitions; (ii) the effectiveness of Creating the Center of Engineering Excellence; (iii) the Company’s financing plans; (iv) trends affecting the Company’s financial condition or results of operations; (v) the Company’s ability to continue to control costs and to meet its liquidity and other financing needs; (vi) the declaration and payment of dividends; and (vii) the Company’s ability to respond to changes in customer demand domestically and internationally, including as a result of standardization. In addition, we may make other written or oral statements, which constitute forward-looking statements, from time to time. Words such as “may,” “expects,” “projects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words, and similar expressions are intended to identify such forward-looking statements. Similarly, statements that describe our future plans, objectives or goals also are forward-looking statements. These statements are not guaranteeing future performance and are subject to a number of risks and uncertainties. Our actual results may differ materially from what is expressed or forecasted in such forward-looking statements, and undue reliance should not be placed on such statements. All forward-looking statements are made as of the date hereof, and we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. Factors that could cause the actual results to differ materially from what is expressed or forecasted in such forward‐looking statements include, but are not limited to, (i) conditions in the capital markets, including the interest rate environment and the availability of capital; (ii) our failure to realize the benefits expected from the Balboa acquisition, our failure to promptly and effectively integrate the Balboa acquisition and the ability of Helios to retain and hire key personnel, and maintain relationships with suppliers (iii) risks related to health epidemics, pandemics and similar outbreaks and similar outbreaks, including, without limitation, the current COVID-19 pandemic, which may affect our supply chain and material costs, which could have material adverse effects on our business, financial position, results of operations and/or cash flows; (iv) changes in the competitive marketplace that could affect the Company’s revenue and/or cost bases, such as increased competition, lack of qualified engineering, marketing, management or other personnel, and increased labor and raw materials costs; and (v) new product introductions, product sales mix and the geographic mix of sales nationally and internationally. Further information relating to factors that could cause actual results to differ from those anticipated is included but not limited to information under the heading Item 1. “Business” and Item 1A. “Risk Factors” in the Company’s Form 10-K for the year ended January 2, 2021. This presentation also presents forward-looking statements regarding non-GAAP Adjusted EBITDA, Adjusted EBITDA margin, and Non-GAAP Cash EPS. The Company is unable to present a quantitative reconciliation of these forward-looking non-GAAP financial measures to their most directly comparable forward-looking GAAP financial measures because such information is not available, and management cannot reliably predict the necessary components of such GAAP measures without unreasonable effort or expense. In addition, the Company believes that such reconciliations would imply a degree of precision that would be confusing or misleading to investors. The unavailable information could have a significant impact on the Company’s 2021 financial results. These non-GAAP financial measures are preliminary estimates and are subject to risks and uncertainties, including, among others, changes in connection with quarter-end and year-end adjustments. Any variation between the Company’s actual results and preliminary financial data set forth above may be material. This presentation includes certain historical non-GAAP financial measures, which the Company believes are useful in evaluating our performance. You should not consider the presentation of this additional information in isolation or as a substitute for results prepared in accordance with GAAP. The Company has provided reconciliations of comparable GAAP to non-GAAP measures in tables found in the Supplemental Information portion of this presentation.

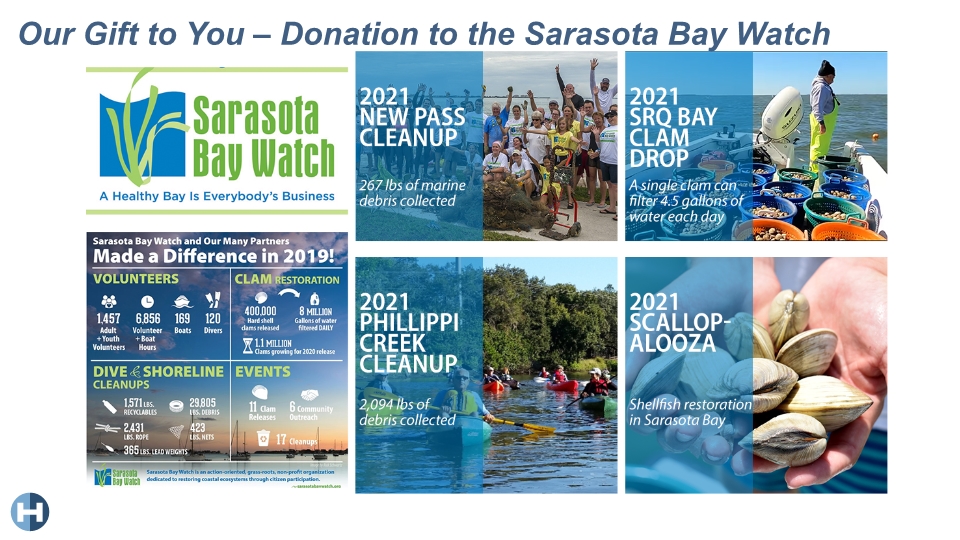

Our Gift to You – Donation to the Sarasota Bay Watch

Today’s Agenda

Augmenting Strategy to Drive Performance Josef Matosevic President and CEO

07 Key Takeaways

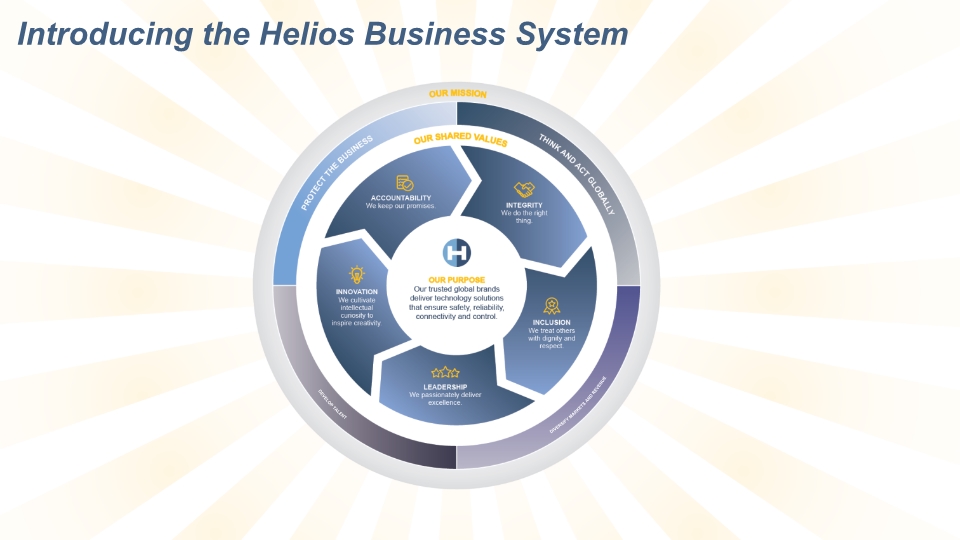

Introducing the Helios Business System

Supporting Strategies for Our Mission

A Scalable Approach to Implementing Strategy

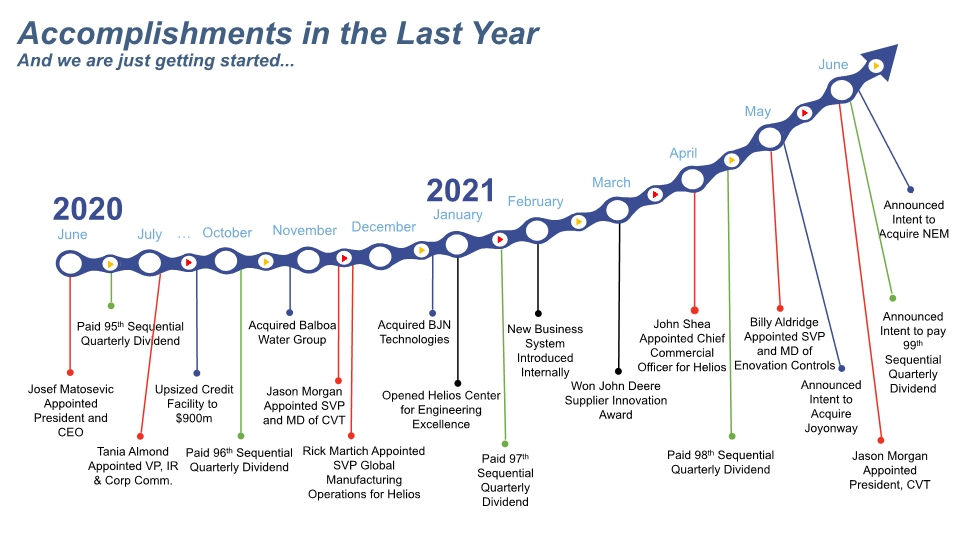

Accomplishments in the Last Year And we are just getting started... Josef Matosevic Appointed President and CEO Paid 96th Sequential Quarterly Dividend June July October December November January February March April May June … 2020 2021 Upsized Credit Facility to $900m Rick Martich Appointed SVP Global Manufacturing Operations for Helios Paid 97th Sequential Quarterly Dividend Acquired BJN Technologies Opened Helios Center for Engineering Excellence Won John Deere Supplier Innovation Award Billy Aldridge Appointed SVP and MD of Enovation Controls Paid 95th Sequential Quarterly Dividend Acquired Balboa Water Group Jason Morgan Appointed SVP and MD of CVT New Business System Introduced Internally Paid 98th Sequential Quarterly Dividend John Shea Appointed Chief Commercial Officer for Helios Announced Intent to Acquire Joyonway Announced Intent to Acquire NEM Jason Morgan Appointed President, CVT Announced Intent to pay 99th Sequential Quarterly Dividend Tania Almond Appointed VP, IR & Corp Comm.

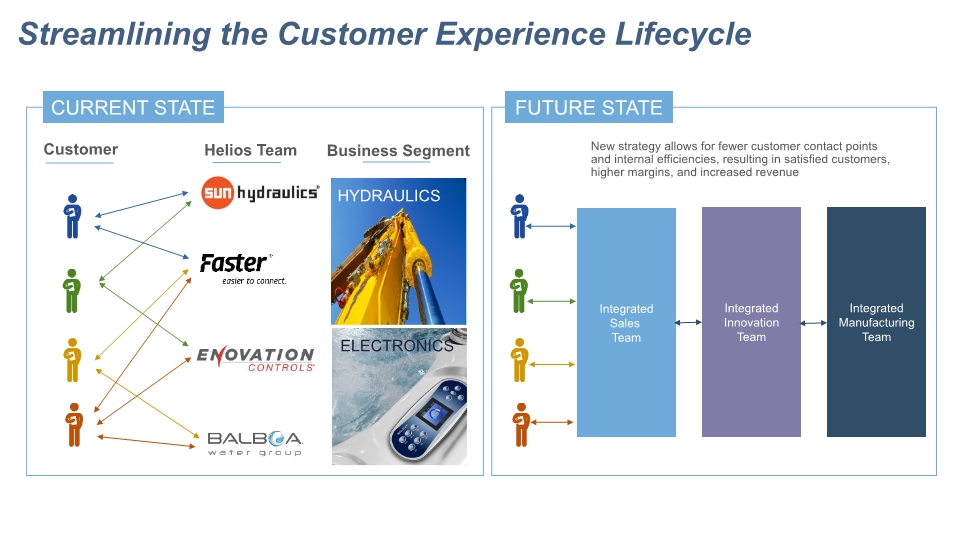

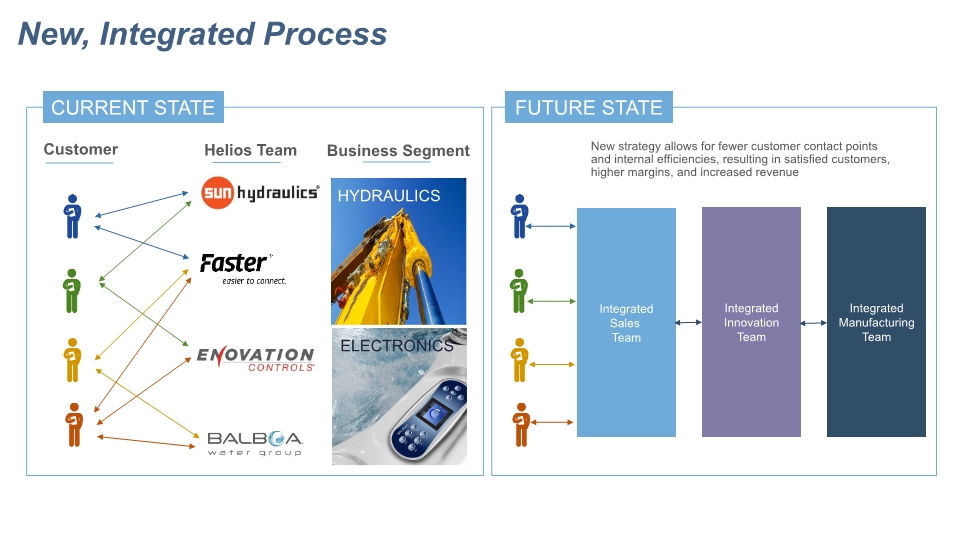

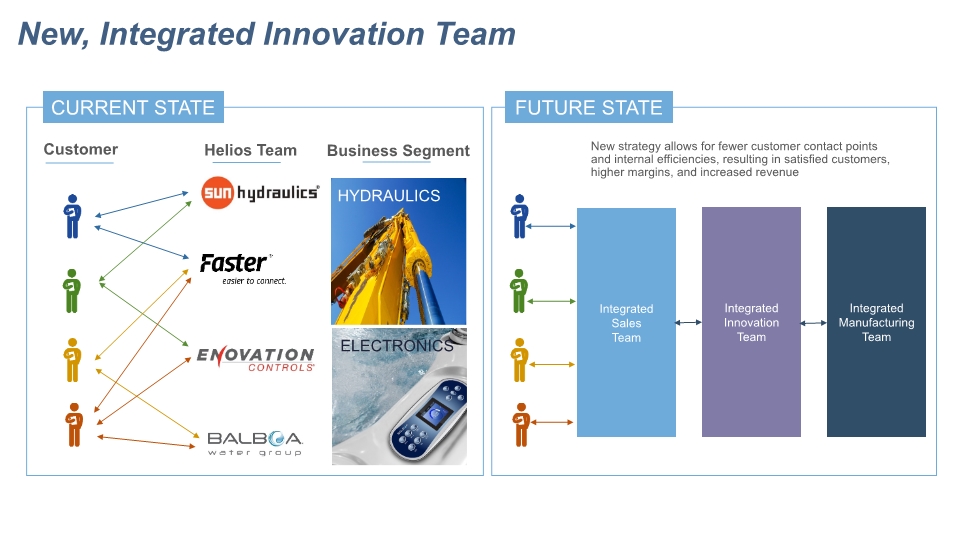

Streamlining the Customer Experience Lifecycle New strategy allows for fewer customer contact points and internal efficiencies, resulting in satisfied customers, higher margins, and increased revenue HYDRAULICS ELECTRONICS CURRENT STATE FUTURE STATE Customer Helios Team Integrated Innovation Team Integrated Sales Team Centralized Sales Team Centralized R&D Team Centralized Manufacturing Team Integrated Manufacturing Team

New Applications Growth Trends Existing End Markets and New Diversified Opportunities End Markets Specialty Vehicle Commercial HVAC Commercial Food Service Pharmaceutical Manufacturing Off Road Vehicles

Business System Driving Acquisition Strategy

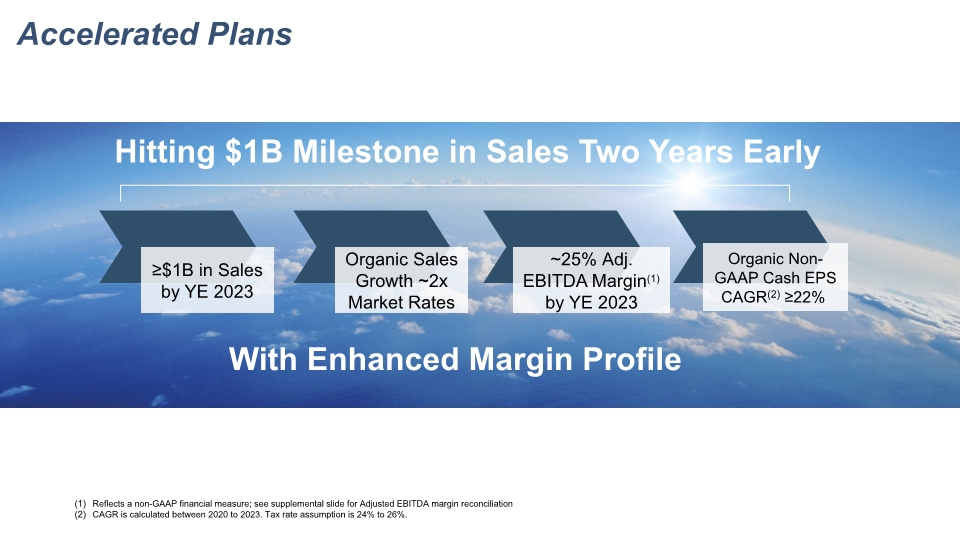

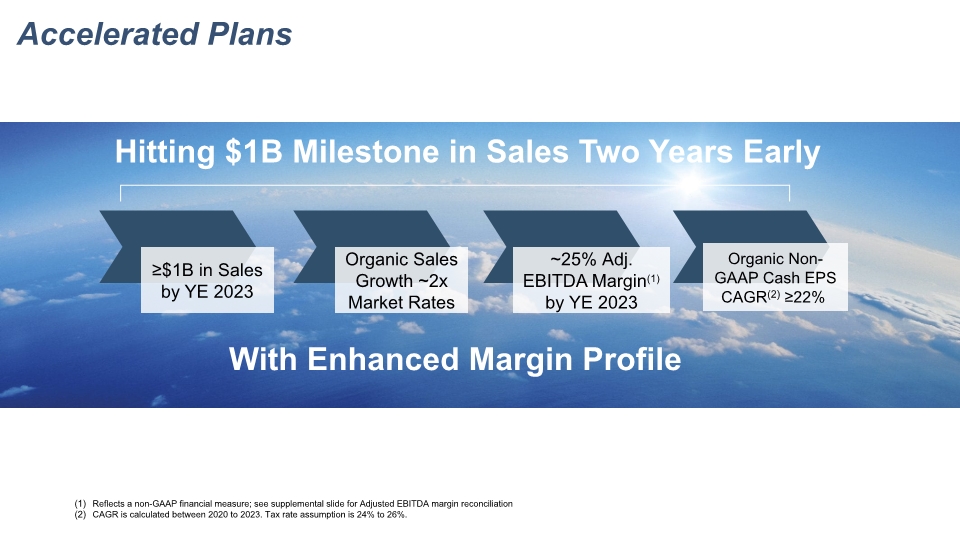

Accelerated Plans Hitting $1B Milestone in Sales Two Years Early With Enhanced Margin Profile Reflects a non-GAAP financial measure; see supplemental slide for Adjusted EBITDA margin reconciliation CAGR is calculated between 2020 to 2023. Tax rate assumption is 24% to 26%.

New Seasoned Management Team / Organizational Structure EVP Sales Balboa Water Group Joined Helios in 2020 In role since 2009 Industry experience 38 years Doug Conyers VP, Engineering Excellence Joined Helios in 2021 In role since 2021 Industry experience 22 years Rick Martich SVP, Global Manufacturing Operations Joined Helios in 2006 In role since 2020 Industry experience 27 years President, CVT Joined Helios in 2018 In role since 2020 Industry experience 26 years Matteo Arduini President & MD of QRC Joined Helios in 2018 In role since 2018 Industry experience 22 years SVP, MD of Enovation Controls Joined Helios in 2008 In role since 2021 Industry experience 21 years Josef Matosevic President & Chief Executive Officer Joined Helios in 2020 In role since 2020 Industry experience 28 years Tricia Fulton Chief Financial Officer Joined Helios in 1997 ln role since 2006 Industry experience 32 years Melanie Nealis, Esq. Chief Legal & Compliance Officer and Secretary Joined Helios in 2018 ln role since 2018 Industry experience 21 years Tania Almond VP, Investor Relations & Corporate Communications Joined Helios in 2020 ln role since 2020 Industry experience 28 years Chief Commercial Officer Joined Helios in 2014 In role since 2021 Industry experience 30 years Jason Morgan John Shea Jean-Pierre (“JP”) Parent Billy Aldridge

Expanding Leadership in Hydraulic Applications Jason Morgan President, CVT

Key Takeaways

Hydraulics Segment Overview Our trusted global brands deliver technology solutions that ensure safety, reliability, connectivity & control Quick-release hydraulic couplings, casting solutions & multi-connection for mobile off-highway applications Distribution of hydraulic, pneumatic, filtration, lubrication and electronic products; system design & installation, servicing & repairs (1Q21 LTM) (1Q21 LTM) (Announced Intent to Acquire)

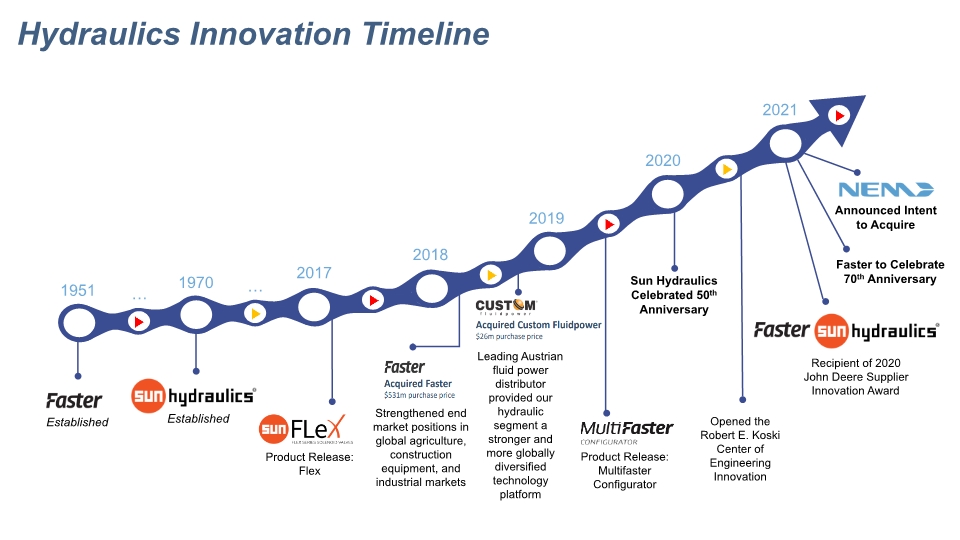

Hydraulics Innovation Timeline Sun Hydraulics Celebrated 50th Anniversary Strengthened end market positions in global agriculture, construction equipment, and industrial markets Leading Austrian fluid power distributor provided our hydraulic segment a stronger and more globally diversified technology platform … … Opened the Robert E. Koski Center of Engineering Innovation Product Release: Multifaster Configurator Product Release: Flex Faster to Celebrate 70th Anniversary Announced Intent to Acquire

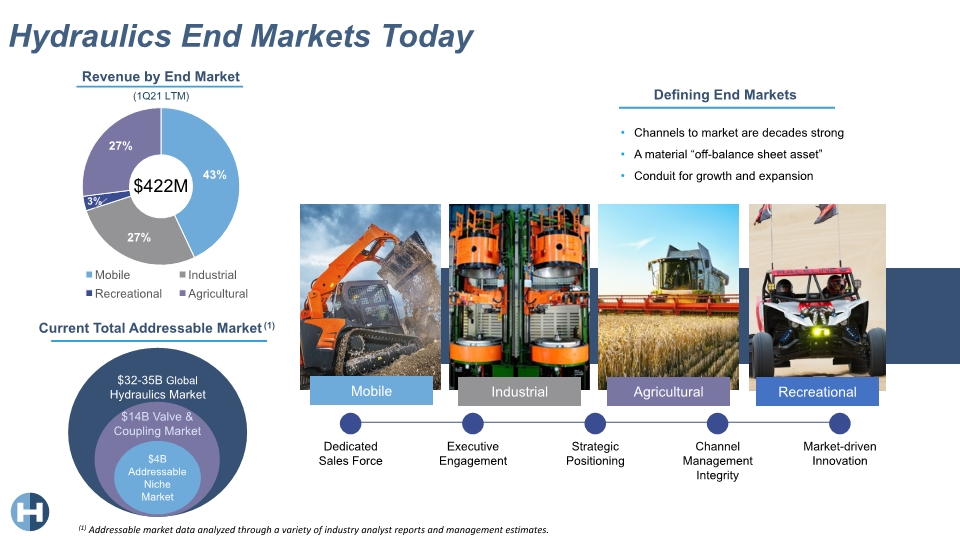

Hydraulics End Markets Today Defining End Markets Channels to market are decades strong A material “off-balance sheet asset” Conduit for growth and expansion (1) Addressable market data analyzed through a variety of industry analyst reports and management estimates. Recreational

Growth Markets Hydraulics Market Expansion Potential Recreational Pharmaceutical Health & Wellness Thermo-Dynamic Current Markets

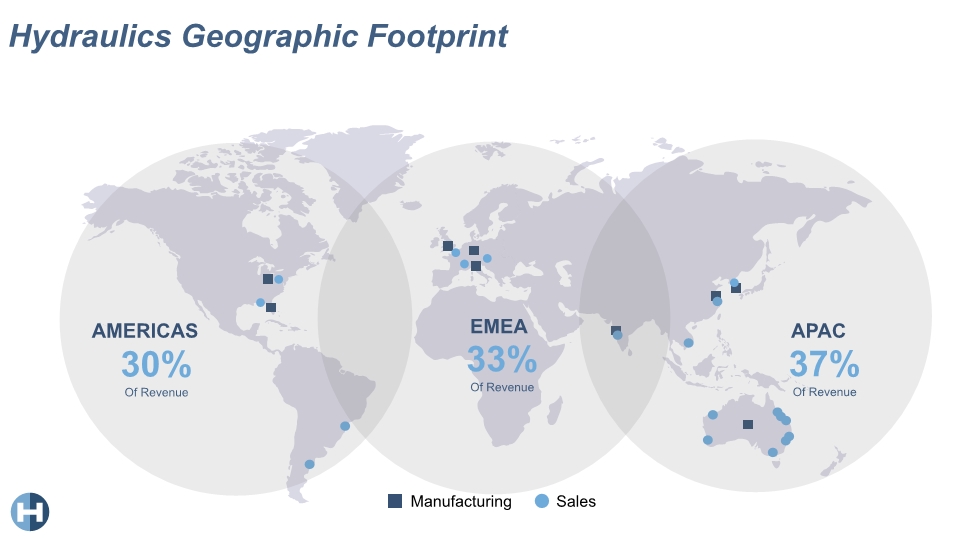

Where we play Where our customers are Hydraulics Geographic Footprint Label: Manufacturing Sarasota, FL Italy Kunshan, China Germany UK Korea Australia (which city?) Ohio India? Sales India Vietnam Australia (use current boxes) Argentina Brazil China Focused growth on white spots - Geographic and Product

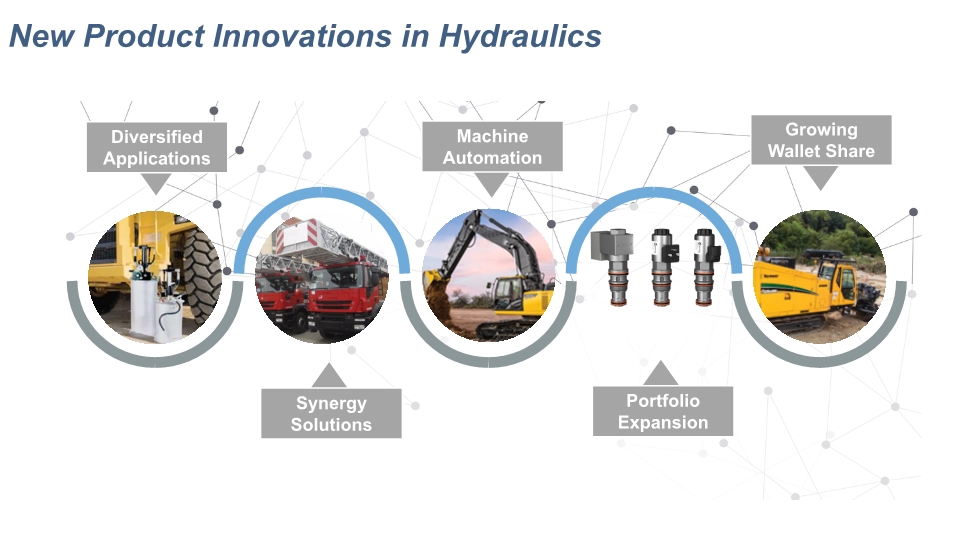

New Product Innovations in Hydraulics Oil Grease 35K 100K life cycles Diversified Applications Synergy Solutions Portfolio Expansion Growing Wallet Share Machine Automation

John Deere Supplier Innovation Award Combining the advantages and features of MultiFaster and Sun electrohydraulic cartridge valves into an integrated manifold - reducing complexity and increasing reliability of the hydraulic circuit as a result. Helios Technologies // Investor Presentation

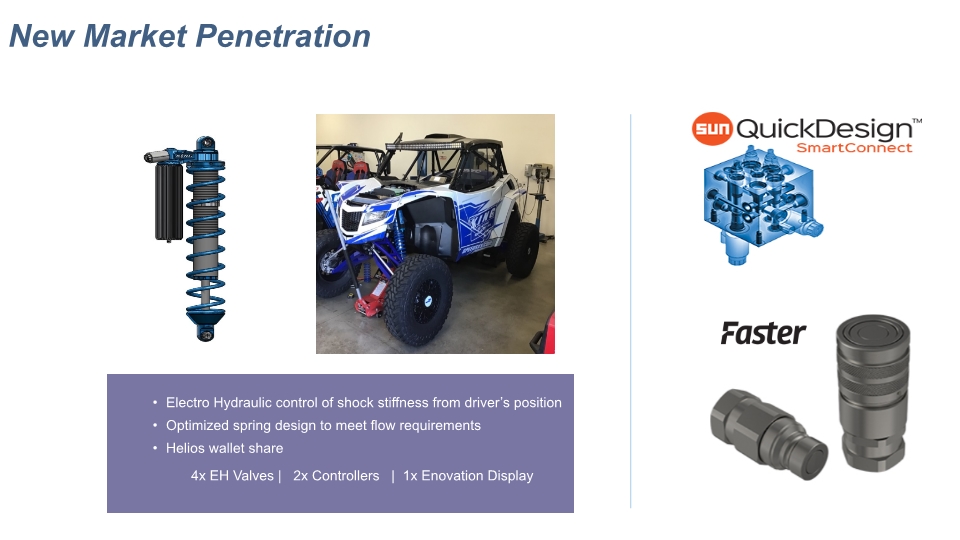

New Market Penetration

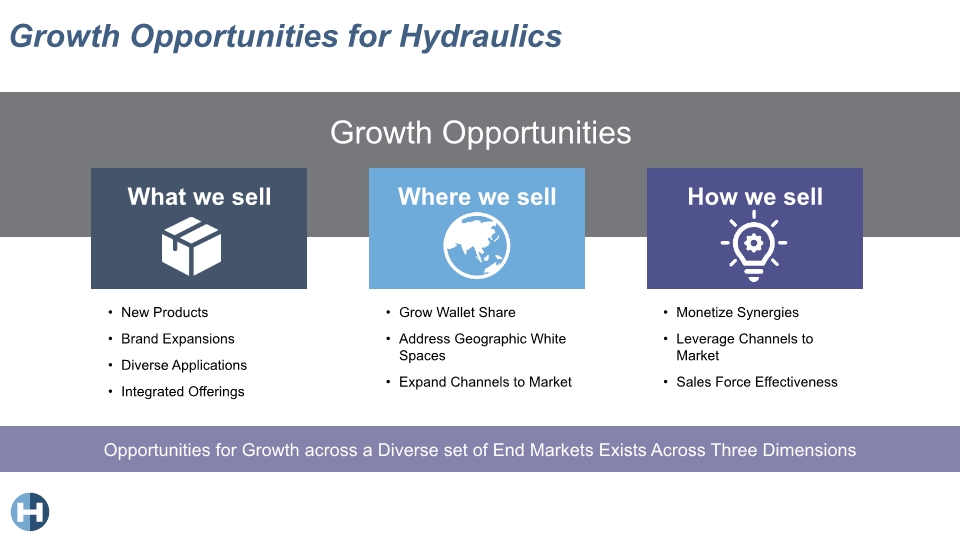

Growth Opportunities for Hydraulics Opportunities for Growth across a Diverse set of End Markets Exists Across Three Dimensions New Products Brand Expansions Diverse Applications Integrated Offerings Grow Wallet Share Address Geographic White Spaces Expand Channels to Market Growth Opportunities Monetize Synergies Leverage Channels to Market Sales Force Effectiveness Where we sell What we sell How we sell

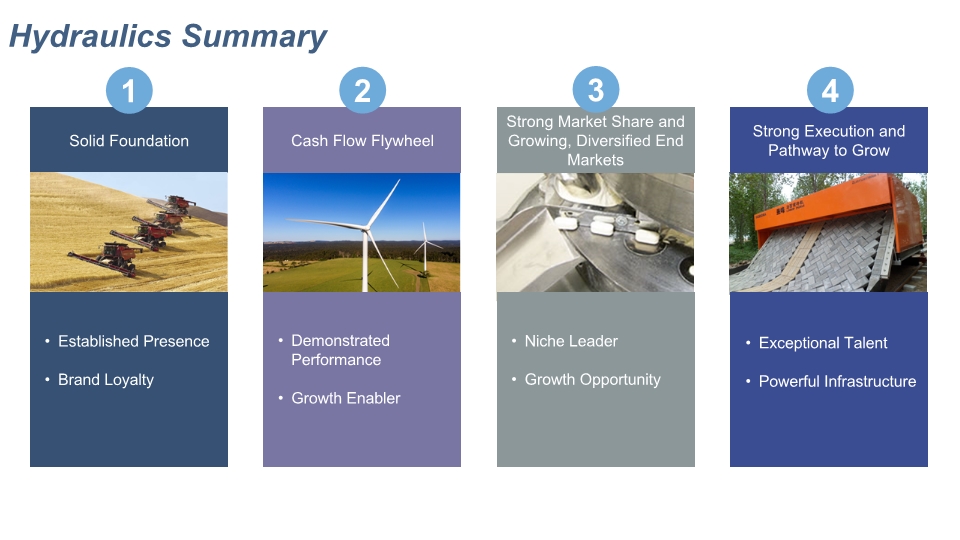

Hydraulics Summary Solid Foundation Established Presence Brand Loyalty Cash Flow Flywheel Demonstrated Performance Growth Enabler Strong Market Share and Growing, Diversified End Markets Niche Leader Growth Opportunity Strong Execution and Pathway to Grow Exceptional Talent Powerful Infrastructure 1 2 3 4

Leading in Engineered Electronic Controls Billy Aldridge, MD, Enovation Controls JP Parent, EVP of Sales, Balboa

Key Takeaways

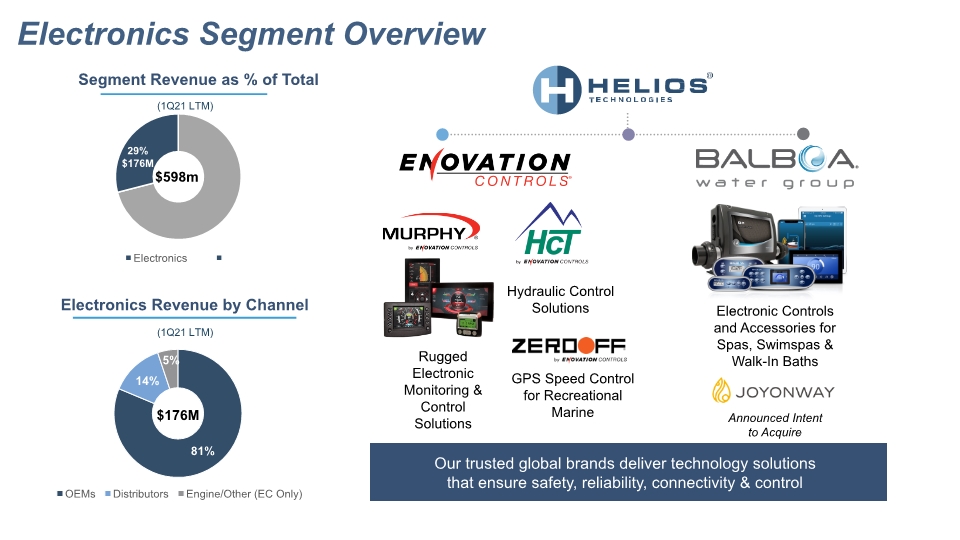

Electronics Segment Overview Channels: - OEMs: $155,804M + $58.12M = $213.92M Distributors: $16,602M + $19.1M = $35.7M Engine/Other (ENC only): = $13.5M (1Q21 LTM) Electronics Revenue by Channel (1Q21 LTM) Hydraulic Control Solutions GPS Speed Control for Recreational Marine Electronic Controls and Accessories for Spas, Swimspas & Walk-In Baths Rugged Electronic Monitoring & Control Solutions Announced Intent to Acquire Our trusted global brands deliver technology solutions that ensure safety, reliability, connectivity & control

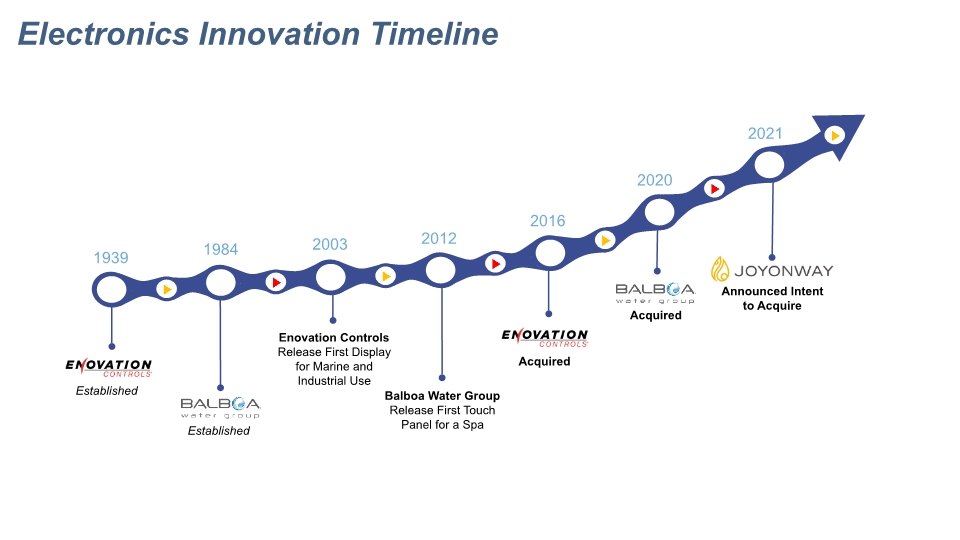

Electronics Innovation Timeline 1984 2003 2012 2016 2020 1939 2021 Established Established Enovation Controls Release First Display for Marine and Industrial Use Acquired Acquired Announced Intent to Acquire Balboa Water Group Release First Touch Panel for a Spa

Electronics End Markets Today $176 Million Off-Highway Material Handling Agriculture Construction Lawn and Garden Industrial & Mobile Marine On/Off-Road Vehicles Recreational Health & Wellness Walk-in Baths Spas & Swim Spas Whirlpool Baths New Images Global Electronics Market $Trillions… $4B Helios’s Electronics Segment Total Addressable Market $2.4B Addressable Niche Market (1Q21 LTM) (1) Addressable market data analyzed through a variety of industry analyst reports and management estimates. End markets include; agriculture, construction, material handling, industrial stationary, recreational marine, recreational vehicle, and lawn and garden. Product categories include; Spa & Swim Spa, Walk-in Baths, and Whirlpool Baths.

Growth Markets Current Markets Electronics Market Expansion Potential Mining Construction Recreational Commercial HVAC Commercial Food Service Bus & Transportation Commercial Lawn Equipment On-Road Recreation

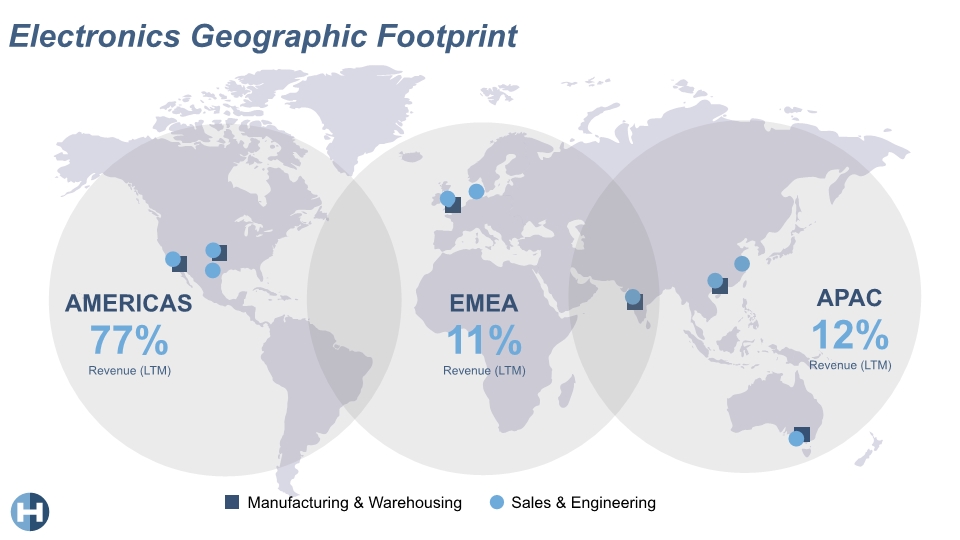

Electronics Geographic Footprint

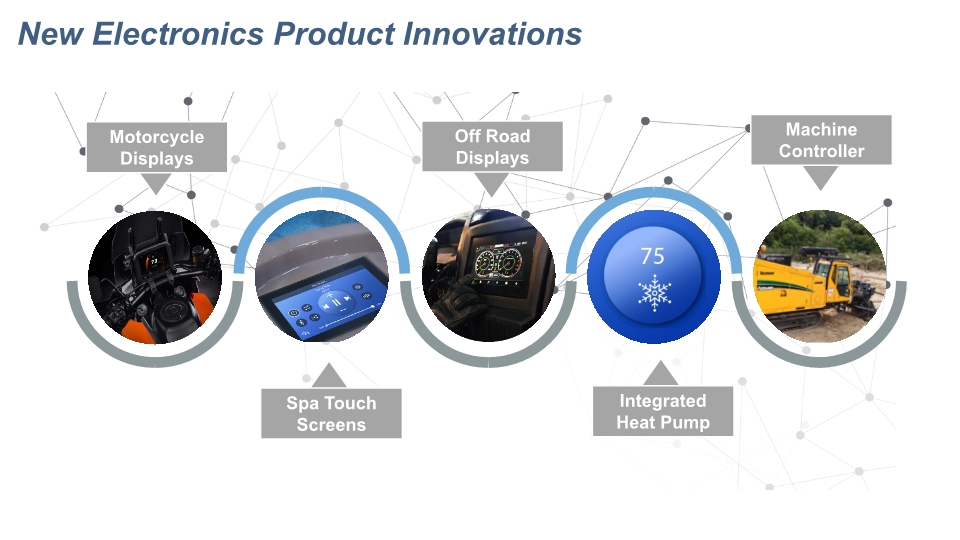

New Electronics Product Innovations Purpose/ Mission Strategy Structure Tactics Talking Points? In Progress Motorcycle Displays Spa Touch Screens Integrated Heat Pump Machine Controller Off Road Displays

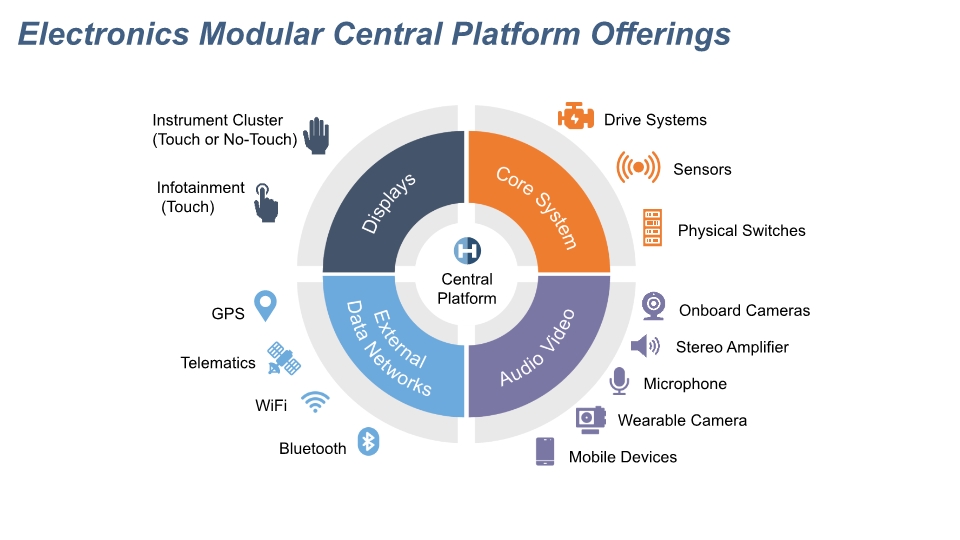

Drive Systems Sensors Physical Switches Electronics Modular Central Platform Offerings Onboard Cameras Stereo Amplifier Microphone Wearable Camera Mobile Devices

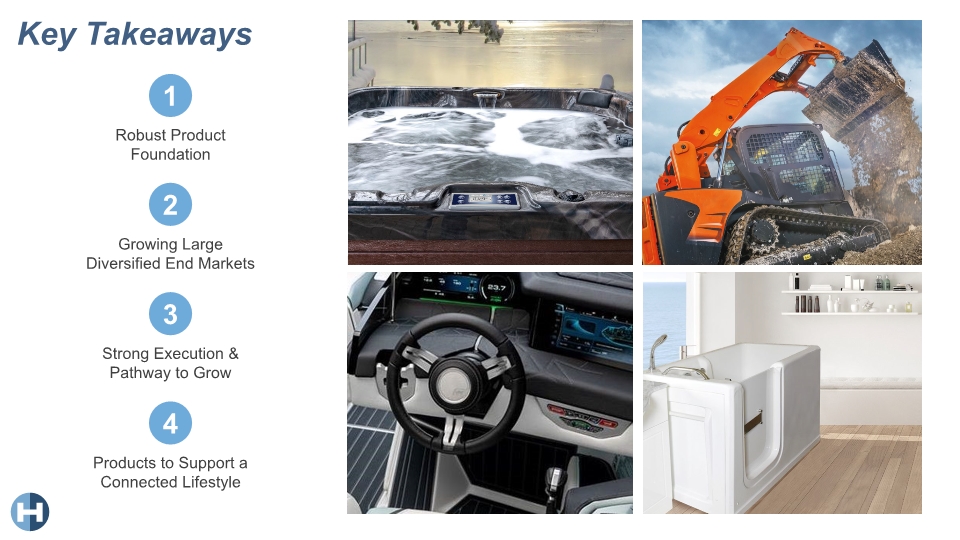

Protect Base Business Industry Proven Solutions OEM Driven Sales Market Leading Offerings Well Positioned for Growth Ready to Fit Applications Develop OEM Solutions Monetize Segment Synergies Expand Channels to Market Increase Wallet Share Target Global White Spaces Brand Expansion Summary Robust Product Foundation Growing Large Diversified End Markets Strong Execution and Pathway to Grow Products to Support a Connected Lifestyle Next Generation of Products Integrated Offerings In-Demand Features Unlock Rich Experiences 1 2 3 4 Helios Technologies // Investor Presentation

Delivering Improved Customer Experiences John Shea Chief Commercial Officer

Key Takeaways Advancing New Integrated Process 1 Augmenting Go-To Market Strategy 2 Accelerating Customer Value Proposition 3

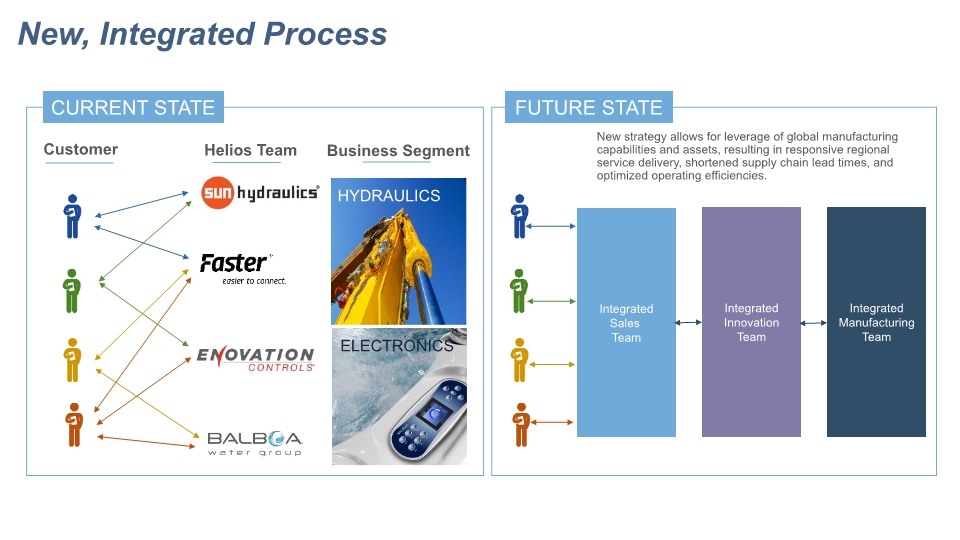

New, Integrated Process New strategy allows for fewer customer contact points and internal efficiencies, resulting in satisfied customers, higher margins, and increased revenue HYDRAULICS ELECTRONICS CURRENT STATE FUTURE STATE Customer Helios Team Integrated Innovation Team Integrated Sales Team Integrated Manufacturing Team

Internal Communication Companywide Customer Relationship Management (CRM) Standardized cadence on customer outreach Sharing of Voice of the Customer (VOC) and trip reports New Process in Action Coordinated Marketing Highlight Helios as opposed to different subsidiaries Standardized marketing materials for trade shows, dealer meetings, etc. Promote System sales Develop mobile marketing kits Customer Experience Center Standardized Training Cross functional training of sales and application teams Development of Market Segment Experts Leverage geographic market expertise to cross sell Leveraged Sales Team

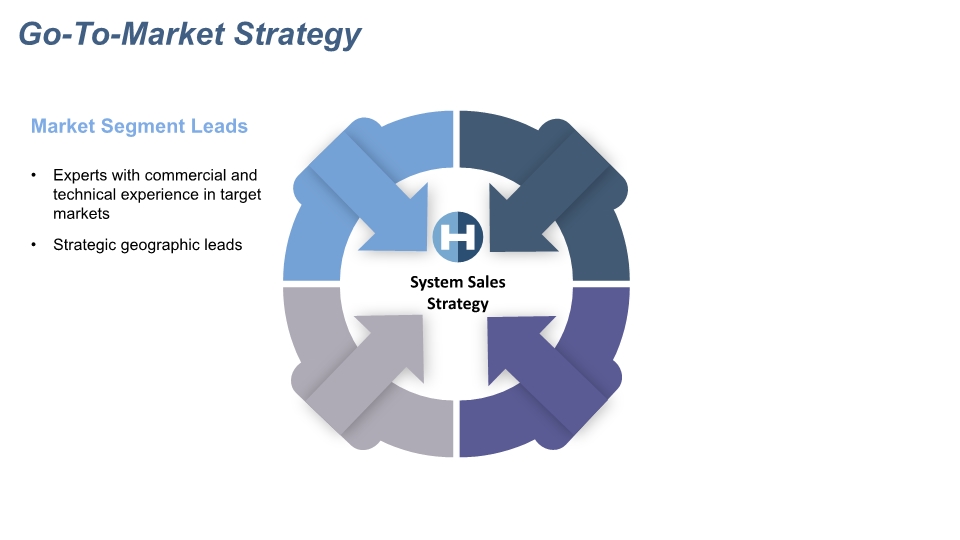

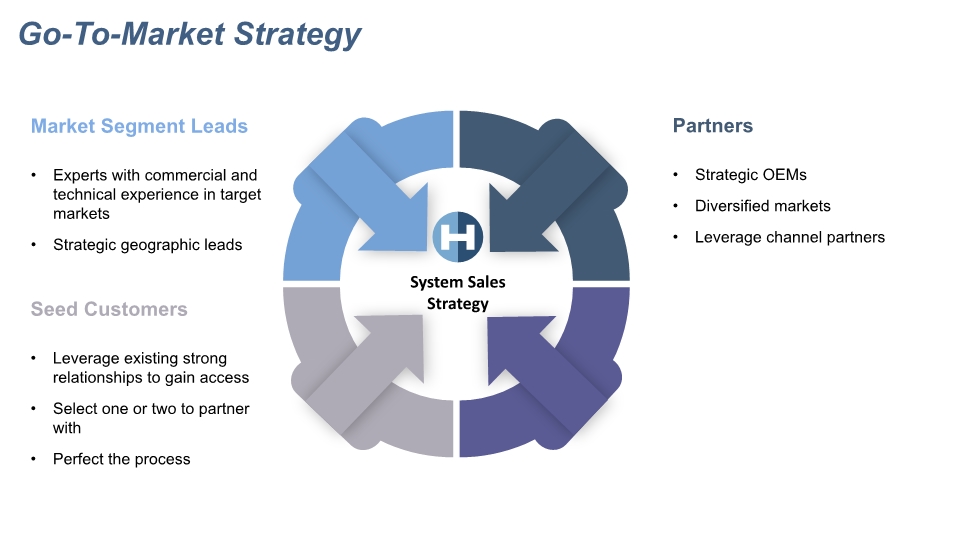

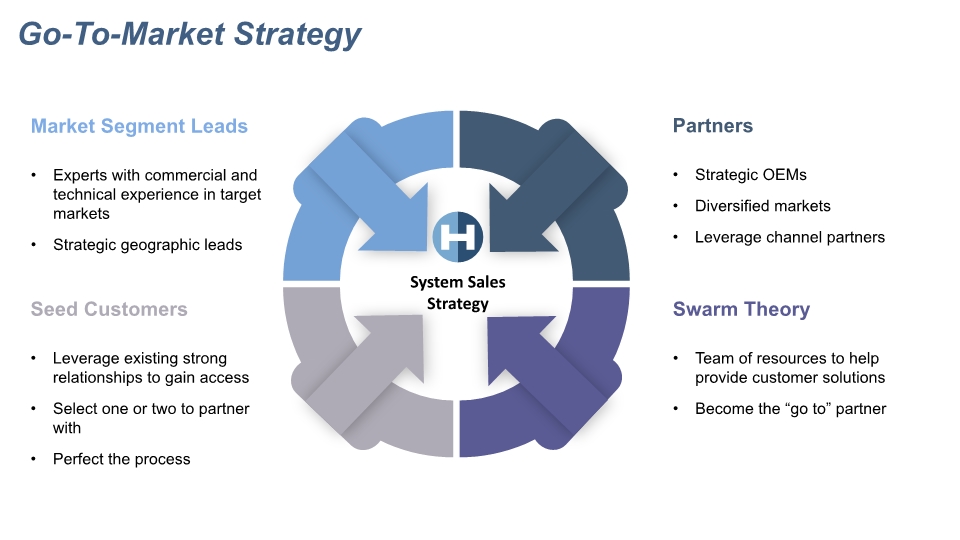

Go-To-Market Strategy Market Segment Leads Experts with commercial and technical experience in target markets Strategic geographic leads System Sales Strategy

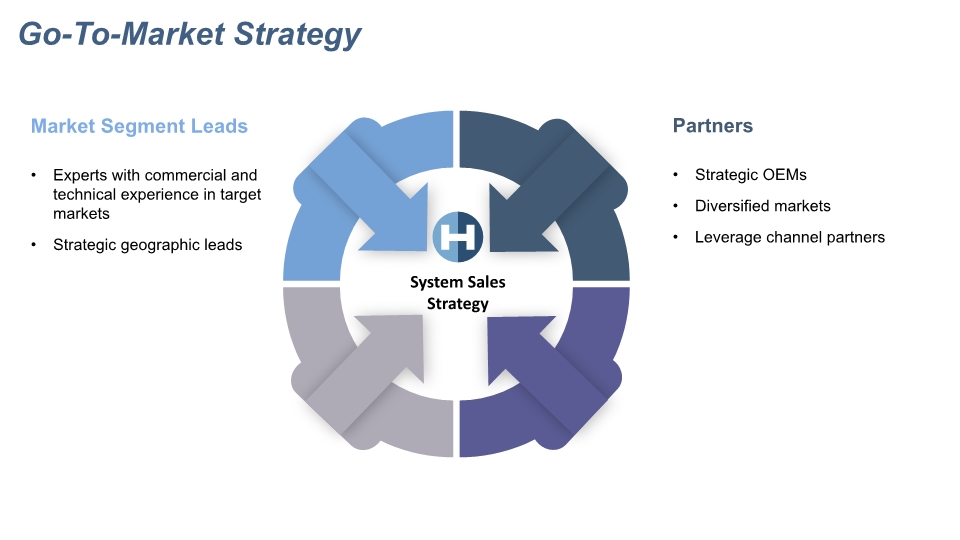

Go-To-Market Strategy Partners Strategic OEMs Diversified markets Leverage channel partners Market Segment Leads Experts with commercial and technical experience in target markets Strategic geographic leads System Sales Strategy

Go-To-Market Strategy Partners Strategic OEMs Diversified markets Leverage channel partners Market Segment Leads Experts with commercial and technical experience in target markets Strategic geographic leads Seed Customers Leverage existing strong relationships to gain access Select one or two to partner with Perfect the process System Sales Strategy

Go-To-Market Strategy Partners Strategic OEMs Diversified markets Leverage channel partners Market Segment Leads Experts with commercial and technical experience in target markets Strategic geographic leads Swarm Theory Team of resources to help provide customer solutions Become the “go to” partner Seed Customers Leverage existing strong relationships to gain access Select one or two to partner with Perfect the process System Sales Strategy

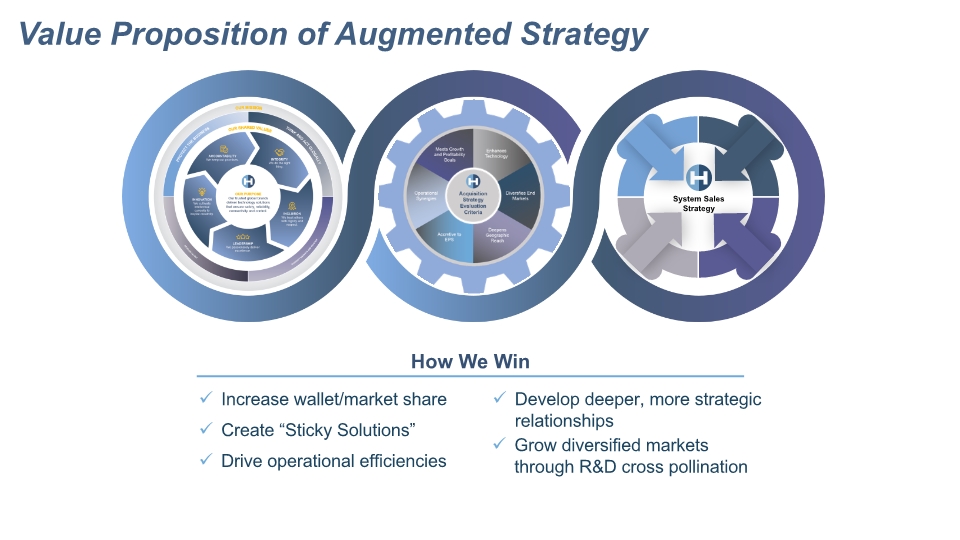

Value Proposition of Augmented Strategy How We Win Increase wallet/market share Create “Sticky Solutions” Drive operational efficiencies Develop deeper, more strategic relationships Grow diversified markets through R&D cross pollination

Summary New Process New Go-To Market Strategy Well thought out approach to build off existing strong customer relationships by slowly introducing other subsidiaries’ products Target “seed” customers to grow wallet share Customer Experience Center Driving Success Experienced sales team to develop Market Segment Experts Team able to penetrate deeper into existing markets and wider into adjacent markets Globally-minded team able to leverage relationships in different geographies 3 2 1 Integrated, streamlined approach Aligned communication, training Single point of contact benefits Helios and our customers Leverages relationships and internal expertise to maximize wallet share

Accelerating Diversified Growth through Innovation Doug Conyers VP of Engineering Excellence

Key Takeaways Cool Engineers (Yes, oxymoron) playing with circuit board design Circuit Board "Abstract Graphics" I'm not sure how/what to graphically depict "Demonstrated Results", but maybe you can somehow show a "Design Image" next to a "Circuit Board Abstract Image" next to a Boat Helm featuring Enovation displays. If you could somehow make a graphic that showed the "morphing" from design to final product, that might be really cool? (And now, you all know why I'm a geek and not in Marketing!) This example fails to exemplify "Innovation", but maybe that's okay? Helios Center for Engineering Excellence:

New, Integrated Innovation Team New strategy allows for fewer customer contact points and internal efficiencies, resulting in satisfied customers, higher margins, and increased revenue HYDRAULICS ELECTRONICS CURRENT STATE FUTURE STATE Customer Helios Team Integrated Innovation Team Integrated Sales Team Centralized Sales Team Centralized R&D Team Centralized Manufacturing Team Integrated Manufacturing Team

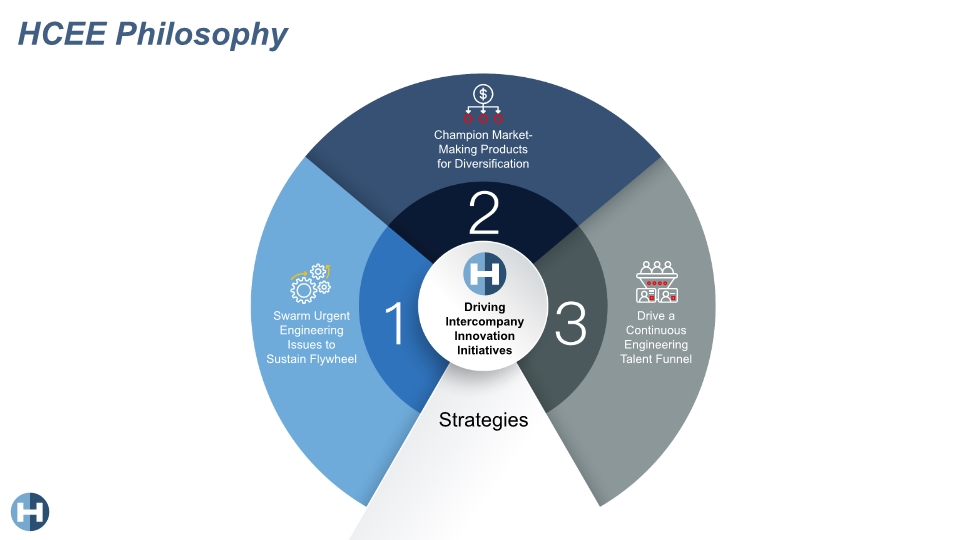

HCEE Philosophy

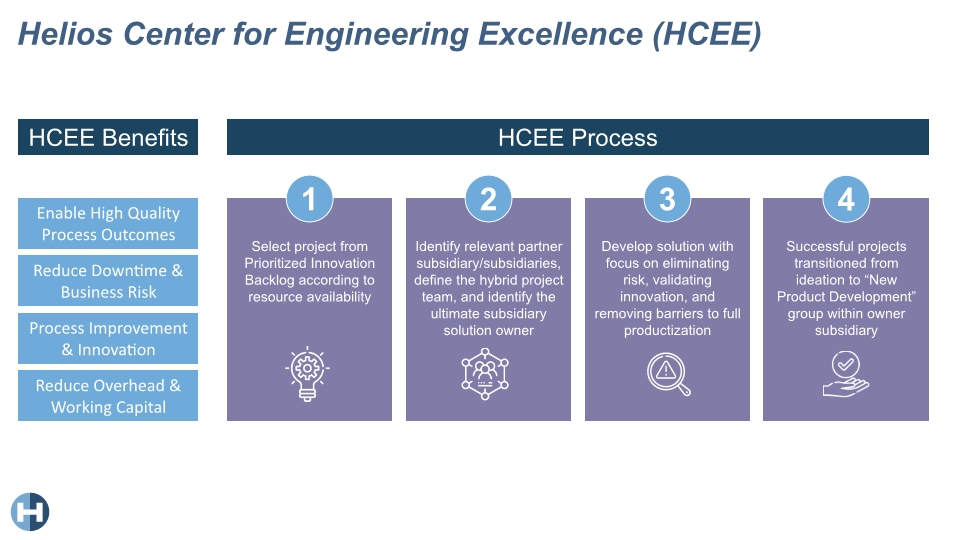

Helios Center for Engineering Excellence (HCEE) HCEE Benefits Enable High Quality Process Outcomes Reduce Downtime & Business Risk Process Improvement & Innovation Reduce Overhead & Working Capital HCEE Process Select project from Prioritized Innovation Backlog according to resource availability 1 Identify relevant partner subsidiary/subsidiaries, define the hybrid project team, and identify the ultimate subsidiary solution owner 2 Develop solution with focus on eliminating risk, validating innovation, and removing barriers to full productization 3 Successful projects transitioned from ideation to “New Product Development” group within owner subsidiary 4

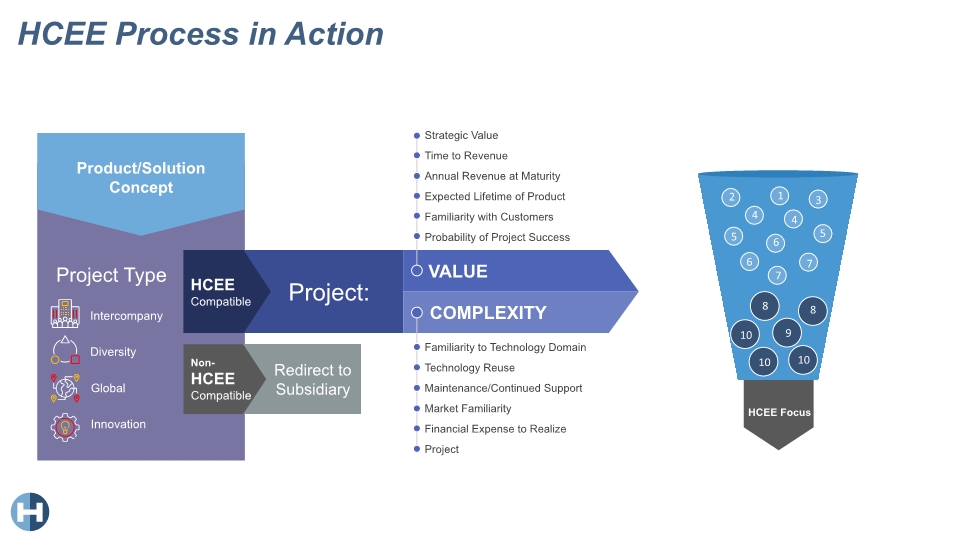

HCEE Process in Action Product/Solution Concept

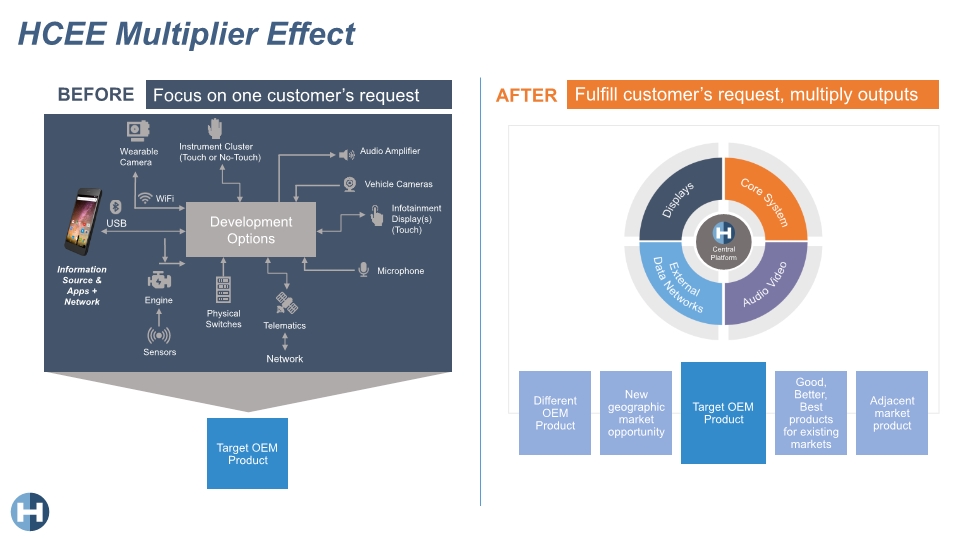

HCEE Multiplier Effect Fulfill customer’s request, multiply outputs Target OEM Product Mobile Devices BEFORE Focus on one customer’s request AFTER

Summary Augmenting Strategy New, Integrated R&D Process; Helios Center for Engineering Excellence Focus on Multiplier Effect 1 2 Demonstrated Results 3 Advancing Technologies Accelerating Growth

Driving Profitable Growth Through Operational Excellence Rick Martich SVP, Global Manufacturing Operations

Key Takeaways

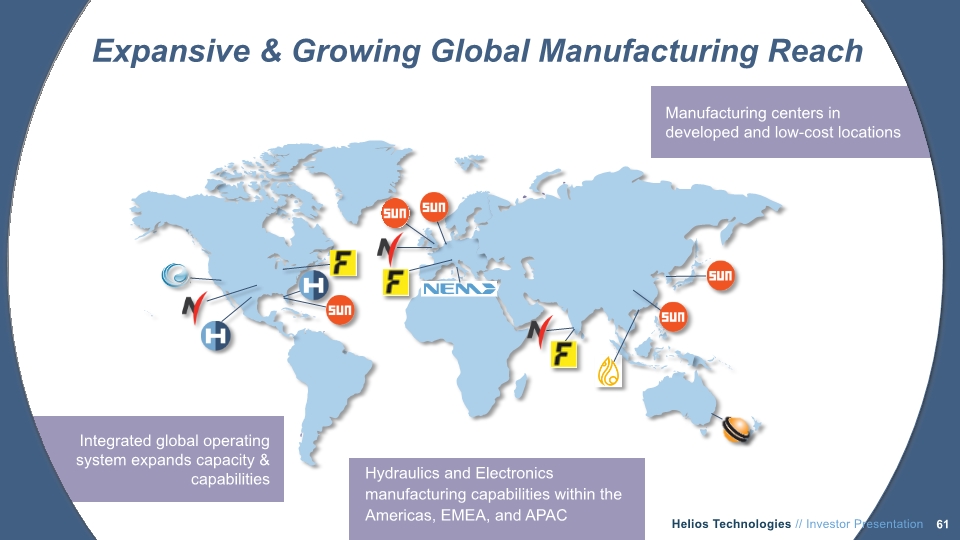

Integrated global operating system expands capacity & capabilities Manufacturing centers in developed and low-cost locations Hydraulics and Electronics manufacturing capabilities within the Americas, EMEA, and APAC Expansive & Growing Global Manufacturing Reach 61 Helios Technologies // Investor Presentation

New, Integrated Process HYDRAULICS ELECTRONICS CURRENT STATE FUTURE STATE Customer Helios Team Integrated Innovation Team Integrated Sales Team Integrated Manufacturing Team New strategy allows for leverage of global manufacturing capabilities and assets, resulting in responsive regional service delivery, shortened supply chain lead times, and optimized operating efficiencies.

Engage the Global Team Articulate the Vision & Strategy Lead with facts & data Nurture Accountability, Understanding & Innovation Drive Profitable Growth & Diversification The Approach 1 2 3 4 5

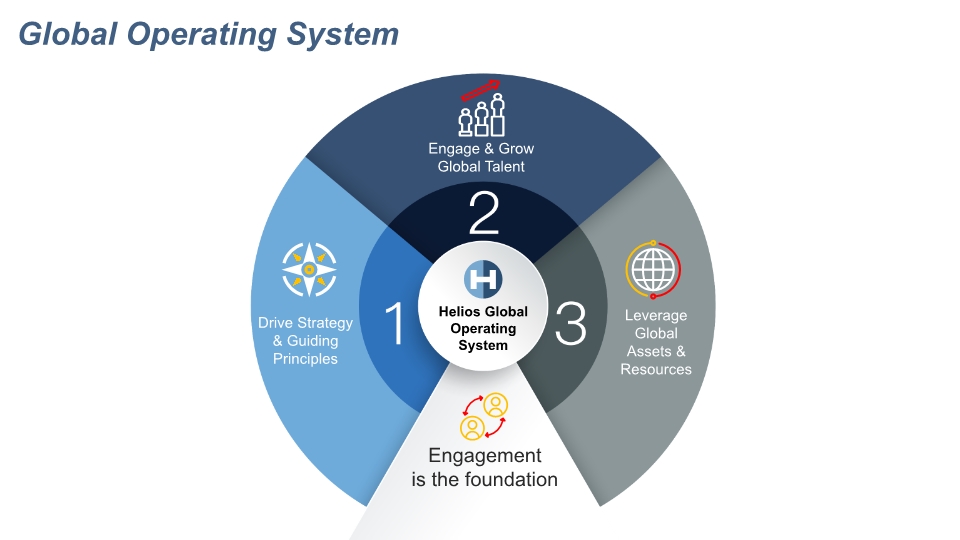

Global Operating System Drive Strategy & Guiding Principles Engage & Grow Global Talent Leverage Global Assets & Resources Engagement is the foundation

Measuring Success Global Manufacturing Operations enables Global Growth while Driving Profitability

Summary Growing manufacturing & supply chain footprint enables Good, Better, Best commercial strategies Global manufacturing footprint enables geographic and end market growth and revenue diversification Breadth of resources across companies can be leveraged to drive profitability Expansive Reach Profitability Focused Growth & Diversification 1 2 3

Creating Value Tricia Fulton Chief Financial Officer

Key Takeaways

Augmented Strategy Recap

Augmented Strategy Recap

Augmented Strategy Recap

Augmented Strategy Recap

Augmented Strategy Recap

Augmented Strategy Recap

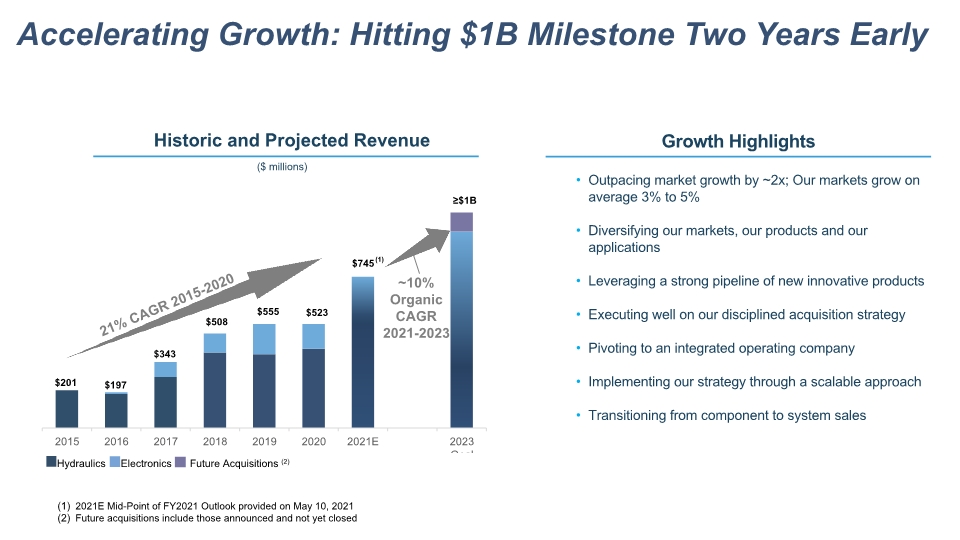

($ millions) Accelerating Growth: Hitting $1B Milestone Two Years Early Outpacing market growth by ~2x; Our markets grow on average 3% to 5% Diversifying our markets, our products and our applications Leveraging a strong pipeline of new innovative products Executing well on our disciplined acquisition strategy Pivoting to an integrated operating company Implementing our strategy through a scalable approach Transitioning from component to system sales Growth Highlights 2021E Mid-Point of FY2021 Outlook provided on May 10, 2021 Future acquisitions include those announced and not yet closed ~10% Organic CAGR 2021-2023 $201 $197 (1) $745 $523 $555 $508 $343 ≥$1B 21% CAGR 2015-2020

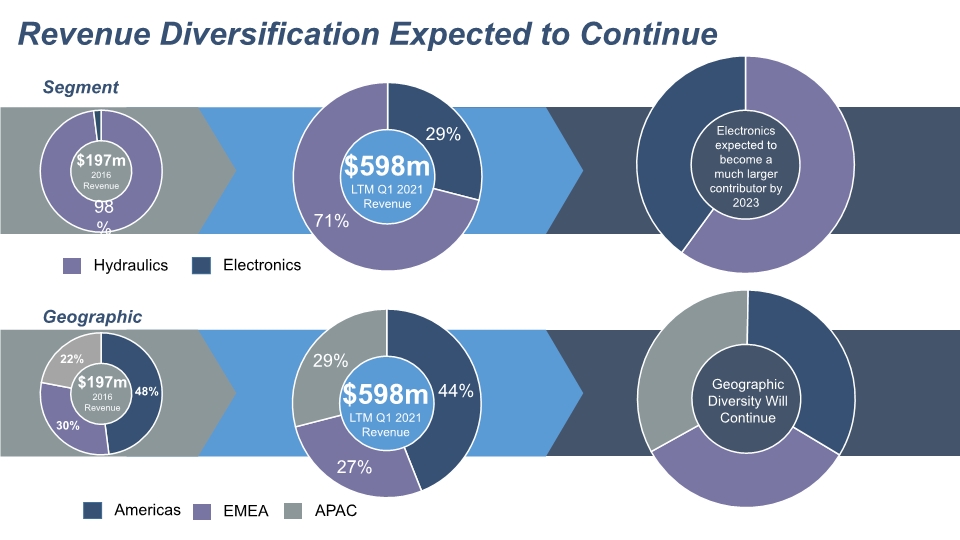

Revenue Diversification Expected to Continue $197m 2016 Revenue $598m LTM Q1 2021 Revenue Hydraulics Electronics Geographic Diversity Will Continue $598m LTM Q1 2021 Revenue APAC EMEA Americas Segment Geographic

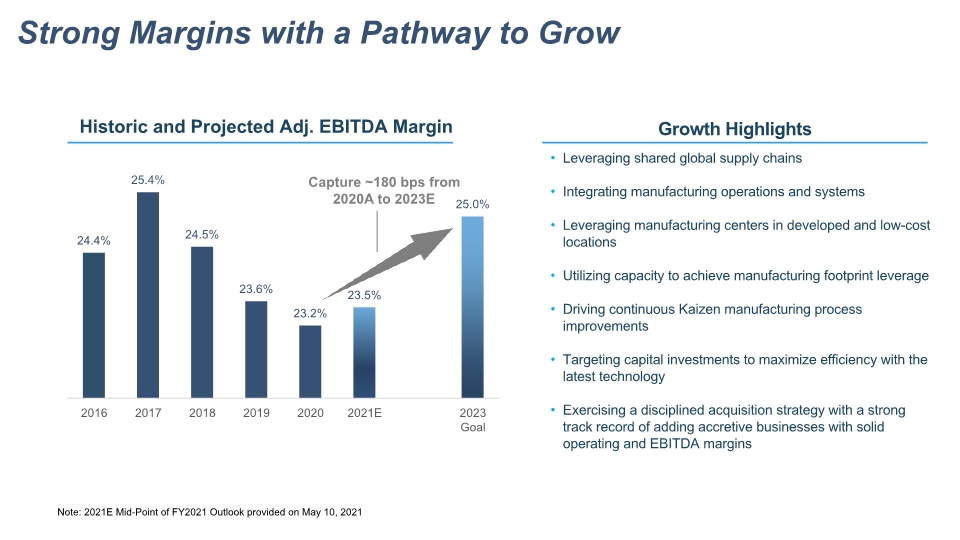

Strong Margins with a Pathway to Grow Historic and Projected Adj. EBITDA Margin Leveraging shared global supply chains Integrating manufacturing operations and systems Leveraging manufacturing centers in developed and low-cost locations Utilizing capacity to achieve manufacturing footprint leverage Driving continuous Kaizen manufacturing process improvements Targeting capital investments to maximize efficiency with the latest technology Exercising a disciplined acquisition strategy with a strong track record of adding accretive businesses with solid operating and EBITDA margins Growth Highlights Capture ~180 bps from 2020A to 2023E Note: 2021E Mid-Point of FY2021 Outlook provided on May 10, 2021

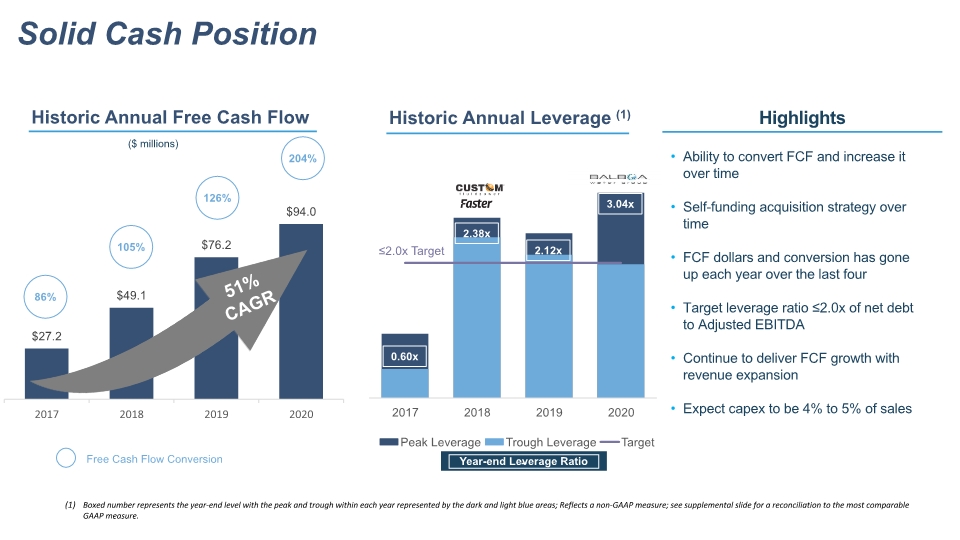

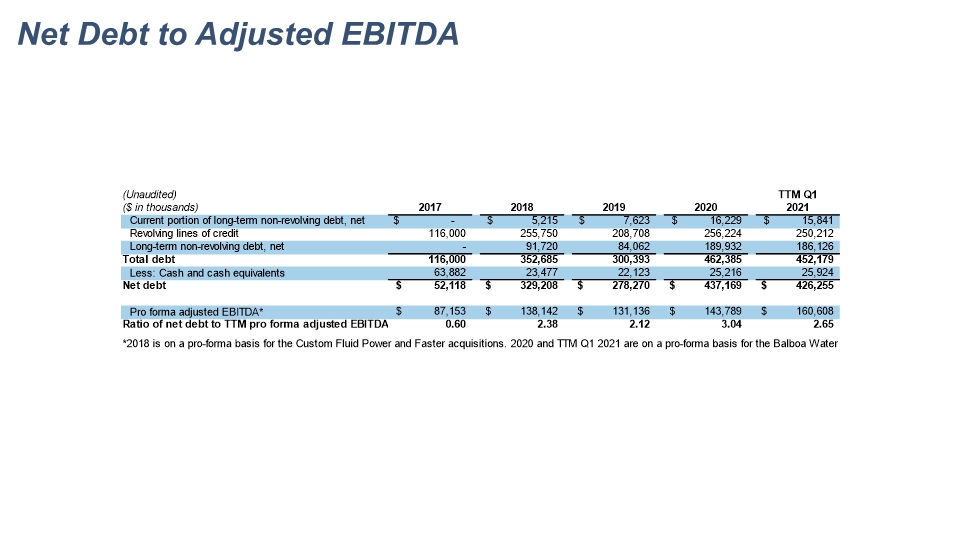

Solid Cash Position Historic Annual Free Cash Flow 51% CAGR ($ millions) ≤2.0x Target HLIO CFO Design Master.pptx Historic Annual Leverage (1) Boxed number represents the year-end level with the peak and trough within each year represented by the dark and light blue areas; Reflects a non-GAAP measure; see supplemental slide for a reconciliation to the most comparable GAAP measure. Ability to convert FCF and increase it over time Self-funding acquisition strategy over time FCF dollars and conversion has gone up each year over the last four Target leverage ratio ≤2.0x of net debt to Adjusted EBITDA Continue to deliver FCF growth with revenue expansion Expect capex to be 4% to 5% of sales Highlights 0.60x 2.38x 2.12x 3.04x Year-end Leverage Ratio -

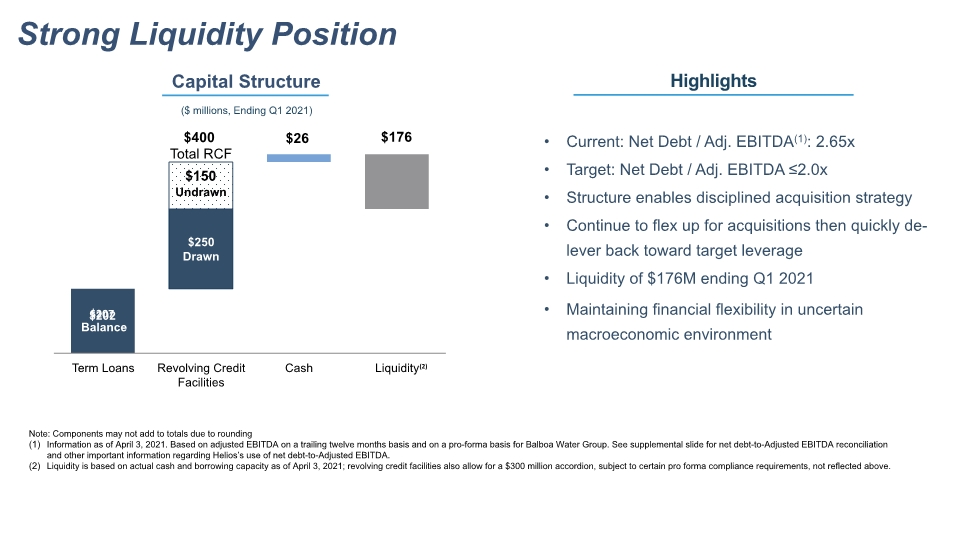

Strong Liquidity Position $202 Balance Undrawn Total RCF $150 (2) Current: Net Debt / Adj. EBITDA(1): 2.65x Target: Net Debt / Adj. EBITDA ≤2.0x Structure enables disciplined acquisition strategy Continue to flex up for acquisitions then quickly de-lever back toward target leverage Liquidity of $176M ending Q1 2021 Maintaining financial flexibility in uncertain macroeconomic environment Note: Components may not add to totals due to rounding Information as of April 3, 2021. Based on adjusted EBITDA on a trailing twelve months basis and on a pro-forma basis for Balboa Water Group. See supplemental slide for net debt-to-Adjusted EBITDA reconciliation and other important information regarding Helios’s use of net debt-to-Adjusted EBITDA. Liquidity is based on actual cash and borrowing capacity as of April 3, 2021; revolving credit facilities also allow for a $300 million accordion, subject to certain pro forma compliance requirements, not reflected above. ($ millions, Ending Q1 2021) Highlights

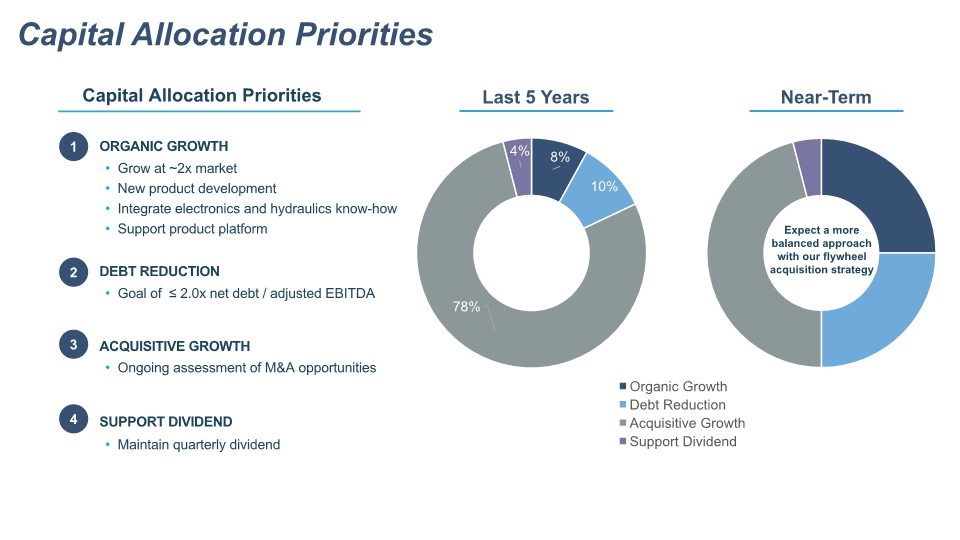

Capital Allocation Priorities Expect a more balanced approach with our flywheel acquisition strategy

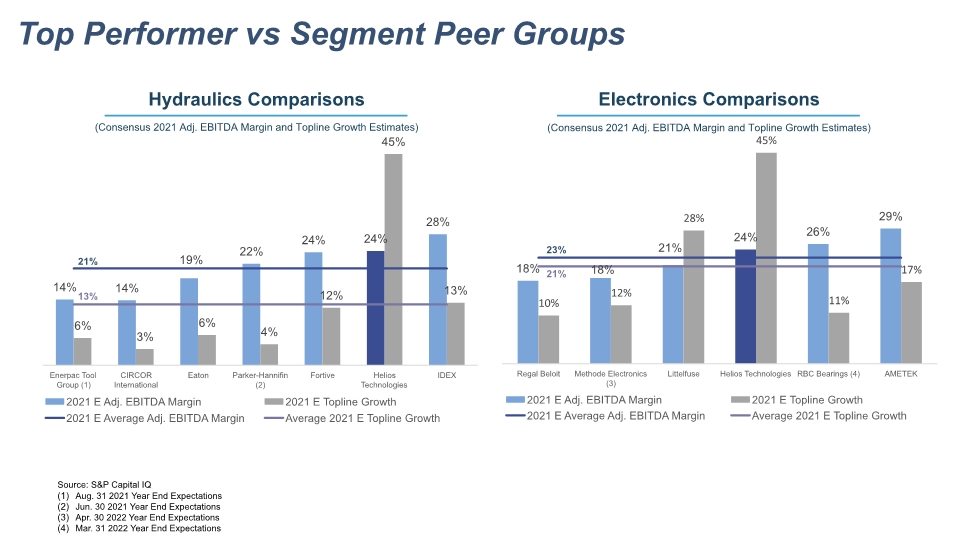

21% Top Performer vs Segment Peer Groups (Consensus 2021 Adj. EBITDA Margin and Topline Growth Estimates) 13% 21% 23% (Consensus 2021 Adj. EBITDA Margin and Topline Growth Estimates) Aug. 31 2021 Year End Expectations Jun. 30 2021 Year End Expectations Apr. 30 2022 Year End Expectations Mar. 31 2022 Year End Expectations Source: S&P Capital IQ

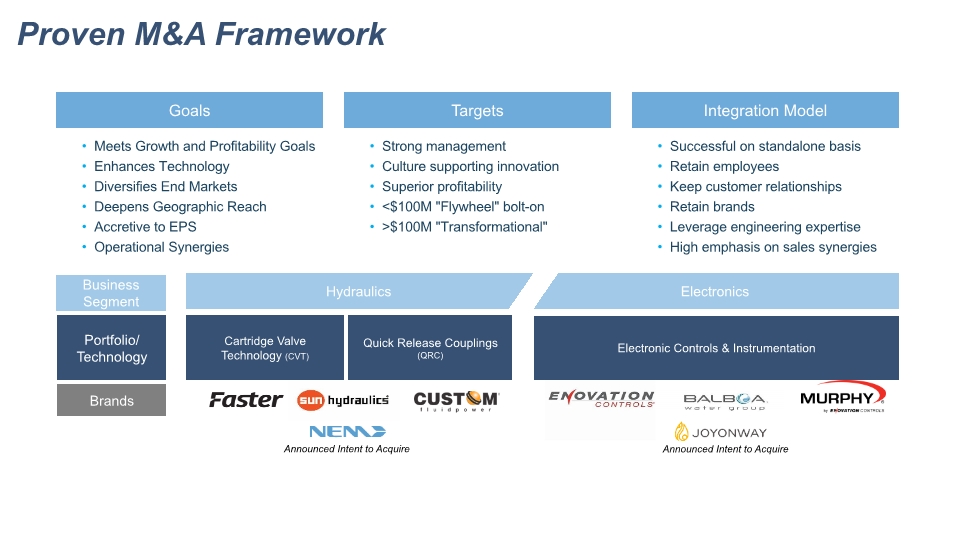

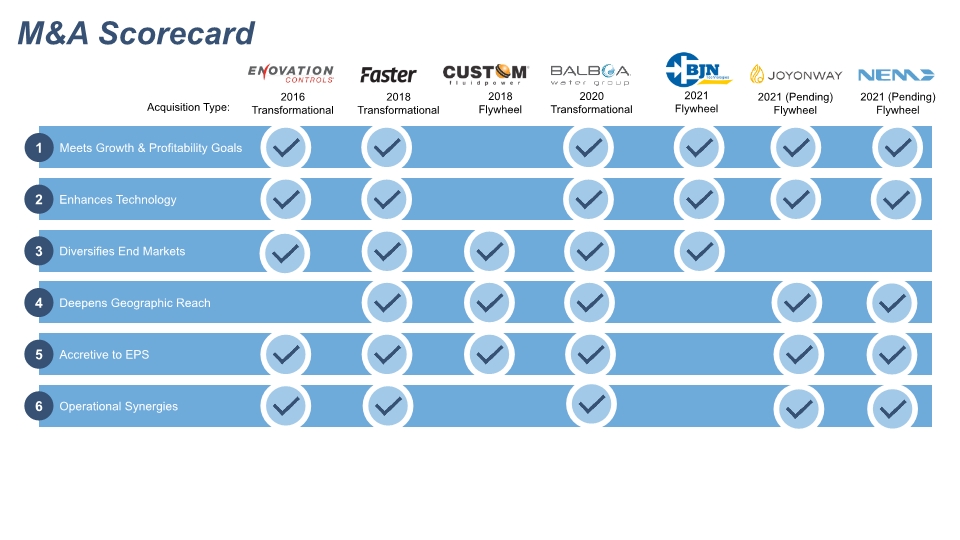

Proven M&A Framework Integration Model Business Segment Portfolio/ Technology Brands Hydraulics Cartridge Valve Technology (CVT) Electronics Electronic Controls & Instrumentation Goals Meets Growth and Profitability Goals Enhances Technology Diversifies End Markets Deepens Geographic Reach Accretive to EPS Operational Synergies Targets Strong management Culture supporting innovation Superior profitability <$100M "Flywheel" bolt-on >$100M "Transformational" Successful on standalone basis Retain employees Keep customer relationships Retain brands Leverage engineering expertise High emphasis on sales synergies Announced Intent to Acquire Quick Release Couplings (QRC) Announced Intent to Acquire

M&A Scorecard Acquisition Type: Meets Growth & Profitability Goals 1 2016 Transformational 2018 Transformational 2018 Flywheel 2020 Transformational 2021 Flywheel 2021 (Pending) Flywheel 2021 (Pending) Flywheel

Accelerated Plans Hitting $1B Milestone in Sales Two Years Early With Enhanced Margin Profile Reflects a non-GAAP financial measure; see supplemental slide for Adjusted EBITDA margin reconciliation CAGR is calculated between 2020 to 2023. Tax rate assumption is 24% to 26%.

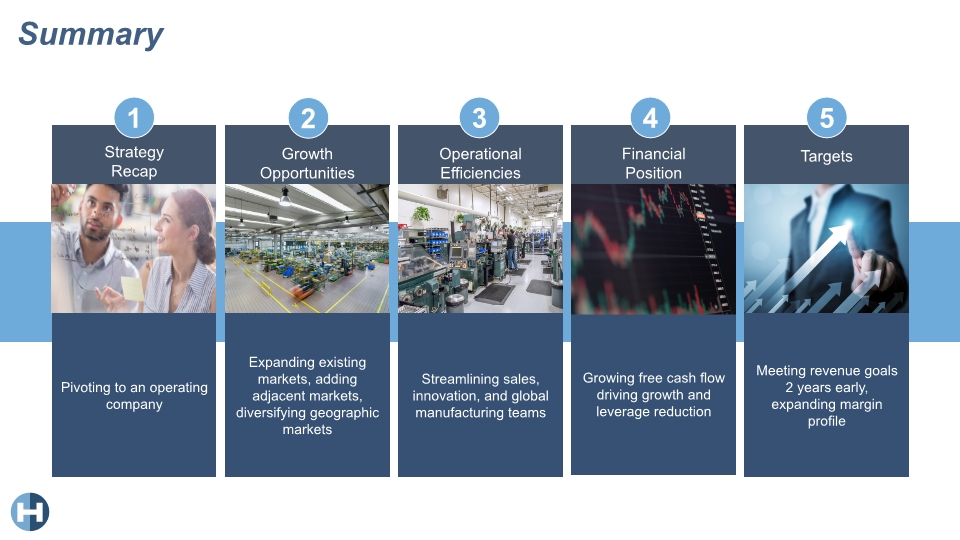

Summary Strategy Recap 1 Growth Opportunities 2 Operational Efficiencies 3 Financial Position 4 Targets 5 Pivoting to an operating company Expanding existing markets, adding adjacent markets, diversifying geographic markets Streamlining sales, innovation, and global manufacturing teams Growing free cash flow driving growth and leverage reduction Meeting revenue goals 2 years early, expanding margin profile

Appendix

Team Biographies

Josef Matosevic joined the Company in June 2020. Prior to joining the Company, he had served as Executive Vice President and Chief Operating Officer of Welbilt, Inc. (NYSE: WBT), a global manufacturer of commercial foodservice equipment, since August 2015. Mr. Matosevic also served as interim President and CEO from August through November 2018. Previously, he held the role of Senior Vice President of Global Operational Excellence at The Manitowoc Company, Inc. (NYSE: MTW), a world leading provider of engineered lifting solutions, from 2014 to 2015, and as Executive Vice President of Global Operations from 2012 to 2014. Prior to joining MTW, Mr. Matosevic served in various executive positions with Oshkosh Corporation (NYSE: OSK), a designer, manufacturer and marketer of a broad range of specialty vehicles and vehicle bodies, from 2007 through 2012. Mr. Matosevic also served as its Executive Vice President, Global Operations from 2010 to 2012, with responsibility for the defense segment, companies global operating systems and lean deployment. He previously served as Vice President of Global Operations from 2005 to 2007 and Chief Operating Officer from 2007 to 2008 at Wynnchurch Capital/Android Industries, a sub-assembler, distributor and sequencer of complex engineered modules for automotive original equipment manufacturers. Mr. Matosevic has over 26 years of global operating and business experience, with skills and focus on Commercial Sales, M&A, Strategic Operating Systems, Lean Six Sigma practices, automation, and supply chain development. Mr. Matosevic holds a bachelor’s degree from Bayerische Julius-Maximilian’s Universität in Würzburg, Germany. Tricia Fulton joined the Company in March 1997 and held positions of increasing responsibility, including Corporate Controller, prior to being named Chief Financial Officer on March 4, 2006 and Interim President and Chief Executive Officer on April 5, 2020 through May 31, 2020. Her prior experience includes serving as the Director of Accounting at Plymouth Harbor from 1995- 1997, various financial capacities for Loral Data Systems from 1991-1995 and as an auditor at Deloitte & Touche from 1989 to 1991. Ms. Fulton is a graduate of Hillsdale College and the General Management Program at the Harvard Business School. She served as a member of the Board of Directors for the National Fluid Power Association from 2011-2019 and as the Chairwoman of the Board for the 2016-2017 term. Josef Matosevic President and CEO Tricia Fulton Chief Financial Officer

Tania Almond joined the Company in August 2020 with over 25 years of experience. She has lead investor relations, corporate communication and competitive intelligence for companies including W. R. Grace (NYSE:GRA), GXS/OpenText (NASDAQ:OTEX), Sourcefire (NASDAQ:FIRE), WiderThan (NASDAQ:WTHN), and NeighborCare (NASDAQ:NCRX). Most recently, she worked in investor relations with the Fortune 100 company Tech Data (NASDAQ:TECD), taken private by Apollo Global Management in June 2020. She has led companies through five initial public offerings (IPOs) / spin-outs in the lead investor relations role and worked in the IR role with the “acquired” company now five times. At the start of her career, she was an equity analyst with Legg Mason Wood Walker, Inc. for nearly six years following the telecommunication, technology and healthcare sectors. She earned a B.A. in Business with a concentration in Computer Information Systems from Notre Dame of Maryland University and an M.B.A. in Finance from The Johns Hopkins University - Carey Business School. Tania Almond VP, Investor Relations and Corporate Communication Melanie Nealis, Esq. Chief Legal & Compliance Officer and Secretary Melanie Nealis joined the Company in July 2018 and brings over 20 years of experience in legal and human resources to the Company. She currently serves as the Chief Legal & Compliance Officer and Secretary for the organization and its subsidiaries. She is responsible for managing the legal and compliance activities of the enterprise on a global basis. Prior to joining the Company, Ms. Nealis was the Deputy General Counsel of Roper Technologies, Inc. (NYSE:ROP) from 2012 to 2018 and senior corporate counsel to Nordson Corporation (NASDAQ:NDSN) from 2005 to 2012. In both of her previous in-house roles, Ms. Nealis was responsible for managing legal services and compliance programs globally. Her responsibilities included: mergers & acquisitions, litigation management, developing and administering compliance programs, labor & employment, commercial contracts, global trade advice and compliance, and other regulatory and compliance activities. Ms. Nealis graduated with a BSBA, summa cum laude, from Xavier University and has a Juris Doctorate degree from the Ohio State University Moritz College of Law, where she graduated with honors in law. Prior to her in-house roles, Ms. Nealis was in private practice in Cleveland, Ohio, beginning her career at the national law firm of Baker & Hostetler LLP. Before becoming an attorney, Ms. Nealis worked as a human resource professional at the Timken Company in Canton, Ohio.

Doug Conyers joined the Company in January 2021 through the BJN Technologies acquisitions into the newly created role Vice President of Engineering Excellence. Prior to the acquisition, he spent five years as CEO/Partner at BJN Technologies, a technology start up that worked closely with Enovation Controls before being acquired by Helios Technologies in 2021. Prior to BJN, Doug worked at Enovation Controls as Director of Mobile Hydraulic Controls Solutions. Earlier in his career, he was responsible for product management, software development, and quality assurance with Globalscape. Doug was also with SecureLogix where he held positions as chief architect, director of systems engineering, and senior software engineer. Mr. Conyers also held software engineering positions with both the Southwest Research Institute and Paradigm Simulations. Doug is the author of several patents in the telecommunications security market. He graduated magna cum laude from Trinity University with a Bachelor of Science degree in Computer Science. Doug Conyers VP, Engineering Excellence John Shea Chief Commercial Officer John Shea joined Enovation Controls in 2014 prior to its being acquired by the Company in 2016. He progressed through several roles there and most recently served as Enovation’s Vice President of Sales. Mr. Shea began his career at Borg-Warner and rapidly advanced to roles of greater responsibility. Regal-Beloit acquired the business from Borg-Warner in 1996 where John became the National Sales and Marketing Manager servicing both the marine and industrial markets. In 2001, he joined ZF Marine where he continued to grow his reputation in the marine industry both as Regional Service Manager and OEM Sales Manager. He earned his Bachelor of Science degree in Finance from Providence College.

Jason Morgan joined Helios Technologies in 2018 in the position of Vice President of Global Tax. He rapidly advanced through roles of increasing responsibility, including Interim CFO for Sun Hydraulics LLC. He became Senior Vice President and Managing Director of CVT in November 2020 where he has been responsible for managing CVT’s global operations. Mr. Morgan began his career in 1995 in public accounting at Van Buren & Company. He has a breadth of experience in the retail, life sciences, industrial finance and technology industries both domestic and international. He has held a variety of progressively challenging roles at businesses that included Dollar General, Akyma Pharmaceuticals, Caterpillar Financial Services Corp, Wal-Mart Stores Inc. and Asurion, a privately held Information Technology and Services company. He earned his Bachelor of Applied Science (B.A.Sc.) degree in Business Administration & Accounting from Tennessee Technological University. Jason Morgan President, CVT Rick Martich SVP, Global Manufacturing Operations Rick Martich joined Enovation Controls over fourteen years ago and progressed from managing customer service and quality, through leading global manufacturing, to operations and international sales. He has over 25-years of leadership experience in engineering, manufacturing, finance and sales. Mr. Martich began his career in 1994 as a process/project engineer with PPG Industries. He went on to The Boeing Company where he led Lean Manufacturing activities on the 777 Floor Beam value stream and implemented Toyota Production System concepts & tools. He then spent time with Level 3 Communications where he progressed through a variety of roles across finance, engineering and services. He earned his Bachelor of Mechanical Engineering degree from Georgia Tech and his MBA from The University of Tulsa with a focus in finance. A Six-Sigma Black Belt, Rick is also a Gemba & Distribution Kaizen Coach.

JP Parent joined the Company through the acquisition of the Balboa Water Group in November 2020. JP has more than 35 years of managerial experience in international companies, of which 30 were spent in United States (after moving with his family from France in 1988) as an executive who demonstrated expertise in planning, developing and executing innovative solutions to address the strategic business plans of multi-disciplinary global organizations. Before joining this industry in 2002, JP worked 19 years for the Zodiac group in varied positions taking him from Quality Assurance Manager, to Plant Manager and Executive Vice President of newly acquired subsidiaries in which he led several turnarounds and instilled discipline in the organization. Born in Paris, JP is bilingual and received a MS in Aeronautical Engineering at the E.N.S.M.A. in Poitiers, France and a certificate in marketing from Stanford University. As a world traveler, JP easily adapted to different business cultures and created a vast network of vendors and customers abroad. Jean-Pierre “JP” Parent EVP of Sales, Balboa Water Group Matteo Arduini President and MD, QRC Matteo Arduini was appointed General Manager of Faster S.r.l. in 2018, after having served as Faster’s Chief Financial Officer beginning in April of 2018. From September 2012 to April 2018, Mr. Arduini was with Brevini /Dana Incorporated (NYSE: DAN). He served as the CFO of the Brevini Group and the project leader in Dana’s acquisition of Brevini Group. For one and a half years after the acquisition, he served as Head of Finance in Dana Brevini Italy. Mr. Arduini graduated from the University of Parma in 1998 with a degree in Economics and gained professional experience through roles at Ernst & Young, Ferrari Cars and Technogym.

Billy Aldridge SVP and MD, Enovation Controls Billy Aldridge joined FW Murphy as the OEM Sales Manager in 2008 where he grew the marine market. In 2009, FW Murphy merged with EControls, forming Enovation Controls (which was acquired by Helios in 2016.) He proceeded to advance into a Director position in 2015 and then in 2018 moved to the position of VP of Business Development. Mr. Aldridge brings over 21 years of experience in the electronic and operations industry. He started his career with MerCruiser/Mercury, part of the Brunswick Corporation in 2000, where he earned his Lean Six Sigma and worked in many different functional areas including Supply Chain, Program Management & OEM Sales. He has a bachelor’s degree in Sociology from Oklahoma State University.

Non-GAAP Reconciliation Tables

Net Debt to Adjusted EBITDA

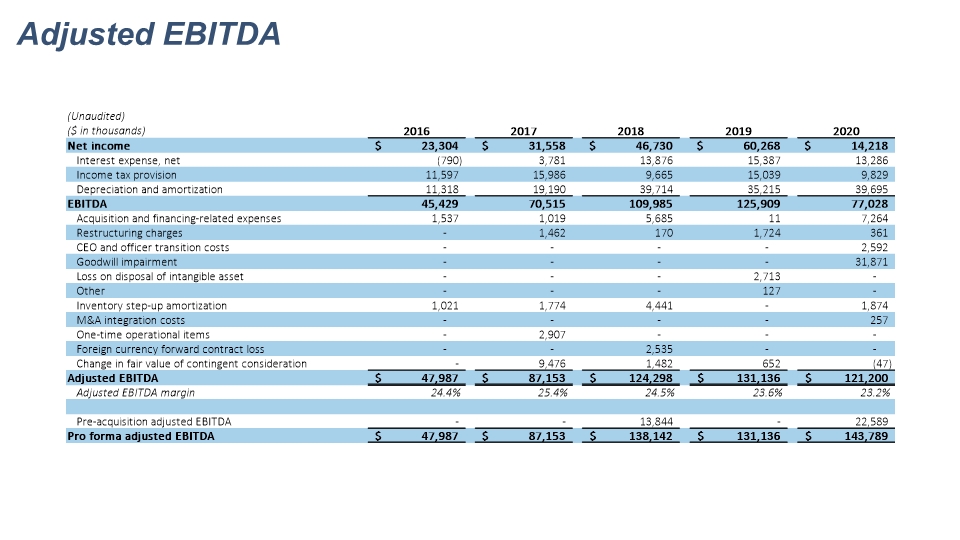

Adjusted EBITDA

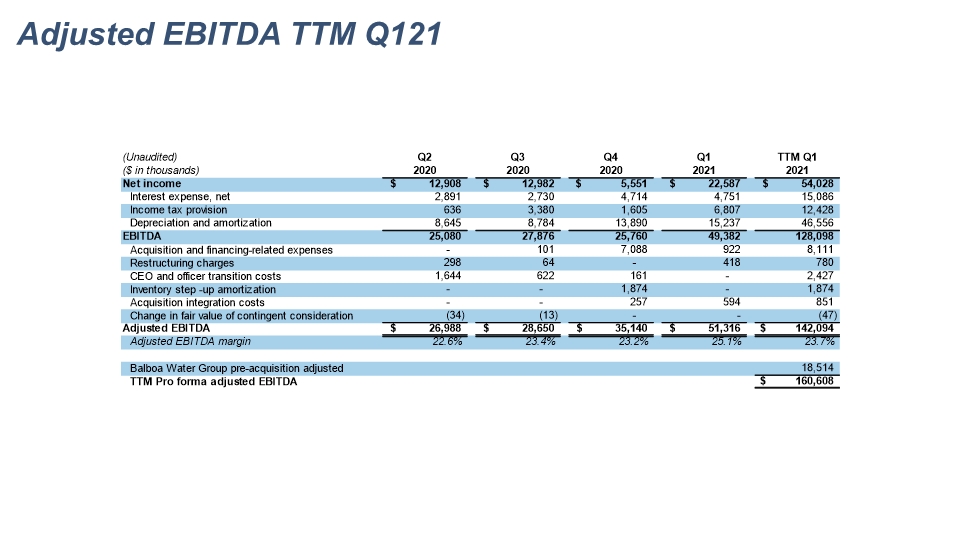

Adjusted EBITDA TTM Q121

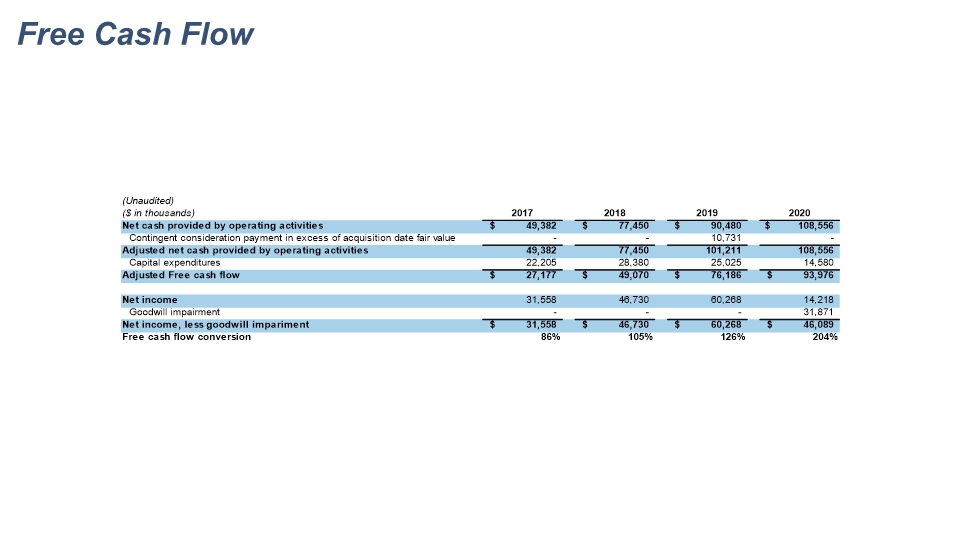

Free Cash Flow